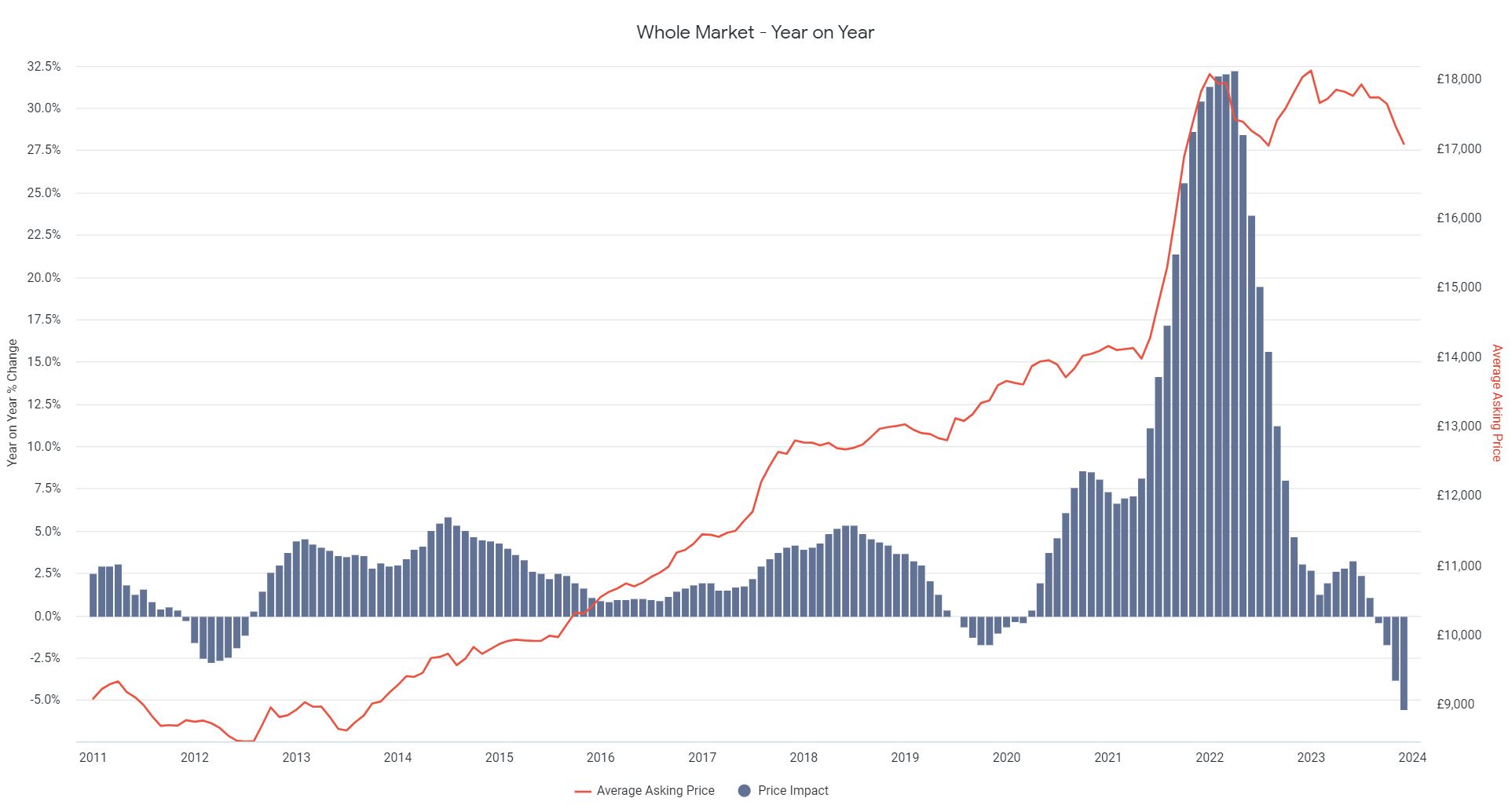

Retail used vehicle values fell by 5.6% on a year-on-year and like-for-like basis last month to £17,064, according to Auto Trader’s Retail Price Index.

It suggests that recent trends in trade prices are now flowing through into the retail market.

Consumer demand on Auto Trader remained robust throughout December, increasing 11.7% year-on-year (up from 8.6% in November), the strongest pace of growth since July 2023.

