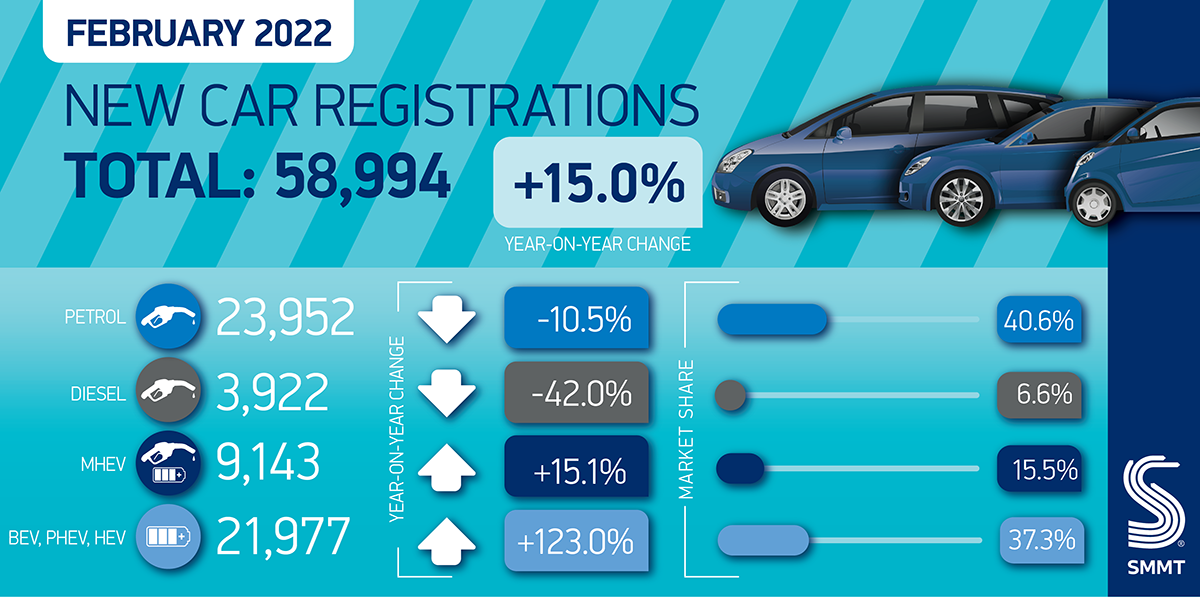

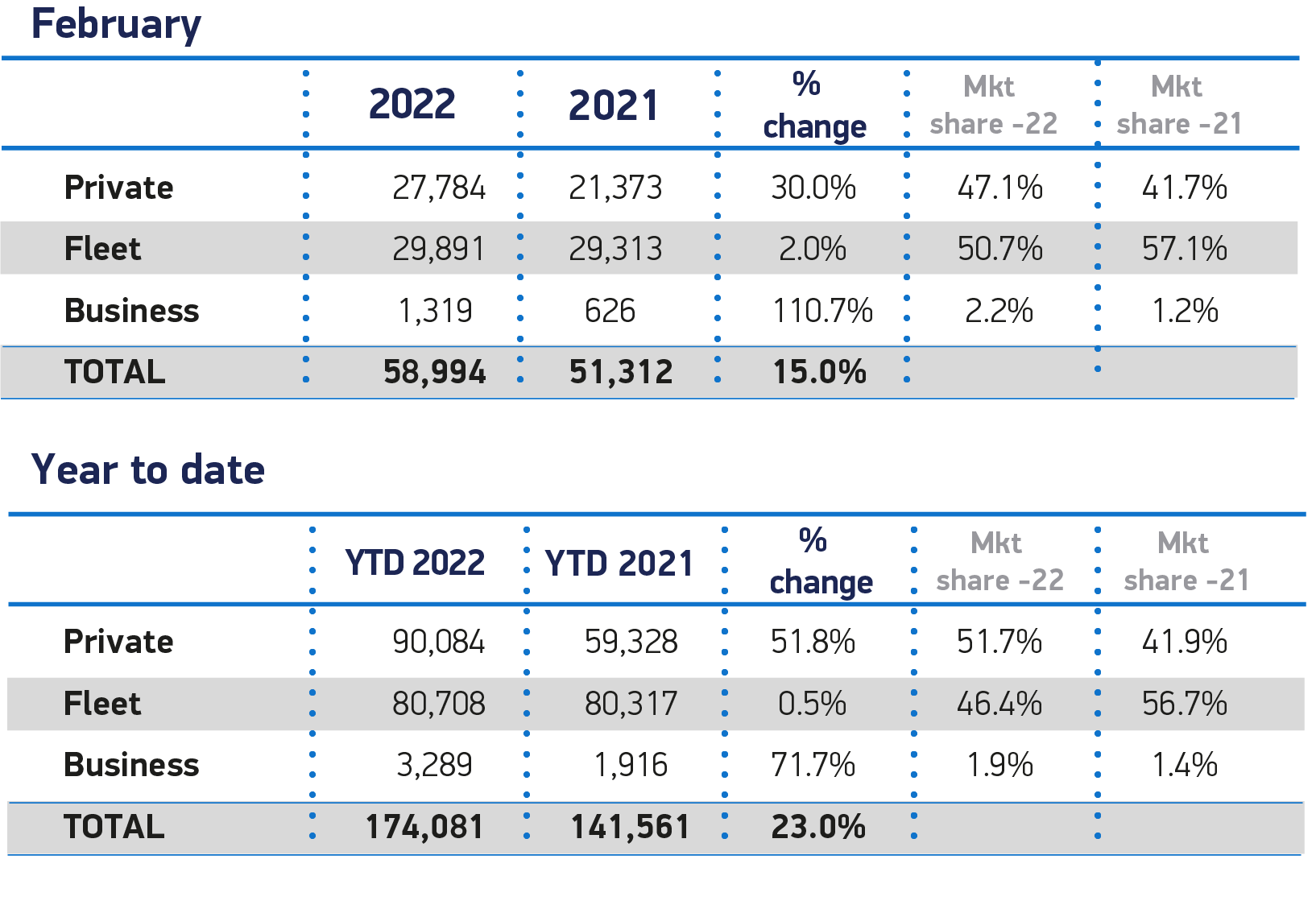

Fleet and business new company car registrations increased by 4.2% in February, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

The 31,210 units registered to fleet and business equated to 53% of the market and with private registrations (27,784 units) recording a 30% rise helped the UK new car market achieve a 15% increase overall.

