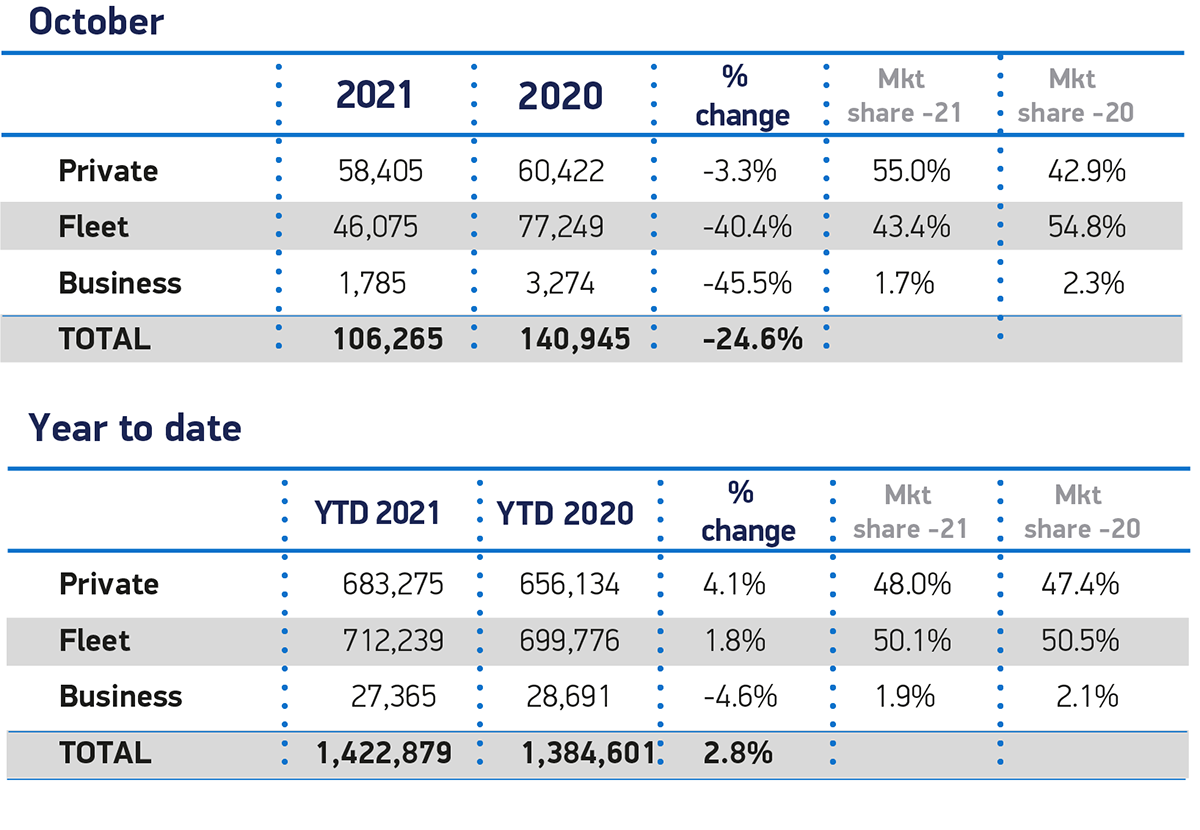

Fleet and business registrations declined by 41% in October, with 47,860 company cars registered compared to 80,523 units in the same month last year, according to new figures released by the Society of Motor Manufacturers and Traders (SMMT).

