Contract hire still dominates with close to 90% of FN50’s risk fleet, reports Gareth Roberts

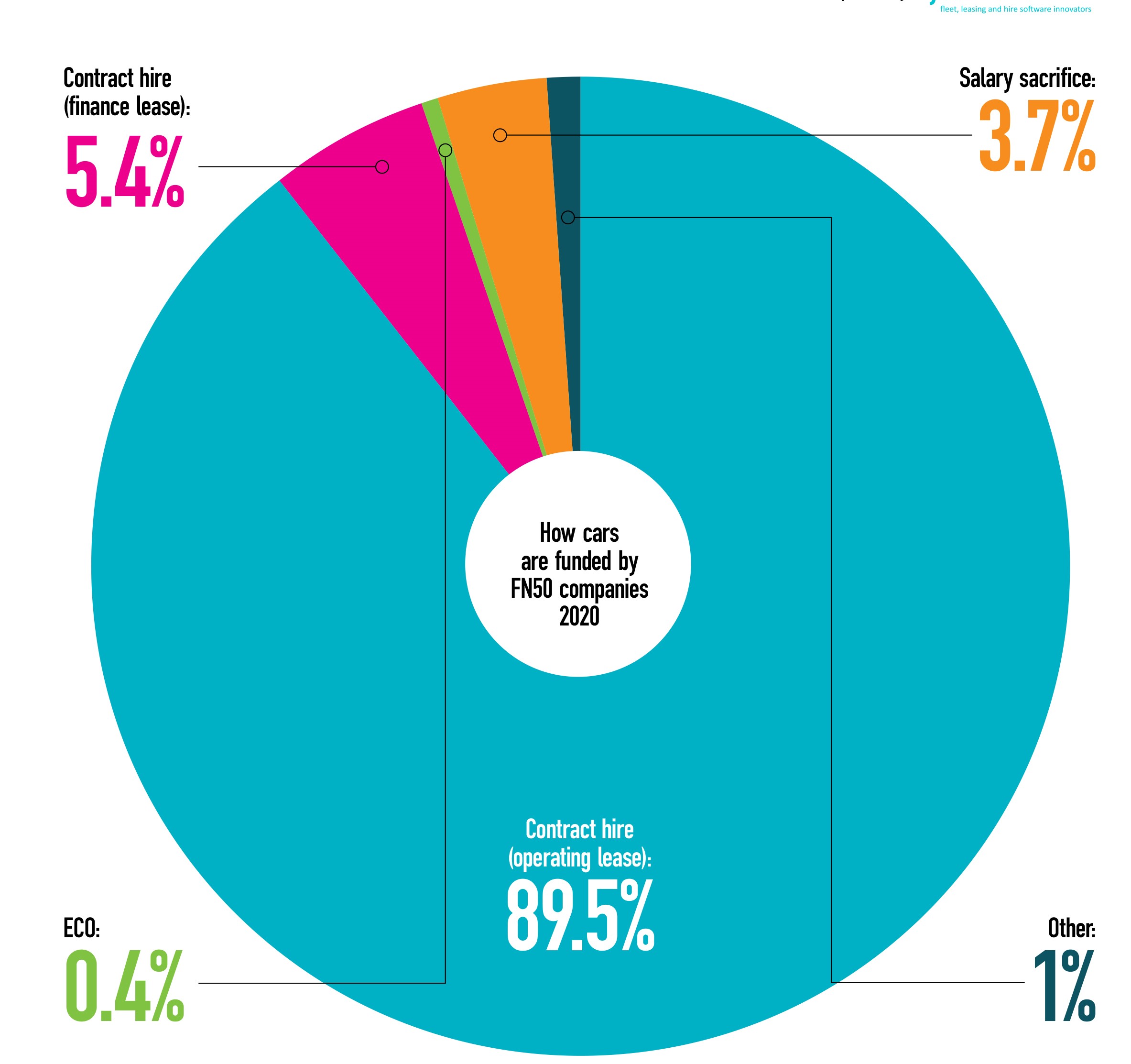

Contract hire continues to dominate the FN50’s risk fleet of 1.2 million cars, with 89.5% – almost 1.1m vehicles – funded via an operating lease.

The funding option’s risk fleet share, however, has declined by two-and-a-half percentage points from last year’s high of 92%.

Finance leases, which instead transfer all of the risk – and rewards – of ownership to the fleet operator, have benefited, with 5.4% of cars now funded this way, up from 3.1%, last year.

Employee car ownership (ECO) schemes still account for 0.4% of the FN50’s car risk fleet, while salary sacrifice’s funding share has fallen marginally, from 3.9% to 3.7% year-on-year. Others increased from 0.4% to 1%.

Despite a small reduction in funding share in this year’s FN50, leasing companies are reporting a “resurgence” in salary sacrifice schemes fuelled by new, low company car tax rates for electric vehicles (EVs).

The car funding option has suffered a few bumps in the road over the years, with tax changes introduced in 2017, under the Optional Remuneration Arrangements (OpRA), reducing the potential savings available through the staff benefit in many cases and lessening its appeal.

At that time, salary sacrifice funded 4.7% of cars on the FN50.

However, with ultra-low emission vehicles (ULEVs) exempt from the changes, and the Government’s decision to cut the benefit-in-kind (BIK) tax rate on zero-emission company cars from 16% in 2019/20 to 0% in 2020/21, employers have been persuaded to revisit schemes or launch one for the first time.

David Bushnell, principal consultant at Alphabet GB, says: “Since the introduction of the new BIK rates there has been a resurgence in salary sacrifice schemes.”