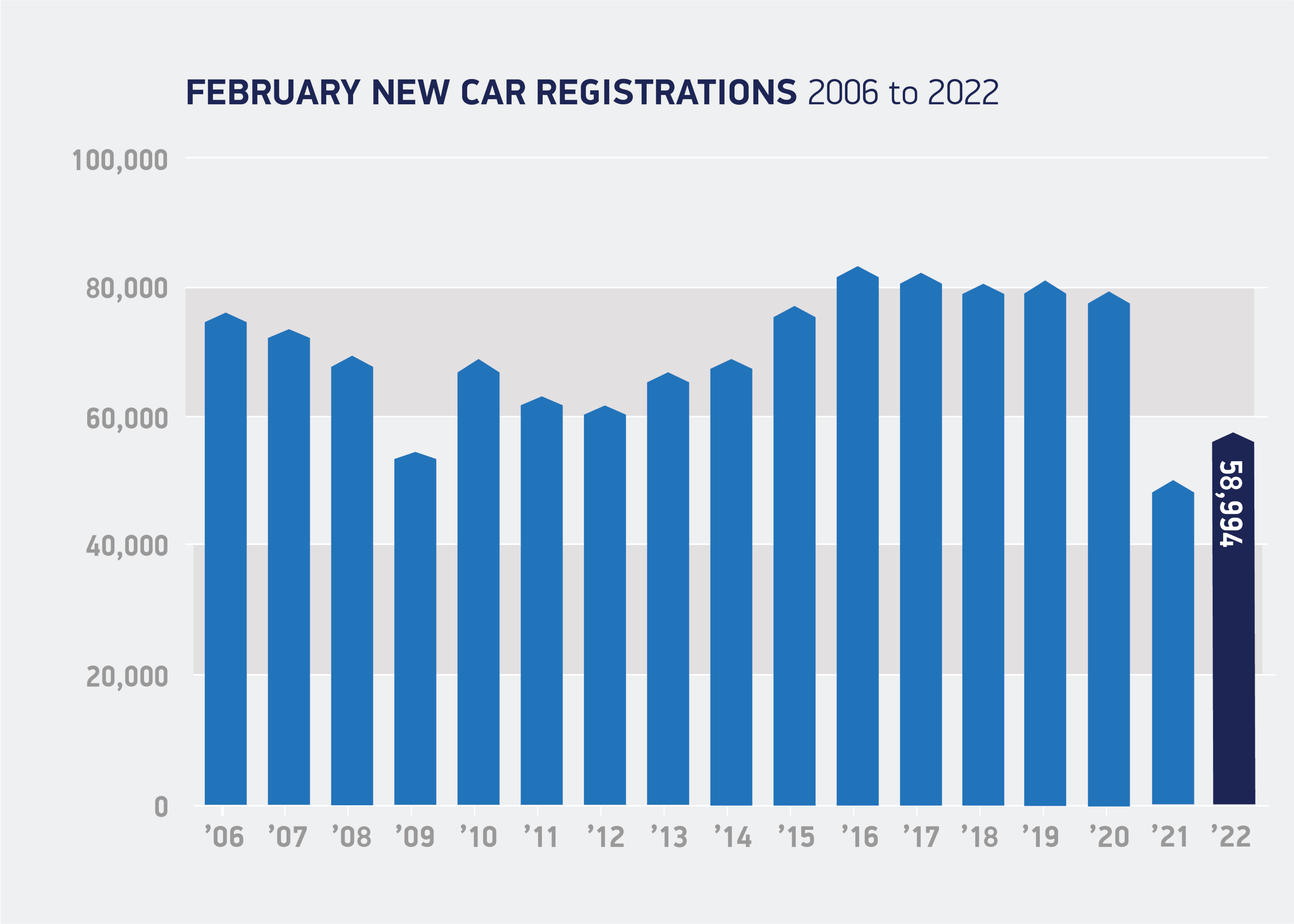

However, despite this positive performance, registrations are down 25.9% on pre-pandemic levels, as vehicle supply remains constrained by semiconductor shortages.

Jon Lawes, managing director of Novuna Vehicle Solutions (formerly Hitachi Capital Vehicle Solutions), said: “Supply chain pressures continue to hamper new car production with some manufacturers reporting average wait times of up to 22 weeks, meaning we’re unlikely to see a wave of new plates hit the roads in the coming weeks.

“This is having a knock-on effect on service, maintenance and repair (SMR) budgets and heightens the importance for fleets of having reliable price protection in place from their leasing provider.”

Manu Varghese, from EY’s UK and Ireland advanced manufacturing and mobility team, says that supply chain impacts and the chip shortage will continue in the short term.

“We are in 2021 results season, with many auto manufacturers attributing falling production numbers (UK car production fell 20% in January this year) and high levels of unfulfilled customer orders to the shortage in semi-conductors,” he explained.

“Despite that, February saw assertive statements from OEMs and automotive suppliers regarding an easing of the crisis.

“Through a combination of vertical integration and partnerships they have begun to see light at the end of tunnel and manufacturers are expecting a ramp up in production during the second half of 2022.”

