There were 166,678 new company cars registered with fleets and business in September, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

The latest sales data suggests fleet and business registrations were down some 8% on September 2019 in an overall market which showed a 4% decline.

Year-to-date fleet and business registrations now stand at 647,939 cars, some 37% down on the one million-plus cars registered in the first nine months of 2019.

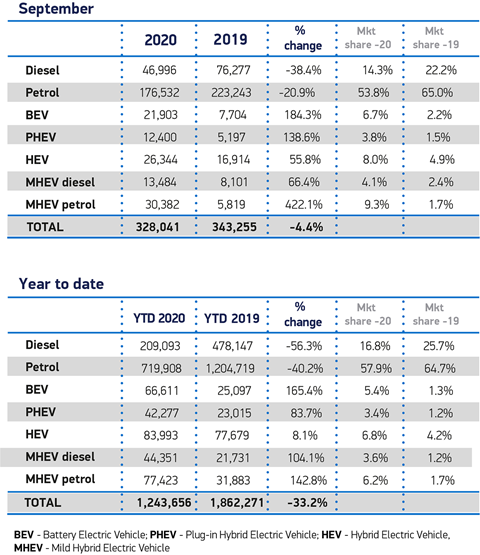

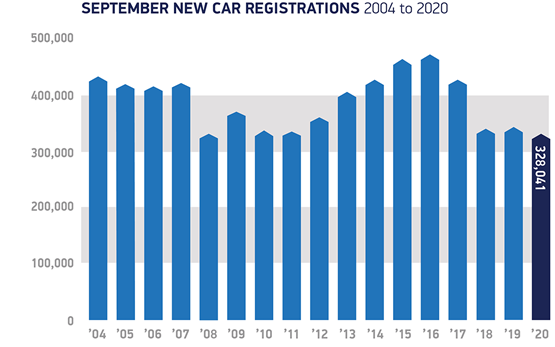

Overall, the new car market recorded 328,041 new registrations in the month – the weakest September since the introduction of the dual number plate system in 1999 and some 16% lower than the 10-year average of around 390,000 units for the month. Private registrations fell by 1% over the month.

The poor monthly performance follows very low volumes recorded in September 2018 and 2019, when regulatory changes surrounding the new WLTP emissions testing regime delayed vehicle certification and caused supply problems across Europe.

Some brands hit by these factors previously saw substantial growth in September 2020, but total registrations still fell well short of previous years and follow an erratic period of market performance since emerging from lockdown.

However, battery electric and plug-in hybrid car uptake grew substantially to account for more than one in 10 registrations as new models continue to increase consumer choice.

Demand for battery electric vehicles (BEVs) increased by 184% compared with September last year, with the month accounting for a third of all 2020’s BEV registrations.

Ashley Barnett, head of consultancy at Lex Autolease, said: “The ongoing rise in EVs is heartening. Upfront barriers including vehicle choice and range anxiety along with an improving infrastructure are all contributing to the transition.

“If anything, home working and shorter commutes are likely to increase appetite for alternatively-fuelled vehicles even more. However, we shouldn’t take our eye off the ball – we’ve still got a long way to go with the total number of EVs on the UK’s roads still only accounting for 0.45% of vehicles.

“Now, all eyes will be on the outcome of the government’s proposal to bring forward the ban on the sale of new petrol and diesel vehicles from 2040 to 2030 to further accelerate EV adoption levels.

“If we’re to keep up momentum, continued fiscal support and on-road perks are needed to increase the rate of adoption in line with the Road to Zero targets.”

The relaxation of Covid lockdown restrictions from June saw consumers return to showrooms and factories restart production lines. However, the market still faces continued pressure, however, with myriad challenges over the next quarter.

Brexit uncertainty and the threat of tariffs still concerns the industry, while the shift towards zero emission-capable vehicles is demanding huge investment from the sector, and stalling fleet renewal across all technologies is hampering efforts to meet climate change and air quality targets now, says the SMMT.

Furthermore, consumer and business confidence is threatened by the forthcoming end of the Government’s furlough scheme, an expected rise in unemployment and continuing restrictions on society as a result of the pandemic.

With little realistic prospect of recovering the 615,000 registrations lost so far in 2020, the sector now expects an overall 30.6% market decline by the end of the year, equivalent to some £21.2 billion in lost sales.

SMMT chief executive Mike Hawes said: “During a torrid year, the automotive industry has demonstrated incredible resilience, but this is not a recovery.

“Despite the boost of a new registration plate, new model introductions and attractive offers, this is still the poorest September since the two-plate system was introduced in 1999.

“Unless the pandemic is controlled and economy-wide consumer and business confidence rebuilt, the short-term future looks very challenging indeed.”

Michael Woodward, UK automotive lead at Deloitte, says that an easing of volume targets has led to dealers pre-registering fewer vehicles than we might see in a normal September.

“While sales typically attributed to pre-registration activity may filter through to the final quarter, the wider knock-on effect on residuals and the used car market remains to be seen,” he said.

“Dealers see pre-registered cars as a way of bolstering used car stocks, and a lack of activity in this space may drive prices up.

“The reduction in pre-registrations is good for OEMs and leasing companies. It keeps new car prices high and hence the residual price of the used car when it comes back. This anticipated strengthening of residuals could allow leasing companies to reduce monthly lease costs or improve their profitability.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, believes that today’s figures highlight the economic pressures that the automotive industry continues to face, during what is usually a strong month following the introduction of new plates at the beginning of September.

He concluded: “A -4.4% drop in new registrations from 2019 could be a cause for concern as the purchasing behaviours of consumers and businesses continue to be affected by the coronavirus pandemic and a challenging economic environment, marred by uncertainty around Brexit and future tariffs.

“However, electric and hybrid vehicles continue to be an area for optimism for the industry as consumers and businesses benefit from the increasing number of options that are available on the market.

"This trend was clearly illustrated by growth in demand for battery electric vehicles, which stood at 184.3% compared with September last year, as electric and plug-in hybrids now account for more than one in 10 registrations.

“To accelerate the adoption of electric vehicles and extend the growth in this segment of the industry, the Government must ensure that there are attractive incentives for consumers and businesses alike, alongside the binding targets on charging infrastructure which the SMMT has called for today.”

A.C. - 05/11/2020 18:47

What's the precise difference between fleet and business vehicles?