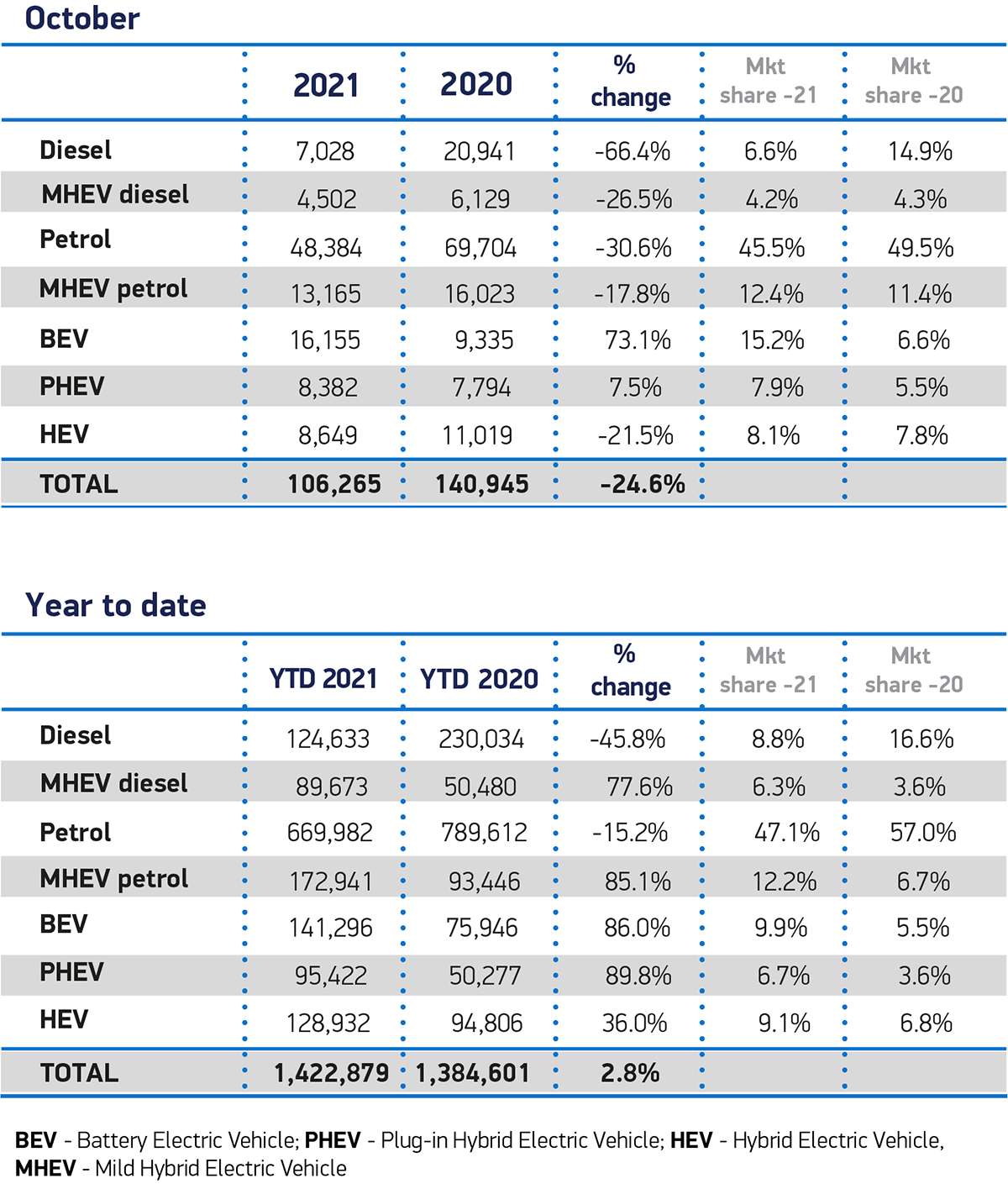

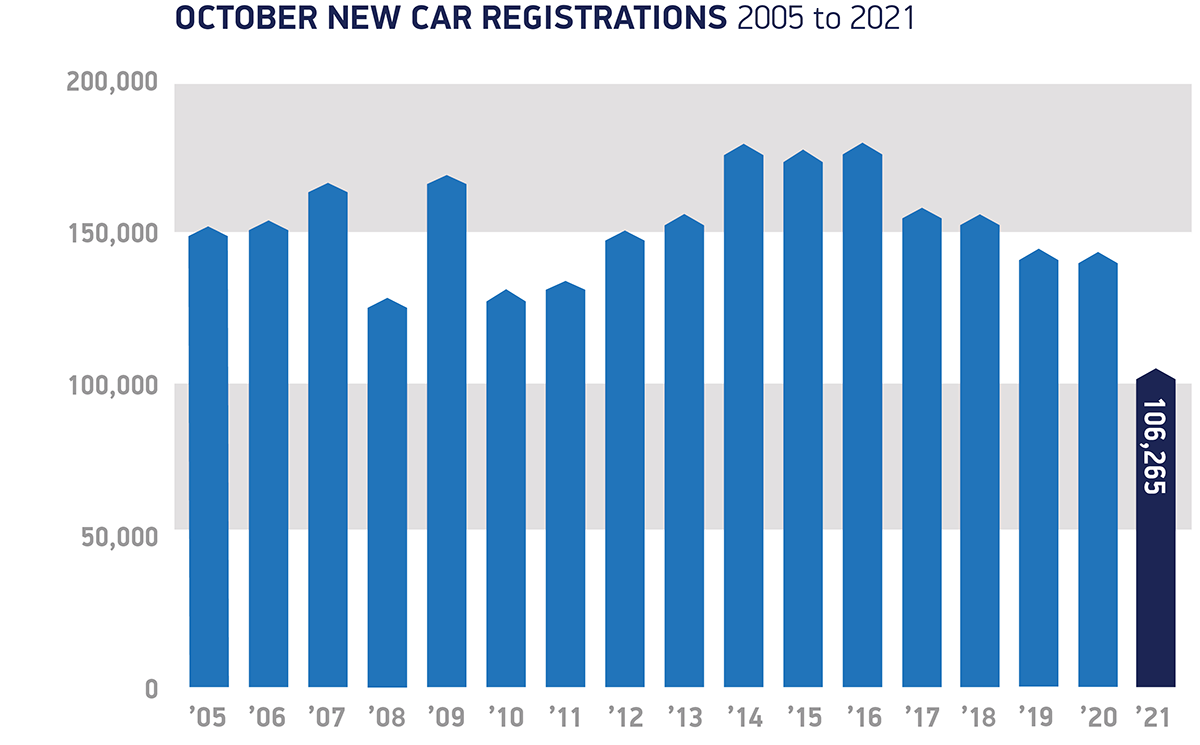

Overall, there were 106,265 cars registered in the month, a 25% decline on the 140,945 units in October 2020. Fleet and business registrations accounted for 41% of the new car market.

The overall market’s monthly performance was the weakest seen since October 1991.

Year-to-date, however, fleet and business registrations are now 1.5% higher, with 739,604 company cars registered compared to 728,467 units last year. Overall, including private registrations, some 1,422,879 cars have been registered.

Looking ahead, the latest SMMT forecast has been revised downward by almost 9% to 1.66 million units, in light of the on-going supply issues and deteriorating economic outlook.

This would see 2021 finish 1.9% or some 30,000 units up on 2020, but some 650,000 units down on 2019’s pre-pandemic 2.3 million performance.

A partial recovery, however, is forecast for 2022, with industry anticipating some 1.96 million new car registrations next year.

This will be driven by continued demand for plug-in vehicles, which is expected to continue at pace with new BEVs anticipated to be more popular than new conventional and mild-hybrid diesels by the end of 2022.

Plug-in cars are also expected to account for more than a fifth (21.5%) of all new car registrations next year.

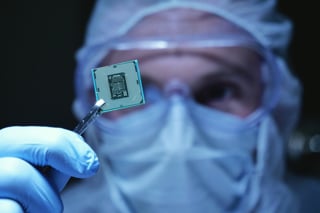

Mike Hawes, chief executive of the SMMT, said: “The current performance reflects the challenging supply constraints, with the industry battling against semiconductor shortages and increasingly strong economic headwinds as inflation rises, taxes increase and consumer confidence has weakened.

“Electrified vehicles, however, continue to buck the trend, with almost one in six new cars registered this year capable of zero-emission motoring, growth that is fundamental to the UK’s ability to hit its net zero targets.

“With next year looking brighter, and even more new models expected, the continuation of this transition will depend on the preservation of incentives that overcome the affordability barrier, and the ability of the public and private sectors to increase public on street charging to allay EV driver concerns.”

Jamie Hamilton, automotive director and head of electric vehicles at Deloitte, says the shortage of semi-conductors continues to be a "drag on the sector".

"Financial results from a number of major manufacturers have demonstrated just how significant the shortage has been to bottom lines," he explained.

“Private sales were down this month by 3%, but there are potential headwinds on the horizon as consumer confidence fell for the first time this year. This follows a strong rebound from the height of the pandemic, as consumers expressed concerns about their personal finances.

