New sales data suggests that limited new car supply is being diverted towards retail rather than fleet and business.

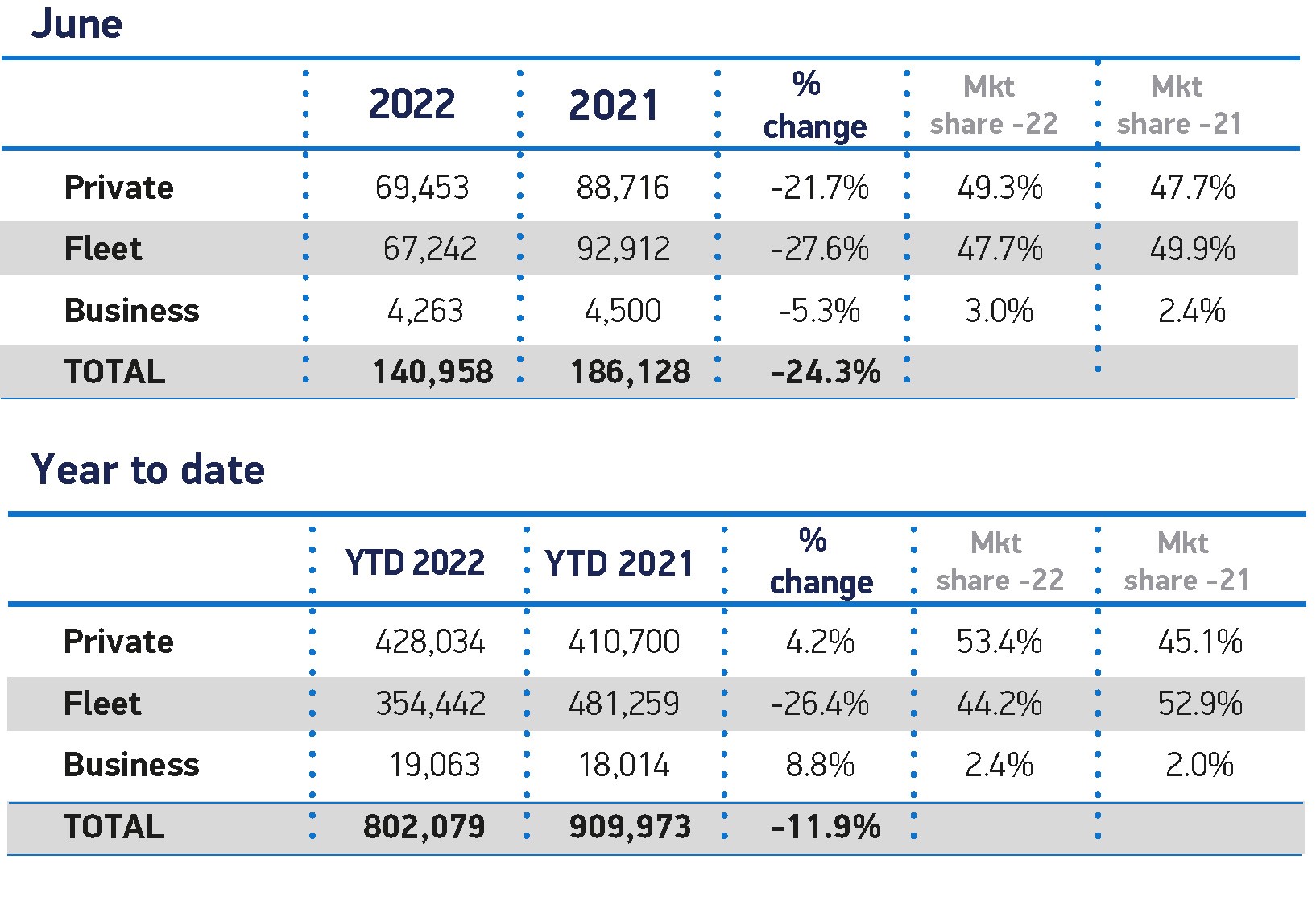

Year-to-date fleet and business new car registrations were down 25.2% in the first half of this year compared to last year, while private registrations were up by 4.2%.

The figures, from the Society of Motor Manufacturers and Traders (SMMT), show that 373,505 units were registered to fleet and business from January to June, while last year the sector received almost half a million units.

Meanwhile, there were 428,034 private new cars registrations, up 4.2% on the 410,700 units registered last year.

Both retail and fleet and business registrations were down in June, however, with fleet and business registrations falling by 26.6% and private new car registrations down by 21.7%.

