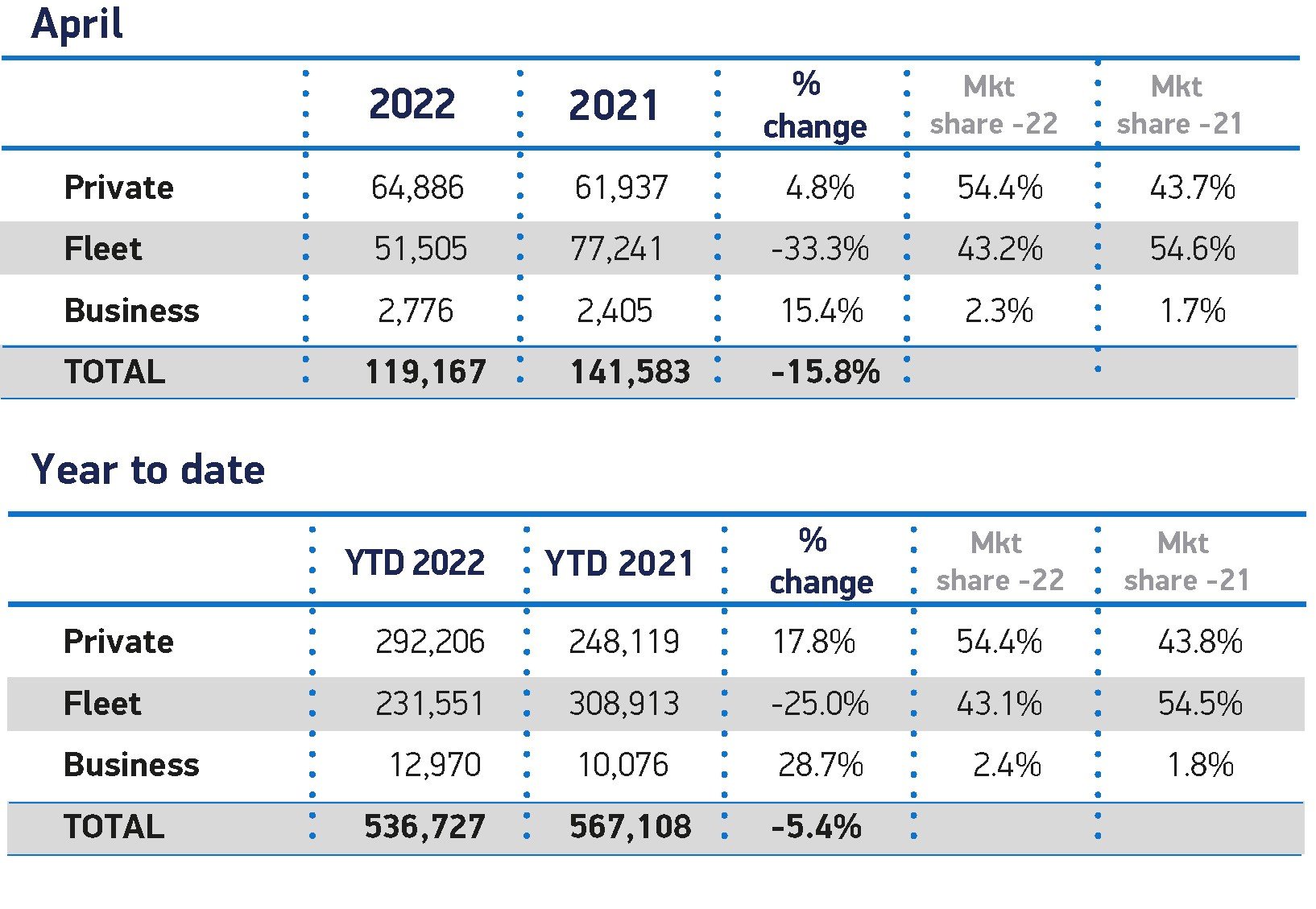

The ongoing chip shortage is being blamed for a 32% fall in company car registrations in April, compared to the same month last year, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

Just 54,281 new cars were registered to fleet and business compared to 79,646 units in April 2021, despite leasing companies reporting record orders for new vehicles.