Meanwhile, Chris Black, commercial director at LeasePlan UK, described salary sacrifice as having a “renaissance” following the tax changes.

He says: “Now, in a time when cost-cutting and corporate responsibility are two of the biggest pressures facing organisations, there really hasn’t been a better time to take advantage.”

'A PERFECT STORM'

Employers can save on national insurance contributions (NICs) for every employee on a scheme, while participating employees save on national insurance and income tax.

Mike Coulton, fleet product and policy manager at Volkswagen Financial Services Fleet, explains that a “perfect storm” of low BIK rates for ULEVs, improved vehicle choice/availability and reduced travel (at least short-term) as a result of Covid-19, have resulted in a “significant increase” in EV orders.

“As such, salary sacrifice has seen a level of interest not witnessed for several years,” he says.

Looking ahead, Coulton does not believe salary sacrifice will replace traditional company cars but adds that the “opportunities for cash allowance takers and the wider workforce are huge”.

Last year’s FN50 survey showed a dramatic increase in the number of cars funded through personal contract hire (PCH) products, with private/retail increasing from 12.8% to 18% of the car risk fleet.

This year, the upturn is less marked, with private/retail’s risk fleet car share reaching 20%.

Bushnell believes new company car tax rates have helped slow the dash for cash seen in previous years.

“Although we were seeing a trend towards employees wanting to opt for a cash allowance, this has been somewhat curtailed by the new BIK rates,” he says.

Tusker also anticipates a continued fleet focus on grey fleet and perk drivers to reduce costs to the business in terms of company car operation and mileage costs.

“The popularity of salary sacrifice car schemes will assist in both areas by reducing cost as well as managing duty of care obligations,” says Tusker CEO Paul Gilshan.

However, Bushnell argues that businesses looking to offer traditional petrol and diesel vehicles to employees that have high mileage profiles, or simply no access to plug-in infrastructure, may be seeking alternative options to avoid paying high BIK rates.

“This is where employee car ownership schemes utilising AMAP (approved mileage allowance payments) could become more commonplace,” he says.

“Drivers and fleet managers need a blended funding solution, which provides guidance and evaluation so they can make an informed decision on the optimum funding route, which benefits both the employee and employer fiscally and operationally.”

THE COVID IMPACT

Coronavirus is forcing fleet managers to leave no stone unturned in search of savings, with a recent Fleet News survey illustrating the full force of the pandemic.

A little less than half (45%) of fleet decision-makers believe their company car fleet size will decrease as a result of the economic impact of Covid-19.

Of those, 48% predict a reduction of less than 10% while 37% foresee a 10-30% reduction.

Andy Barrell, head of business development at Lex Autolease, suggests that finance leases could provide flexibility for those managing cashflow post-Covid.

He explains: “The flexibility that is available with a finance leasing option – including extending the vehicle’s agreement beyond the end of its lease – might become a more attractive offer as businesses look at how they can manage cashflow in the shorter term.”

The treatment of a finance and operating lease depends on which accounting standards the organisation adheres to.

For organisations that report to International Financial Reporting Standards (IFRS), the introduction of IFRS16 from January 1, 2019, means that both operating leases and finance leases must be reflected in the company balance sheet and profit and loss account.

Prior to this, operating leases were treated as ‘off-balance sheet’ items.

Most small and medium-sized enterprises (SMEs) currently report to the UK’s generally accepted accounting principles (UK GAAP).

Bushnell says that this change in how contract hire leases are reported may mean we start to see “more of a balance” between the two leasing options.

But, recent research from the Arval Mobility Observatory indicated that there may be an increase in the use of operational leasing, as a means of acquiring company cars.

When asked whether they intended to introduce or increase use of operational leasing in the next three years, more than a quarter (26%) of fleets said ‘yes’, compared with just over one-in-10 (12%) when the same question was posed in 2019.

The move to operational leasing was marked across organisations of all sizes except the smallest.

Broadly speaking, those smaller organisations are looking to re-contract and carry out cost saving initiatives to save money while there is financial instability in their marketplace, says Arval.

It also expects its short- and mid-term rental business to remain a popular option for many businesses looking for greater flexibility.

Simon Staton, client management director at Venson Automotive Solutions, believes some fleets who currently outright purchase may now be more open to a fleet funding review, particularly if they are in industries that have been hit hardest by coronavirus.

“The opportunity to release cash back into the business through sale and leaseback may be an attractive and necessary option,” he says.

“For perk cars, where EV works, then salary sacrifice will probably come to the forefront in the short-to-medium term because of the favourable tax situation and the choice of models available.”

THE NEED FOR FLEXIBILITY

Simon Carr, chief commercial officer at Alphabet GB, explains: “It’s clear that people need increased flexibility at this current time.

Fleet providers should recognise this and be proactive in offering solutions to customers.”

Carr is expecting to see a rise in demand for shorter-term, adaptable leasing arrangements to bridge the gap between rental and long-term leases, as drivers’ roles and requirements change.

“Future demand for subscription is recognised, but we don’t see this as an immediate core sector replacement,” he says.

Lex Autolease has been part of subscription trials and, while recognising their potential in “very specific circumstances”, says that the economic model for such services remains a challenge, as can be seen by the poor financial results that continue to be delivered by traditional vehicle rental companies.

As such, it argues that changes to shorter leases and more flexible products are likely to remain small scale due to their relative expense with the market continuing to mainly fulfil demand for providing long-term funding solutions.

Login to comment

Comments

No comments have been made yet.