As a result, the fleet and business share of the market reduced to 50.7% as manufacturers continue to prioritise private consumers in the supply-constrained environment.

New car supply 'worsening' for some fleets

Fleet trade and training body, the Association of Fleet Professionals (AFP), says that new car supply for some fleets is worsening and remains extremely patchy for almost all.

Paul Hollick, chair of the AFP, said: "We are hearing many stories that suggest the situation is worsening, at least for certain businesses, and show no apparent signs of improving.

“Some fleet managers are telling us that drivers are having to go through the process of choosing a new car half a dozen times before finding one for which a manufacturer will even provide an production slot – and that date is likely to be a year or more away.

“Other manufacturers have closed their order books either completely or for certain models. In general terms, PHEVs have become very difficult to acquire and it seems that production is being skewed away from them towards EVs, probably because of CAFE regulations.

“Even when cars can be obtained, they are often being delivered without meeting the order specification. The wrong colour is fairly commonplace but equipment is often missing – parking sensors seem to be a particular issue – with no resulting adjustment in price.

“All of these problems exist for petrol and diesel cars but can generally be doubled for EVs.”

Fleets have been left with little choice but to continue operating their existing cars for as long as possible but with new car shortages now in their second year, there was increasing pressure on managers.

“The situation creates two sets of problems," Hollick explained. "The first is that the car is ageing and difficulties with keeping it on the road in a cost effective manner increase over time.

"Some cars are now being operated into their fifth year and will probably still be on the fleet in their sixth because they cannot be replaced. These are unchartered waters in maintenance terms.

“The second is an employee satisfaction issue. Drivers who are keen to move into EVs but simply cannot get hold of the right model are having to continue to pay benefit in kind on ageing and increasingly unattractive diesel models, with no solution in sight. There is no easy answer to this situation and it does cause some disruption.”

