Used car values fell by 1.9% in July despite healthy wholesale activity, according to pricing experts at Cap HPI.

The fall of 1.9%, or £350 on average, is a larger drop than the average pre-Covid July figure of a drop of 1.2%. The largest-ever July decline was 2.2% in 2019.

Average used car prices remain almost 30% higher than they were two years ago.

At the one-year age point, values dropped by 1.6% or about £525 in July. At the older age points, cars were again slightly more affected, dropping by 2.2% (£250) at five years and 2.9% (£135) at 10 years old.

Jeremy Yea, senior valuations editor at Cap HPI, said: “We expect August to see more retail consumers prioritising their holidays over purchasing a new or used car, so buying activity could remain muted during the summer holiday period.

“While wider economic factors such as rising interest rates, fixed mortgage deals coming to an end, and pressure on household budgets will also likely play their part in further compounding buying activity.”

Taking in all the above factors and summer seasonality, Yea says that we are likely to see some similar used car market deflation in August, with average downward market movements being applied.

He added: “The used car market will also continue to see volatility for alternatively-fuelled vehicles, however, with hybrids under pressure due to price discrepancies versus EVs, and EVs themselves continuing to realign amongst themselves, seeking out more of a natural order after the last few tumultuous months.”

City Cars proved to be the weakest sector overall, dropping by 3.2% or £250, following last month’s drop of 3.5% (£280).

Even with two sizeable month-on-month percentage drops, this sector still remains in a state of inflation when compared to 12 months ago.

EVs returned to being the lowest-performing fuel type this month with an average fall of 2.8% or £600.

The cumulative movement for EVs over the last 11 months now amounts to a fall of 42.6% - in comparison to petrol which has fallen, on average, by 5.3% during the same period.

However, the majority of EVs in July moved back in line with other fuel types which sit in the same sector.

Yea concluded: “Pressure on electric vehicle values overall do continue to ease, with the latest trade and retail prices making the switch much more compelling for both dealers and consumers.

“As reported last month, there are a number of models, where prices, attractive finance rates and monthly payments now look reasonable compared to their internal combustion engine equivalents, which has helped generate some additional interest in EVs.”

BCA average values remain consistent

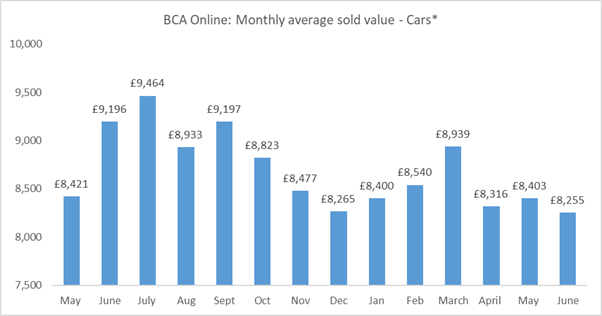

Cap HPI’s analysis of the market comes as average values remained reasonably consistent for the third month in a row at BCA, with the mix of vehicles continuing to heavily influence the overall average value of £8,255 in June.

Unsurprisingly, the shortage of genuine 3 to 4-year-old product continues to be a key factor and as a result, car supermarkets are competing strongly for the best examples.

Continuing the trend emerging over recent weeks, demand has strengthened for the best quality stock with increased competition for vehicles in Grade 1 and 2 condition, particularly for late-plate, low mileage examples which remain in short supply. In contrast, values on poorer quality stock require close attention, as the gap between the grades has widened further.

BCA UK’s chief operating officer, Stuart Pearson, said: “Given that economic conditions have shown little improvement over recent months, with inflation remaining stubbornly high despite rising interest rates, we’ve seen strong attendance and competitive bidding across our online sales during the month.”

He added: “There is definitely a widening gap between the price performance of the best and worst condition vehicles and we’re working closely with sellers to ensure that pricing expectations are realistic, as this has shifted fairly quickly during the month.

“The shortage of vehicles in the 3 to 4-year sector is fuelling some really strong activity. However, the pricing expectations on some of the older, more damaged stock requires very close attention to ensure that first time sales are achieved.

“The challenge for any remarketer is to aim to sell every vehicle first time for the optimum value and staying up to date with the latest pricing information and using all of the available reference points remains crucial to success.”

He concluded: “Whilst we are continuing to see a steady increase in volume reaching our remarketing network, the market is far from being saturated.

“This should ensure some stability around values, even with the continuing challenges around the economy and the cost-of-living pressures.”

Login to comment

Comments

No comments have been made yet.