"Compared to Q2, fewer consumers now intend to buy a new car in the coming three months, suggesting that any pent-up demand built up over the last year may start to fall away."

Despite current challenges for fleet this month, there may be better news ahead, suggests Deloitte. "With CFOs placing greater emphasis on increasing capital expenditure in the quarter ahead, and with more businesses looking to reduce emissions by transitioning fleets and company cars to electric, we should see fleets pursue replacement vehicles at scale sooner rather than later," continued Hamilton.

“With the eyes of the world on COP26 this month, we are reminded of the important role that EVs will play in achieving decarbonisation goals.

"The UK is well on its way to an all-electric future, and battery electric vehicles sales grew by 73% compared to last year, accounting for 15% of all new car sales this month. As a result, the SMMT expects more plug-in EVs to be sold in 2021 than in the whole of the previous decade combined.

“To keep up this momentum and achieve the goals set over the next decade, we will need to see a more equitable rollout of public charging points which would ensure EVs are also accessible to those households without off-street parking.”

Richard Peberdy, UK head of automotive at KPMG, added: “October is traditionally a quieter month after September’s plate change. But a gloomy picture is compounded by fewer cars rolling off production lines due to supply chain challenges, and the beginnings of shakier consumer confidence with the looming threat of interest rate rises. Such factors are contributing to a booming second-hand market at the cost of new car sales.

“The impact that record high fuel prices will have on pushing motorists towards electric vehicle options shouldn’t be understated. Yet EVs aren’t insulated from the wider energy crisis. A tough winter for energy companies will make plug-in drivers think carefully about their tariffs to avoid unexpectedly high bills.”

2021 to be a record year for electric vehicles

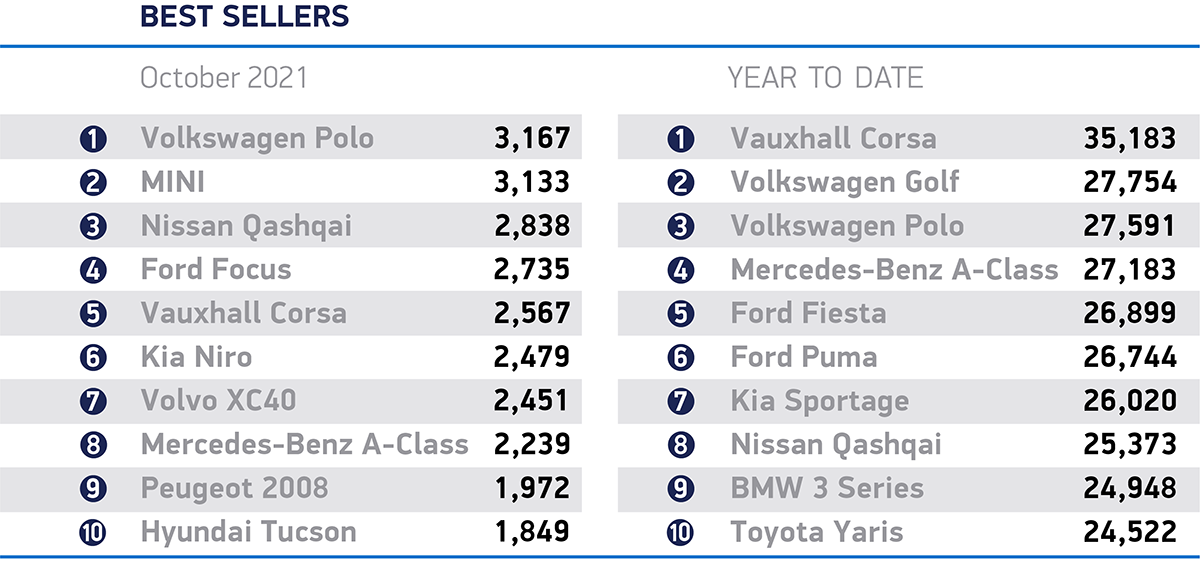

In October, plug-in vehicle uptake remained positive, with battery electric vehicles (BEVs) equalling their September market share of 15.2% with 16,155 units, while plug-in hybrid vehicles (PHEVs) grew to 7.9% or 8,382 units.