Plug-in sales account for a fifth of the new car market

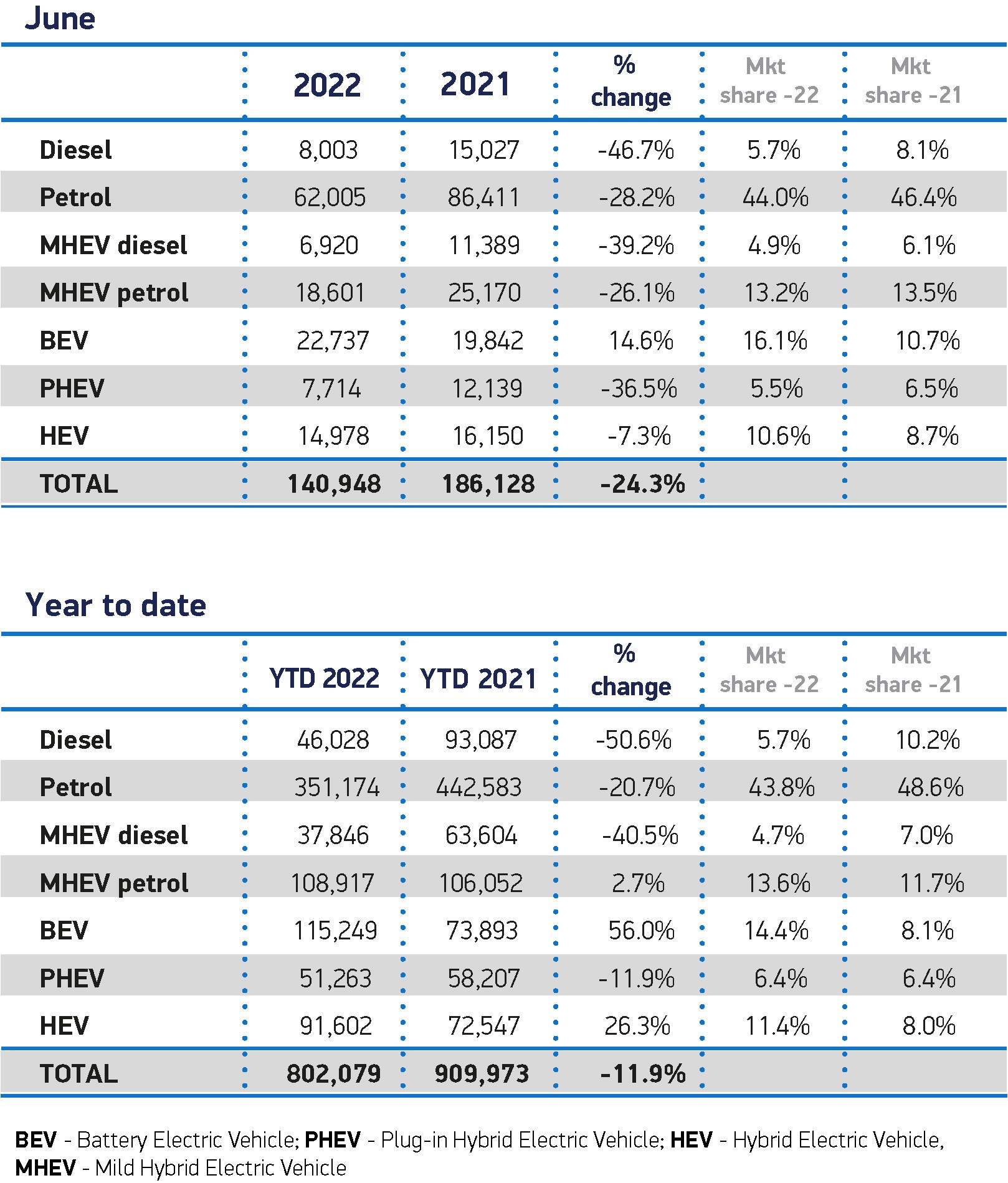

Battery electric vehicles (BEVs) continued to grow, with a 14.6% increase in volume, as market share continued to grow, reaching 16.1%, up from 10.7% a year before.

Conversely, plug-in hybrid electric vehicle (PHEV) uptake fell by 4,425 units to take a 5.5% market share.

In total, plug-in vehicles comprised more than a fifth (21.6%) of new cars joining the road in the month.

All other powertrains saw declines in registration volumes and market share apart from hybrid electric vehicles (HEVs), which, despite a 1,172-unit fall, increased their market share to 10.6%.

Mike Hawes, SMMT chief executive, said: “The semiconductor shortage is stifling the new car market even more than last year’s lockdown.

“Electric vehicle demand continues to be the one bright spot, as more electric cars than ever take to the road, but while this growth is welcome it is not yet enough to offset weak overall volumes, which has huge implications for fleet renewal and our ability to meet overall carbon reduction targets.

“With motorists facing rising fuel costs, however, the switch to an electric car makes ever more sense and the industry is working hard to improve supply and prioritise deliveries of these new technologies given the savings they can afford drivers.”

Henry Duff, head of net zero at British Gas, says that UK businesses are set to adopt more than 160,000 EVs as part of a £13.6 billion electrification drive in the next 12 months.

“As demand for EVs intensifies, we must ensure that the UK’s charging network is ready for drivers to access reliable, convenient and easy to operate charge points," he said.

"The Government’s decision to redirect investment away from the plug-in car grant towards advancing the rollout of charge points will go some way to help meet the demand for better infrastructure and give motorists the confidence to make the switch to electric.”

Global vehicle production struggles to meet demand

Given the ongoing shortages of essential components, exacerbated by pandemic restrictions in China, global vehicle production has struggled to keep up with demand throughout 2022.

