Fleet and business registrations in January were almost 5% (4.88%) lower than in the same month last year, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

It follows a turbulant year, where true fleet sales were down 7.8% in 2018.

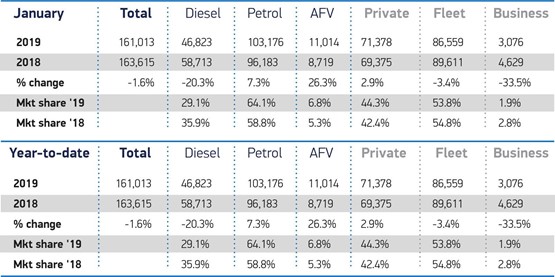

The UK’s new car market dipped 1.6% overall in January, with 161,013 new cars being registered.

Fleet and business retained the bulk of registrations, although the market showed a shift towards private sales – which were up 2.9%.

Many businesses are still waiting to order new company vehicles due to a lack of clarity over future taxation.

Mike Hawes, SMMT chief executive, said, “It’s encouraging to see car registrations in January broadly on par with a year ago as the latest high tech models and deals attracted buyers into showrooms. This, however, is still the fifth consecutive month of overall decline in the market. To restore momentum, we need supportive policies, not least on vehicle taxation, to encourage buyers to invest in new, cleaner vehicles that best suit their driving needs – from the latest petrols and diesels to an ever growing range of exciting electrified vehicles. This would be good for the environment and good for the industry and those who depend on it.”

Appetite for alternatively fuelled vehicles grew 26.3%, resulting in a total 6.8% market share. The performance supports the latest forecast for this sector, currently expected to rise more than a quarter by the end of 2019 to around 177,000 units.

Some 86,000 of these cars are set to be ultra low emission plug-in hybrids and battery electrics – taking plug-in market share to around 3.7% as an ever-increasing number of models come on sale. However, the SMMT says this level is still at the lower end of Government ambitions, underlining the need for greater purchase incentives and investment in charging infrastructure.

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, said: “With an increase of over 26% in the adoption of AFV registrations, there is clearly a growing confidence in electric, plug-in hybrid and hybrid cars.

“This demonstrates an ever increasing awareness that AFVs can provide significant cost savings whilst meeting air quality guidelines which are increasingly at the forefront of vehicle purchase decision making.

“Although fleet and notably business registrations have dipped markedly, initiatives such as Optimise Prime, the world's biggest trial of commercial electric vehicles, will accelerate the transition amongst drivers as they become more confident in the charging infrastructure supporting AFVs.”

Petrol demand also grew in January, up 7.3%, but this was not enough to offset another month of decline for diesel, as registrations fell -20.3%.

Ian Gilmartin, head of retail and wholesale at Barclays Corporate Banking, said: “There are some bright spots in the new car data with the first increase in private sales since August and a really impressive 26% rise in alternatively fuelled vehicles. However, the celebrations in the showrooms will be fairly muted, as although consumer purchases held up it wasn’t enough to prevent an overall decline with business buyers reluctant to commit to long term fleet investment until they are more comfortable with the broader economic outlook.

“As Nissan made clear at the weekend, a lack of clarity around Brexit is hurting UK vehicle manufacturing, but it’s also affecting car sales. Dealers have been holding out hope for some certainty, or at least a clearer route to certainty, on Brexit plans being in place before the new plates hit the road in March. That now looks pretty optimistic, and it could be that the most important month for the new car sector is falling at the worst possible time, so the car industry will want to see some progress in the very near future.”

The Ford Fiesta was the best-selling car in January, followed by its stablemate the Focus.

Mercedes-Benz was the only premium brand to feature in the top 10 for the month, with the A-Class ranking fifth and the C-Class placing 10th.

Login to comment

Comments

No comments have been made yet.