Year-to-date fleet and business registrations are down by almost a quarter (23%) in the first four months of 2021, with 244,521 cars registered compared to 318,989, last year.

However, private registrations have fared better with April showing a 4.8% rise year-on-year, with 64,886 new cars registered.

Private registrations are also up almost 18% year-to-date, with manufacturers prioritising the private market over fleets.

Mike Hawes, SMMT chief executive, said: “The worldwide semiconductor shortage continues to drag down the market, with global geopolitical issues threatening to undermine both supply and demand in the coming months.

“Manufacturers are doing everything they can to deliver the latest low and zero emission vehicles.”

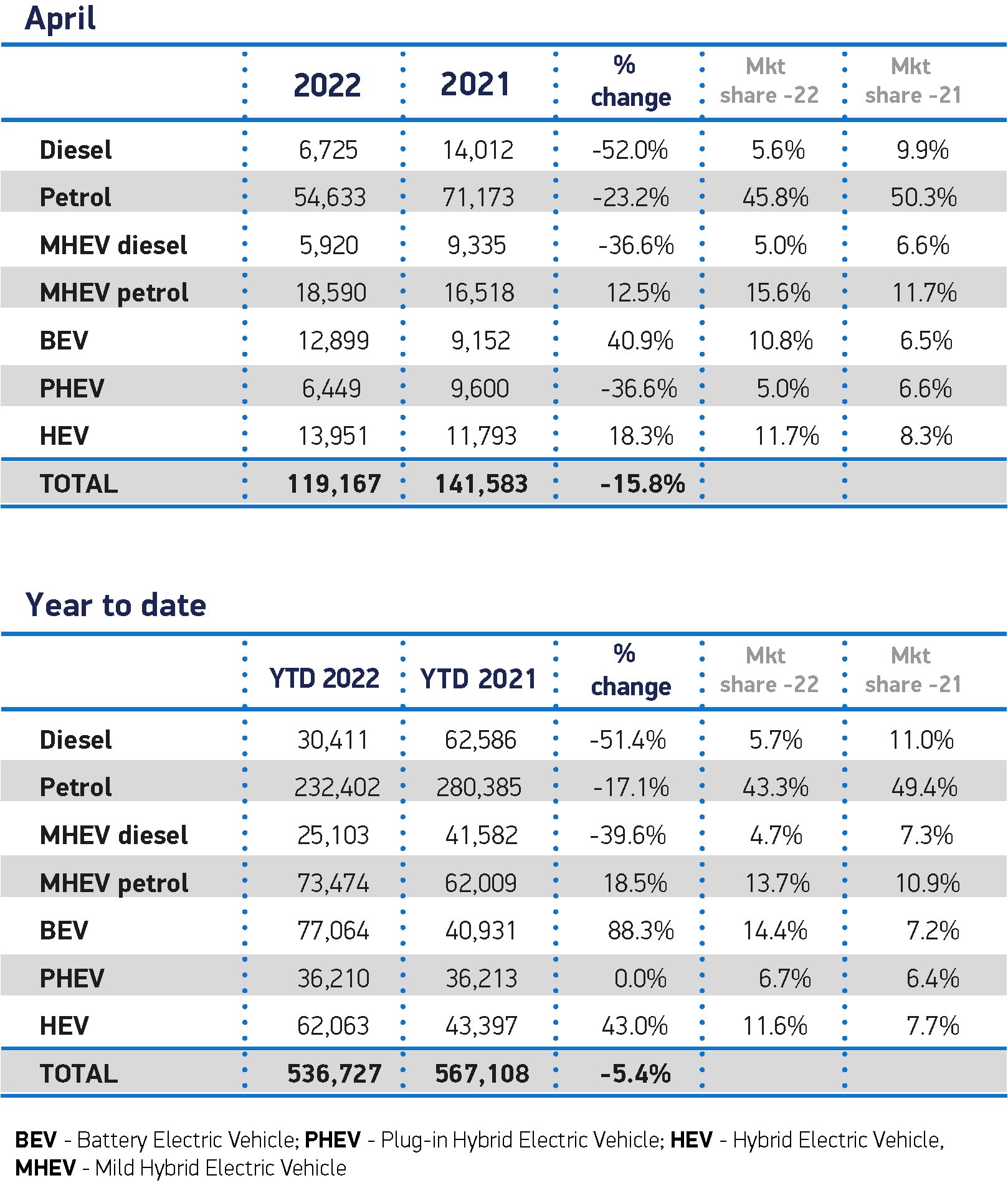

Battery electric vehicles (BEVs) registrations continued to grow with 12,899 of the latest zero emission cars joining UK roads – an increase of 40.9% on the same month last year – and taking a 10.8% market share, up from 6.5% last year.

While registrations of hybrids (HEVs) also rose by 18.3%, the number of new plug-in hybrid (PHEV) registrations decreased by a third (32.8%). As a result, electrified vehicles comprised 27.9% of all new car registrations during April.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “Policymakers have played a huge role in encouraging EV manufacturers to bring zero emission vehicles to the UK despite the ongoing supply chain issues, delivering a real boost to our green economy.

“In order to ensure that the good work continues beyond 2025, balancing demand and supply is now key to achieving the UK’s longer-term ambition.

“The recently launched Zero-Emission Vehicle Mandate policy consultation further cements the UK’s ambition to lead the EV charge and will be vital to help shape the trajectory for an electric future in the years ahead.”

SMMT downgrades market outlook

The SMMT says the sector faces further economic headwinds, with rising inflation, not least due to the spiralling energy and fuel costs squeezing household incomes, and further supply chain and other uncertainties arising from the global political situation and the effects of the Russian invasion of Ukraine.

Given the ongoing impact of supply chain constraints and broader macro-economic factors, SMMT has revised its market outlook for 2022, with 1.72 million new cars new cars now expected to be registered during the year, down from the 1.89 million outlook in January.