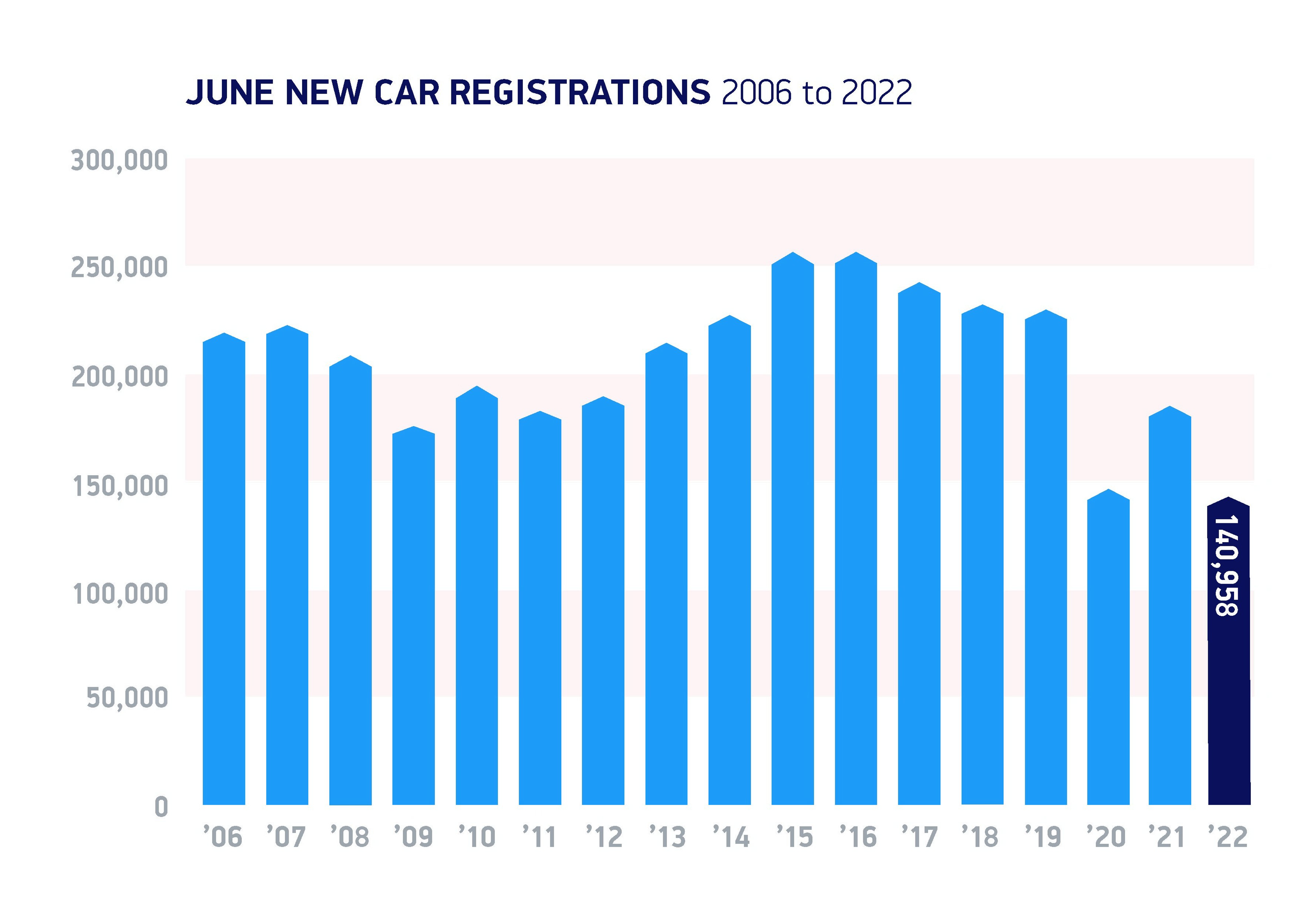

New car registrations for the year to date have fallen by 11.9% to 802,079 units – the weakest first half year performance since 1992, bar 2020

Some 107,894 fewer new cars have been registered during the first half of 2022 compared with the same period last year – despite 2021 demand being restricted by dealership lockdowns until April, with consumers only able to buy vehicles through click and collect.

More positively, electric vehicle market share continues to grow. Plug-ins account for a record one in five new car registrations year to date, demonstrating manufacturers’ commitments to deliver the latest zero emission capable vehicles.

The pace of this growth, however, is decelerating, with registrations up by 26.0% in the first half of 2022, compared with growth of 161.3% during the first half of 2021.

While growth rates were expected to moderate as the market begins to establish, the slowdown is more than had been anticipated, leaving the market behind the industry’s outlook.

Part of this fall is attributable to the continuing supply chain shortages that are hampering production of all models, but the scrappage of the plug-in car grant means the UK is now the only major European market without purchase incentives for private EV buyers, says the SMMT.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “Despite the ongoing material challenges troubling the new car market, electric vehicle uptake has continued to rocket, with today’s half-year figures representing a 56% increase on this time last year.

“In order to continue this momentum, we must guarantee that EVs are affordable for all through a stable second-hand market while ensuring the UK’s public charging infrastructure is robust enough to match the increased number of electric vehicles on the roads.

“The government’s decision to redirect investment away from the plug-in car grant towards accelerating the roll-out of charge points will go some way to help meet the demand, but we must continue to see further investment from policy makers.

“This includes a long-term visibility of company car rates beyond 2025 to give fleet decision makers the clarity they need to make purchasing decisions, especially with the longer lead times from manufacturers currently being experienced.”

Jon Lawes, managing director of Novuna Vehicle Solutions, says that it is exciting to see EV demand continue, despite ongoing vehicle supply shortages.

“As eye watering prices at the pumps prevail, there has never been a better time to lease an EV, particularly via generous salary sacrifice schemes where we’re seeing a huge demand from customers seeking to help their employees join the EV revolution,” he said.

“Leasing not only offers a cost effective way to get into an EV, it also provides protection of fixed costs against the challenging backdrop of rising inflation.”

Login to comment

Comments

No comments have been made yet.