FN50 suffers second consecutive reversal but funders remain upbeat thanks to electric vehicle opportunities, reports Stephen Briers

For the second consecutive year, the FN50 top 10 has, aside from some minor positional shuffling, remained the same: the same companies largely in the same places.

The two exceptions are Arval and LeasePlan switching places and an identical swap by Free2Move and Zenith.

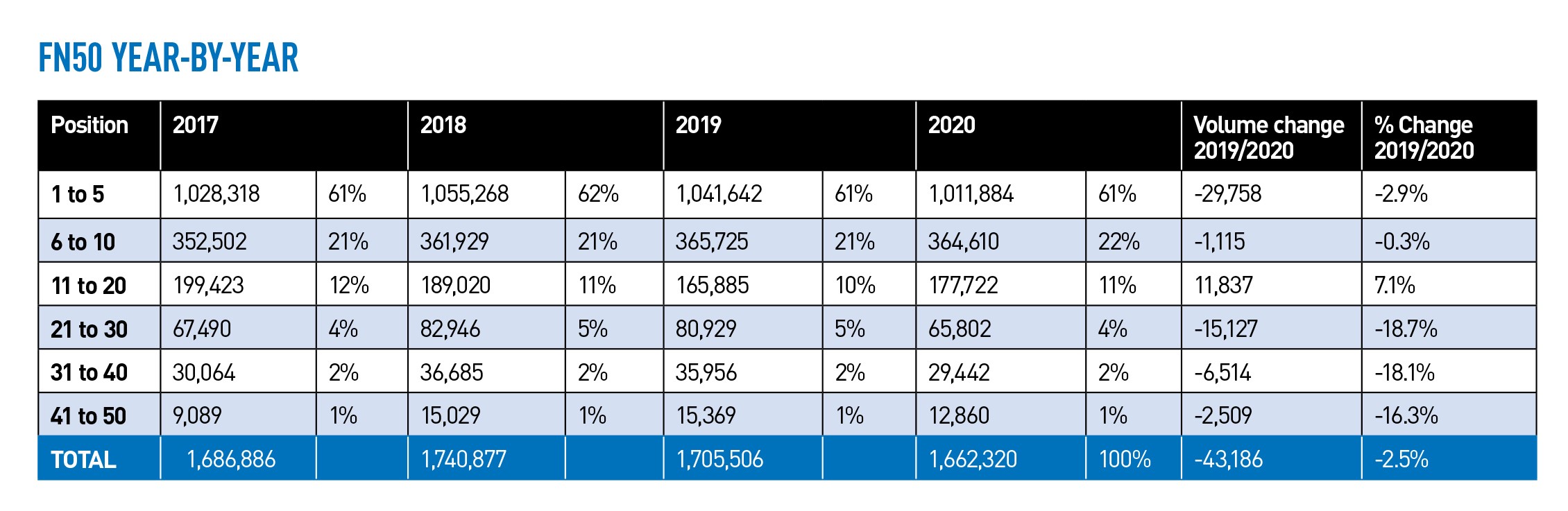

Also occurring for the second consecutive year is a decline in total car and van volumes funded by the UK’s 50 biggest leasing companies. The 2.5% reversal, or 43,186 vehicles, is slightly higher than the previous year’s 2%/35,371, resulting in an FN50 funded fleet of 1,662,320 vehicles.

However, where last year the drop in vehicles was largely prompted by the exit of Mercedes-Benz Financial Services (now retail only) and Sandicliffe Motor Contracts (no longer funding), the year it is due to an industry-wide reduction in company cars.

This is a result of people opting for cash (the number of employees paying benefit-in-kind (BIK) tax on a car continues to fall – 90,000 have left a car scheme over the past five years) and, more recently, by the impact of Covid-19 on jobs, although the full shock of this impending economic crisis is still to be felt.

And, while opt-outs are often converted into personal leases, this hasn’t plugged the gap.

Consequently, the number of company cars in the FN50 has fallen year-on-year by 3.3%, or 41,080 units, while vans saw a negligible 0.5% dip of 2,106 vehicles.

It continues a three-year trend of vans taking a gradually increasing share of the total number of vehicles funded by the FN50: in 2017 they accounted for 24%; this year it’s 27%.

The FN50 data presents a slightly less sombre picture than the recent industry-wide figures released by the British Vehicle Rental and Leasing Association which showed a lease fleet decline of 3.6% year-on-year, at a little more than 2.53 million vehicles.

However, its survey revealed growth in the van fleet by 2.1%, which partially offset a heavier deficit in cars of 5.2%.

Swing towards PCH

Healthier performance by personal leasing Business contract hire bore the brunt of the losses, down 9.7%, while personal contract hire (PCH) enjoyed a healthier performance, up 5.7%. This is echoed by the FN50 members, where the larger organisations have been extending their penetration into the personal leasing sector in recent years.

The past couple of years have seen a definite swing towards PCH among the UK’s biggest leasing companies. In 2018, fleet leasing accounted for 87% of their car business; this year that has fallen to 80%. Almost a quarter of a million cars (244,194) are now PCH.