Combined with a slight softening in the rate of supply to just 1% year-on-year growth, Auto Trader’s Market Health metric - which assesses market profitability based on supply and demand dynamics – increased from 6% in November to 10.6% in December, also the highest since July.

Auto Trader’s proxy data points to about a 4% increase in used car transactions last month.

Furthermore, used cars continue to sell quickly; in December it took an average of just 36 days for a car to sell, which is the same as in 2022.

Auto Trader predicts robust used car demand will continue in 2024 and result in a small market uplift. It forecasts transactions will increase to an estimated 7.24 million sales.

Pockets of strength in pricing

December marked the fourth consecutive month of year-on-year decline for retail prices. But as in previous months there was considerable nuance in the data as the trend of fleet destocking pushed down 1–3-year-old prices by 10.1% year-on-year to £24,806.

Used cars more than 10-years-old still showed positive price growth, with 10–15-year-old vehicles up 5.3% year-on-year to £6,532 and 15-year-plus vehicles rising 2.5% to £5,516.

Cars aged 3-5 years old dell by 6.1% to £19,639.

Among fuel types, the average cost of a used electric vehicle (EV) was down 22.7% to £29,718 – continuing the trend of much larger falls than petrol (down 3.8% to £15,482 year-on-year) and diesel (falling 2.2% to £15,371).

Auto Trader’s director of data and insights, Richard Walker, said: “Our data clearly shows that the fundamentals of the used car market remain solid; consumer demand is robust, and cars are selling quickly, which combined with the slow return in supply, means retail prices continue to show more resilience than their trade counterparts.

“Worryingly, it appears some pricing strategies are being guided by wholesale trends, placing unnecessary pressure on retail values, and risking profits in the process.

“Rather than a cause for concern, the retail and wholesale markets being out of sync presents a profit opportunity for retailers who analyse the data on a car-by-car basis and price stock relative to retail valuations.”

Top 10 used car price growth (all fuel types) | December 2023 vs December 2022 like-for-like

|

Ranks |

Make |

Model |

Dec 23 Average Asking Price |

Price Change (YoY) |

Price Change |

|

1 |

Volkswagen |

Beetle |

£7,847 |

9.4% |

-0.5% |

|

2 |

Audi |

RS4 Avant |

£44,428 |

5.8% |

0.2% |

|

3 |

Mercedes-Benz |

M Class |

£11,734 |

5.4% |

-2.0% |

|

4 |

Dacia |

Sandero Stepway |

£9,659 |

5.0% |

-1.2% |

|

5 |

Dacia |

Sandero |

£8,330 |

4.8% |

-0.7% |

|

6 |

Land Rover |

Freelander 2 |

£8,223 |

4.2% |

0.3% |

|

7 |

Peugeot |

Partner Tepee |

£9,245 |

4.1% |

-1.4% |

|

8 |

Citroen |

Berlingo |

£12,996 |

3.6% |

3.3% |

|

9 |

Porsche |

Boxster |

£20,438 |

3.6% |

0.0% |

|

10 |

Audi |

R8 |

£76,551 |

3.4% |

1.2% |

Top 10 used car price contraction (all fuel types) | December 2023 vs December 2022 like-for-like

|

Rank |

Make |

Model |

Dec 23 Average Asking Price |

Price Change |

Price Change (MoM) |

|

10 |

Porsche |

Taycan |

£84,785 |

-19.1% |

0.8% |

|

9 |

Tesla |

Model S |

£31,818 |

-20.3% |

1.8% |

|

8 |

Fiat |

500e |

£20,024 |

-21.1% |

-0.8% |

|

7 |

Hyundai |

IONIQ |

£15,297 |

-22.5% |

-0.4% |

|

6 |

Citroen |

e-C4 |

£20,905 |

-22.8% |

0.5% |

|

5 |

Volkswagen |

ID.3 |

£25,572 |

-22.8% |

-0.2% |

|

4 |

Vauxhall |

Corsa-e |

£17,334 |

-22.9% |

-0.5% |

|

3 |

BMW |

i3 |

£16,518 |

-23.1% |

-1.3% |

|

2 |

Nissan |

Leaf |

£15,169 |

-23.2% |

2.6% |

|

1 |

Renault |

Zoe |

£13,165 |

-23.6% |

3.0% |

Login to comment

Comments

No comments have been made yet.