UK car manufacturing output fell by more than a third (37.6%) last month, the worst July performance since 1956, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

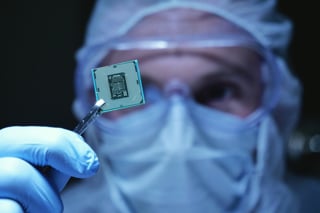

Manufacturers have been grappling with the global shortage of semiconductors and staff absence resulting from the ‘pingdemic’, with some altering summer shutdown timings to help manage the situation.

In July, production for the UK market declined by 38.7% to 8,233 while manufacturing for export also fell, down 37.4%, with 45,205 cars shipped overseas.

Mike Hawes, chief executive of the SMMT, said that the figures lay bare the “extremely tough conditions” UK car manufacturers continue to face.

“While the impact of the ‘pingdemic’ will lessen as self-isolation rules change, the worldwide shortage of semiconductors shows little sign of abating,” he added.

“The UK automotive industry is doing what it can to keep production lines going, testament to the adaptability of its workforce and manufacturing processes, but Government can help by continuing the supportive Covid measures currently in place and boosting our competitiveness with a reduction in energy levies and business rates for a sector that is strategically important in delivering net zero.”

Exports accounted for more than eight out of 10 (84.6%) vehicles built in the month. More than a quarter (26%) of all cars made in July were either battery electric (BEV), plug in hybrid (PHEV) or hybrid electric (HEV), their highest share on record.

Meryem Brassington, electrification propositions lead at Lex Autolease, said that the record-low vehicle production figures reaffirm the challenging conditions the UK motor industry continues to face.

“Despite this, it’s encouraging to see the production of hybrid and full electric vehicles continue to show no signs of slowing down," she added. "If we’re serious about leading the EV charge, then policy makers and manufacturers must continue to work together to accelerate the UK’s electrification plans and ensure that the Road to Zero remains at the top of the agenda."

Production overall remains up 18.3% on Covid hit 2020 at 552,361 units, but this is down significantly (28.7%) on 2019 pre-pandemic levels when 774,760 cars rolled off production lines.

Richard Peberdy, UK head of automotive at KPMG, said: “Supply chain pressures continue to weigh heavy on auto manufacturers as the wider economy edges closer towards recovery.

“Carmakers will be cursing a mix of factors stifling their ability to produce more vehicles, namely materials and labour shortages and increases to shipping costs.

“Manufacturers are absorbing the costs for now, but we could soon see price rises being passed on to consumers should problems persist, which runs the risk of dampening the sales recovery.

“Many carmakers find themselves in a bind between electric vehicles (EV) and traditional combustion engines.

“Despite some encouraging EV uptake among consumers, regular petrol cars are still popular because of their lower price point, with some remaining wariness over EV technology and reliance on charging.

“We can expect more calls from the industry for further Government support to help produce the vehicles that will drive us towards a net-zero carbon future.”

Just last week, Jaguar Land Rover (JLR) warned leasing companies that lead times for 53 model variants are now in excess of one year.

Facing the same supply issues, Mercedes-Benz has removed specification features from certain models “from late June production and until further notice,” in order to limit delivery time delays.

It followed Toyota announcing a 40% cut in worldwide production in September. It had planned to produce almost 900,000 cars next month but has now said that will be reduced to 540,000 units.

Every car- and van-maker is being impacted by the computer chip crisis. Almost 95% of fleets responding to a Fleet News poll said they were experiencing vehicle delays.

Login to comment

Comments

No comments have been made yet.