June marked another month of contracting prices for used electric vehicles (EVs), with the average retail value (£31,430) falling 19.1% year-on-year, new data suggests from the Auto Trader Retail Price Index.

It makes June the sixth consecutive month of year-on-year decline, with average EV prices falling by around £5,000 since January (£36,179) and nearly £9,500 since their peak in July 2022 (£40,728).

Finance and leasing terms of brand-new electric cars bought three-four years ago have ended, which has, as expected, resulted in a very strong increase in supply over recent months, particularly from fleets.

While consumer demand for second-hand EVs has been robust, up 6% year-on-year in June, it’s been unable to keep pace with the sharp increase in availability – supply was up 174% year-on-year last month.

Auto Trader says it is this imbalance that has caused prices to contract recently, as opposed to any loss in consumer appetite.

However, supply growth levels are softening. June was the lowest level in nine months and down significantly on the 303% increase recorded in January.

Used EV values beginning to stabilise

As such, despite June marking the highest rate of year-on-year price contraction recorded by Auto Trader, there are strong signs of used EV values beginning to stabilise, with June also seeing the lowest level of month-on-month price contraction (-0.9%) since August last year.

The drop in average EV prices is rapidly closing the upfront price gap between many electric models and their ICE counterparts, and in some cases, has already made them cheaper.

For example, a three-year-old electric Jaguar I-Pace was £600 cheaper than a traditionally fuelled F-Pace in April, but in June the gap grew to nearly £2,000.

Following the price realignments made by Tesla, the average price of a used 3-year-old Model 3 (£30,700) is now only £3,200 more expensive than a BMW 3 Series of the same age – down from £3,600 in April, and £22,000 in August.

The result has been a positive one, with used Tesla cars selling faster than any other in the market, taking an average of just 19 days.

More broadly, EVs are taking longer to sell than any other fuel-type. However, the average number of days it takes for them to leave forecourts is falling steadily as they become ever more affordable, dropping from 42 days in May, to 38 days in June. Both petrol and diesel cars remained flat over the same period at 27 days.

Auto Trader’s director of data and insight, Richard Walker, said: “Although EV values are still contracting, it’s important to put it into the right context.

“The electric market is still an immature one, and what we’re seeing is a natural and expected correction in the wake of a massive influx of stock over recent months.

“It may be some time before the market reaches a complete equilibrium, but we are seeing clear signs of prices stabilising and some very attractive savings for car buyers. It means that for retailers who are able to follow the data, and source the right electric stock for their forecourt, there’s some very strong profit potential out there.”

Used market sees 39th consecutive month of growth

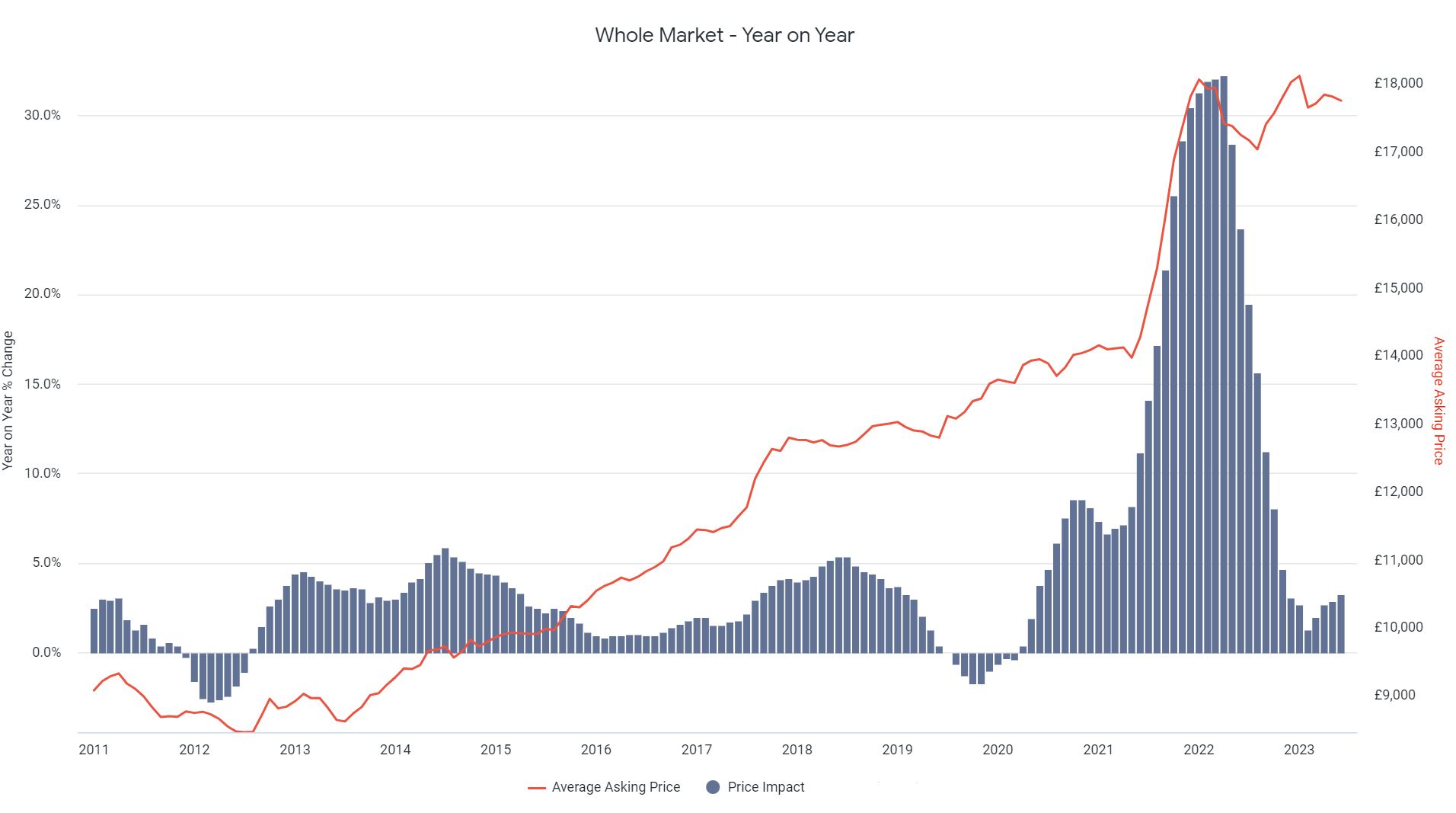

Looking at the second-hand car market as a whole, prices are accelerating at their fastest rate in eight months, says Auto Trader.

With an average retail value of £17,756, June marks a year-on-year price growth of 3.2% on a like-for-like basis, and the 39th consecutive month of growth.

Over that period, the average retail price of a used car has increased circa £3,900.

Although retail prices in June softened slightly on a month-on-month basis, decreasing by 0.3% on May, this is near to seasonal norms, with prices falling as much as 0.9% over the same period in 2019.

The strength and stability in second-hand retail values is continuing to be driven by the imbalance in market dynamics, explains Auto Trader.

Indeed, used car supply, which has been affected since the start of the pandemic and the subsequent shortfall in new car production, was down 4.1% year-on-year in June, while consumer demand was up 2.3%.

Walker, said: “The used car market has enjoyed a strong first half of the year, with the rise in retail values doing little to dampen consumer demand, which has been reflected in the very strong levels of engagement we’ve seen on our marketplace over recent months.

“Although the current health of the economy does add a degree of uncertainty for the months ahead, based on what we’re currently tracking across the market, our outlook for the rest of 2023 remains an optimistic one.”

Login to comment

Comments

No comments have been made yet.