Growing demand for electric vehicles

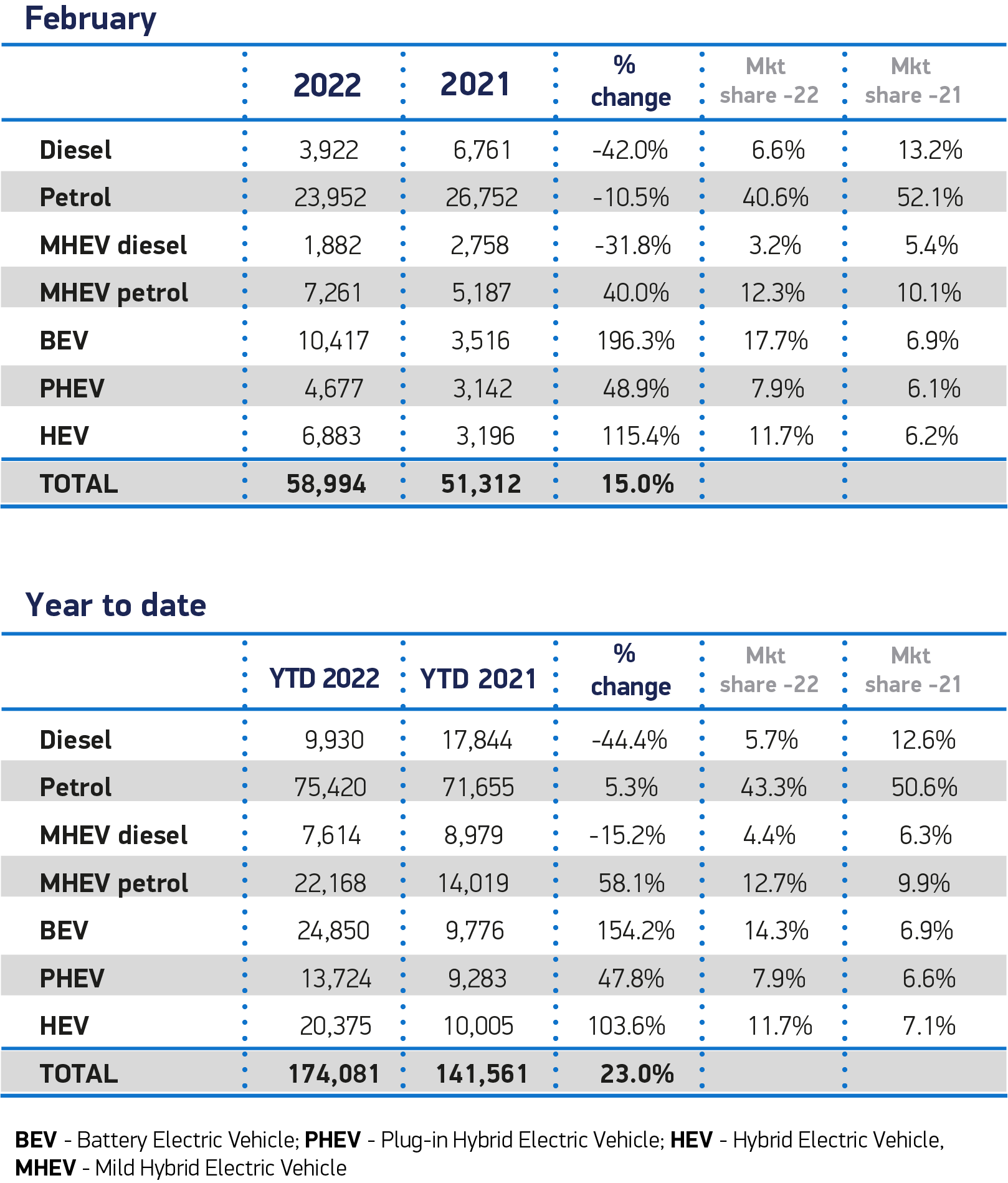

Battery electric vehicles (BEVs) took a 17.7% market share to reach 10,417 units, while registrations of plug-in hybrids (PHEVs) rose to 4,677 units and a 7.9% share of the market.