While this still represents a 4.5% rise on 2021, it highlights the effect the semiconductor shortage is still having on supply as well as anticipated impacts from rising living costs, says the SMMT.

The outlook for plug-in vehicles also was downgraded with the forecast for BEV registrations now at 289,000 units, down from 307,000; and PHEVs at 144,000, down from 163,000.

HEVs also saw their outlook fall from 198,000 to 193,000. This means that plug-in electric cars are now expected to account for a quarter of all registrations (25.2%) during the year, with BEVs alone comprising around one in six new cars on the road.

Jon Lawes, managing director of Novuna Vehicle Solutions, said: “Supply chain issues are causing OEMs to feel the pinch more than ever as they struggle to fulfil increasing orders, on top of a backlog of deliveries.

“With a protracted shortage of vehicles, it is prudent for drivers and fleet operators to be planning further ahead, increasing their renewal cycle from six to nine months in advance.

“For leasing companies, there is an onus on providing flexible extension agreements to help alleviate the current situation.”

Richard Peberdy, UK head of automotive at KPMG, added: “As implications of conflict in the Ukraine further complicate supply chain challenges that were already lingering from the pandemic, the impact of a rising cost of living adds further uncertainty for the automotive industry in 2022.”

Manu Varghese, from EY’s UK & Ireland advanced manufacturing and mobility team, says that high oil prices, reduced availability of key raw materials, transportation challenges caused due to Covid lockdowns in Asia, and shortage of freight carriers has continued to create disruption for automotive manufacturing both in the UK, and globally.

He explained: “April followed a similar pattern to March with sales being weighed down by supply chain related concerns, rising prices of components and the energy crisis.

“Geopolitical uncertainty has continued to create uncertainty and derailed the slow recovery that we had begun to see at the beginning of the year.

“With the start of the pandemic now over two years ago, we will continue to see the nearly new car pipeline hampered due to the production reductions limiting cars into the market from that time.”

Login to comment

Comments

No comments have been made yet.