Often, manufacturer-owned leasing providers have a greater proportion of retail business due to the agreements sold via their franchised dealers, such as FCA’s Leasys at 69% and Renault’s RCI at 67%, while ALD, which powers white label finance for the likes of Kia and Ford, is also weighted towards private leasing. Santander Consumer Finance (the clue being in the name) is 82.5% private and Affinity Leasing, which specialises in corporate affinity schemes for employees, is 96% private.

With the likes of Zenith (ZenAuto) and Arval (Arval for Employees) stepping up their retail aspirations, and growth in salary sacrifice schemes (although not all leasing companies view these as private leasing because of the central agreement with the employer), plus bank-owned organisations such as Lex Autolease improving internal synergies, personal lines could tighten their grip on the FN50 numbers in the coming years.

“The market has been diversifying for many years now and personal leasing in its various forms has penetrated both the retail market and corporate sectors,” says Craig McNaughton, corporate director at the UK’s biggest fleet lender Lex Autolease.

However, a compelling counter-argument centres on the growing attractiveness of electric and plug-in hybrid cars due to the very low BIK tax rates over the next four years.

Some leasing companies are already reporting electric cars accounting for 30-40% of their order books.

McNaughton again: “The advent of 0% BIK for EVs and low BIK for ULEVs has seen movement back into company cars and salary sacrifice.”

He believes that traditional fleet funding methods will remain dominant, despite suggestions among some industry commentators that a growing need for flexibility will persuade companies to negotiate shorter terms and consider alternative funding arrangements.

“We have been part of subscription trials with partners and they do have potential in very specific circumstances, but the economic model for such services remains a challenge, as can be seen by the poor financial results that continue to be delivered by traditional vehicle rental companies,” he says.

“As such, changes to shorter leases and more flexible products are likely to remain small scale due to their relative expense with the market continuing to mainly fulfil demand for providing long-term leasing/funding solutions.”

Nevertheless, flexibility is a recurring theme during 2020 due to the uncertainties caused by Covid-19 and a surge in people working from home, reducing their dependence on the car.

Alphabet doesn’t see subscription services as a replacement for traditional funding, but it does recognise the need for increasing flexibility, according to chief commercial office Simon Carr.

“We expect to see a rise in demand for shorter term, adaptable leasing arrangements to bridge the gap between rental and longer-term leases as drivers’ roles and requirements change,” Carr says.

“Funding choices will become even more data-led and wholelife costs will play an even bigger part in fleet managers’ decisions as the total cost of mobility will be key to running a successful fleet in a time when travel has naturally reduced.”

Flexibility doesn’t just mean shorter terms, however. Salary sacrifice expert Tusker has responded to customers’ needs to “provide shorter and longer agreement options for employees to increase inclusion for lower earners and those on shorter employment contracts”, says CEO Paul Gilsham.

EVs stimulating growth

Meanwhile, Claire Evans, fleet consultancy director at Zenith, believes EVs are stimulating growth in all sectors of the market, from company cars to salary sacrifice to personal contracts.

“We are already seeing a trend into leased vehicles and away from ownership with the growth in electric vehicles and movement to subscription-based services based on monthly affordability,” Evans says.

“It has resulted in increases in salary sacrifice and personal contract hire cars, where EVs account for one-in-two and one-in-four orders placed this year, respectively. We expect to see this trend continue.”

As part of the FN50 survey, leasing companies provide data on the vehicles they manage on behalf of a fleet customer but don’t fund.

For cars, the numbers have risen, showing that the need by UK business for fleet management support is growing, as outsourcing of a function sometimes seen as non-core continues.

This year, the number of cars under fleet management has risen by 27,046 to 259,518; meanwhile, the number of vans has fallen slightly, from 62,808 to 62,129.

As a business essential tool, vans are much more likely to be an in-house responsibility, particularly if the company also runs trucks with their elevated legal and compliance requirements.

The rise in fleet management has helped many leasing companies to offset the reversals in fleet funding.

With three new entrants in 2020, 26 of the 47 returning FN50 companies saw their funded fleet fall compared with 2019, up from 19 companies last year.

By far, the biggest impact was felt by those left outside the top 20 (see table), where double-digit falls were commonplace.

Half of the top 10 are funding more vehicles than a year ago, with notable growth in cars and vans by Arval, lifting it by 6% to leapfrog LeasePlan into third place, and seventh-placed Hitachi Capital Vehicle Solutions, up 7% thanks to wins in both cars and vans.

Free2Move bumped Zenith from eighth after a 5% boost to its funded business, almost entirely cars with a 7,000-unit rise, while Zenith experienced a marginal 1% drop in funded business – although its van division was up year-on-year.

Zenith has also extended its penetration into the truck business with the acquisition in September of Cartwright Fleet Services, Cartwright Rentals and Cartwright Finance Sales from the administrators.

The move created one of the UK’s largest HGV and specialist fleets with more than 50,000 vehicles and one of the UK’s largest trailer rental fleets.

It also underlines how some of the UK’s top lenders are now multi-asset funders with a breadth of interests, from salary sacrifice, job need and perk cars to vans, trucks and trailers.

And some are starting to gow even further, with e-scooters/ e-bikes, car share and other forms of mobility services.

Login to comment

Comments

No comments have been made yet.