New plug-in vehicle uptake rates have accelerated so rapidly that more will join Britain’s roads in 2021 than during the whole of the last decade, according to the latest forecast from SMMT.

A total of 271,962 new BEVs and PHEVs were registered between 2010 and 2019. However, as the UK hosts the COP26 environmental summit, SMMT now expects Britain to break its plug-in records, forecasting that businesses and consumers will take up around 287,000 of the latest zero-emission capable cars during 2021 alone – around one in six new cars. Based on current forecasts, BEV registrations are also expected to exceed those of diesel by the end of 2022.

The rise is even more remarkable given that 2021 is expected to be a relatively weak year for new car registrations, some 30% below the average recorded over the past decade.

The semiconductor shortage has reduced overall global car production, but manufacturers have done all they can to ensure the availability of as many plug-in vehicles as possible.

Uptake rates of plug-in vehicles began to accelerate dramatically during 2020, as the billions of pounds invested by manufacturers in new technology resulted in the widest ever choice of zero emission-capable cars. More than a quarter of all car models available in the UK can now be plugged in.

Fleets have been particularly incentivised to invest in plug-in cars thanks to a range of tax breaks and grants, meaning around two in every three new BEV registrations this year have been for large fleets.

Sustaining this surge and ensuring zero-emission mobility is accessible for all will depend on encouraging all consumers to make the switch away from fossil fuels, says the SMMT.

The UK already plans to be the first major automotive market to end the sale of new conventional petrol and diesel cars in 2030, but delivering this bold aim will require the continuation of purchase incentives to encourage those drivers currently unable or unwilling to make the transition to electrified motoring.

Even more significant, however, is the need for turbocharged investment by both the public and private sector into the essential public charging infrastructure required by a growing plug-in vehicle fleet, it says.

Hawes explained: “As Britain hosts COP26 and seeks to align the world in committing to achieving net zero and limiting the global average temperature rise to 1.5 degrees above pre-industrial levels, our latest outlook shows the UK experiencing a surge in plug-in vehicle uptake.

“Massive investment by industry as well as long standing government incentives have seen us go from just 188 new plug-in cars in 2010, to almost 300,000 in 2021.

“To achieve net zero by the desired date, however, uptake rates must continue to grow. This requires ongoing incentives to help consumers make the switch and significant investment in public charging infrastructure. Backed by the ingenuity and innovation of the automotive sector, we can then deliver zero-emission mobility that is accessible and affordable for all.”

Meryem Brassington, electrification propositions lead at Lex Autolease, says that the continued uptake of EVs, reported in the latest SMMT figures, is clear evidence that momentum continues to shift away from petrol and diesel.

"As electric vehicles continue to increase their market share, sustained investment from policymakers to facilitate the journey towards an electric future will be critical," she said.

"The Government’s EV infrastructure and manufacturing commitments in the Net Zero Strategy are a step in the right direction, while innovation and the decarbonisation of road transport is needed to drive forward the transition to zero emission vehicles. All eyes will be on industry leaders at COP26 as we strive to clean up the UK’s roads ahead of the 2030 ICE ban deadline.”

Lucy Simpson, head of EV enablement at Centrica Business Solutions, added: "The soaring uptake of plug-in vehicles is hard evidence that cleaner and greener EV technology is fast becoming the transport method of choice.

“However, we need to ensure all drivers can make the switch, requiring a significant investment in the UK’s charging infrastructure. The £1 billion commitment to boost electric vehicle charging and production in the government’s Net Zero Strategy is a welcome step, but we need to see quicker action – the roll out of charge points must keep pace with the acceleration in EV registrations if we are going to achieve a greener future for transport.”

Jon Lawes, managing director at Hitachi Capital Vehicle Solutions, concluded: “Whilst the upward trajectory of EV registrations remains promising, the market continues to be hampered by ongoing new model shortages which is reflected by the unparalleled surge in demand for used vehicles.

“If we're committed to maintaining this momentum and realise the targets being discussed at COP26, the Government needs to go much further to support the industry.

“The ZEV mandate would be a step in the right direction, but significantly more public sector-led investment in EV infrastructure is paramount. We need policy clarity from Government, not soundbites.”

Login to comment

Comments

No comments have been made yet.