When combined with hybrid (HEV) registrations (6,883), electrified vehicles accounted for more than a third of all new cars leaving dealerships.

While this demonstrates the growing demand for electric cars, February is typically the lowest volume month, as many buyers delay purchases until the ‘new plate’ month of March, and fluctuations in supply for some key models can have a more pronounced effect in terms of market share.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “After a record-breaking year for zero-emission vehicles, there appears to be no signs of the market slowing down, with EVs now accounting for 14.3% of all new motors bought in the UK.

“Coupled with several manufacturers planning the release of new electrified models this year, the outlook for EVs looks exceptionally bright.”

She added: “Despite the ongoing turbulence across the industry continuing to impact the supply of new vehicles, tentative green shoots of recovery are starting to appear within the supply chain and it’s possible that we will see some of the pent-up demand released in the months ahead.

“Yet, if we don’t see continued investment in the roll out of publicly available charge points then ultimately the UK won’t be able to meet the demand for an electrified future.

“All eyes will be on the Chancellor this month for clarity and additional incentives for both fleets and private drivers to accelerate the electric revolution.”

EV infrastructure investment 'needed'

The SMMT says that there is a growing need for the acceleration of public charge point provision. Last month, the automotive trade body published its seven-point plan to increase the number of public on-street chargers.

Mike Hawes, chief executive of the SMMT, said: “More than ever, infrastructure investment needs to accelerate to match this growth.

“Government must use its upcoming Spring Statement to enable this transition, continuing support for home and workplace charging, boosting public charge point rollout to tackle charging anxiety and, given the massive increase in energy prices, reducing VAT on public charging points. This will energise both consumer and business confidence and accelerate our switch to zero emission mobility.”

Last month, the AA urged the Treasury to cut VAT on electricity to 5% for public charge points to match the rates that homeowners with their own charging posts benefit from.

The AA says that more should be done to help BEV drivers without access to off-street parking who cannot benefit from home charging at preferential rates.

April will see the effective end of the Electric Vehicle Homecharge Scheme (EVHS), which has provided vital funding for homeowners to install their own charge point.

Ahead of the government’s Spring Statement, SMMT is calling for an extension to both the EVHS and its business counterpart, the Workplace Charging Scheme, beyond 2025 to ensure EV uptake remains on track to meet Government’s net zero deadlines.

It also recommends that VAT on electricity used for public charging points be cut to match that for home use, so that EV drivers are treated equally regardless of where they charge their vehicle.

Lucy Simpson, head of EV propositions at British Gas, said: “In order to stay ahead of the electrification curve, we must continue to respond to the charging challenges to avoid the millions of people without private driveways being excluded from EV ownership.

“It's clear that there are regional disparities in public charging availability and this need to be addressed.”

Leon Wong, EV business development manager at The Pilot Group, also believes that addressing common barriers to adoption, like the availability and equality of charging infrastructure, will be key.

“Financial stimulus remains a clear driver for individuals and businesses making the switch to electric, and must remain a priority for policymakers as the UK looks to achieve its Road to Zero targets,” he said.

Jamie Hamilton, automotive director and head of electric vehicles at Deloitte, says manufacturers and dealers will barely have time to reflect on February’s performance as all eyes turn to March.

“The release of a new plate means that March is, traditionally, the most important month for new car sales and can account for as many as one in five annual registrations,” he said.

“However, the ability for manufacturers to fulfil ’22 plate orders will likely be compromised by the ongoing semi-conductor shortage.”

> Interested in comparing electric vehicle data? Check out our EV tool.

> Interested in ensuring the efficient use of EVs. Check out our dedicated editorial sections: Insight & policy | EV news | Charging & infrastructure | Costs & incentives | Benefit-in-kind | EV case studies | EV road tests

Login to comment

Comments

No comments have been made yet.