The European new car market registered a total of 907,000 units in January, representing an 11% increase when compared with the same month last year.

It also marks an improvement on January 2021, when Europe’s economies were recovering from the pandemic while the industry was facing the worst of the global semiconductor shortage.

Volumes are still behind pre-pandemic levels, however. European registrations totalled 1.13m units in February 2020 and 1.22m units in February 2019.

Felipe Munoz, global analyst at JATO Dynamics, said: “We are seeing positive signs, but not enough to take the market back to the position it was in before the pandemic hit. The reality is that we might never see sales at that level again.”

Bloomberg Intelligence (BI) anticipates 5-10% growth in 2023, which is 25% below 2019.

Gillian Davis, BI industry analyst (autos), explained: “Supply-chain constraints have abated, though tightening consumer budgets amid inflation and rising interest rates are a risk to pricing and the auto-sales recovery. Still, the uncertain economic backdrop is unlikely to translate into a decline in 2023, given 2022 purchasing volume matched previous European recession lows. Excess demand vs. supply -- a critical driver of pricing since 2H20 in helping automakers counter volume decreases and maintain or improve profit margin -- could reverse in 2023 as vehicle output picks up.”

Last month, growth was largely driven by SUVs. According to JATO Dynamics data, registrations across all SUV types (small, compact, midsize, luxury) totalled 464,900 units, up by 14% compared to January 2022. With a market share of 51.3%, January marked the first time that SUVs have accounted for more half of total new car registrations in Europe.

Volkswagen Group achieved the largest registrations with 129,500 units (+33%), followed by Stellantis with 62,800 units (-7%), Hyundai-Kia with 46,200 units (-5%), Toyota with 38,300 units (+11%), and Renault Group with 34,300 units (+20%). Chinese brands registered 12,100 units – an increase of 109%.

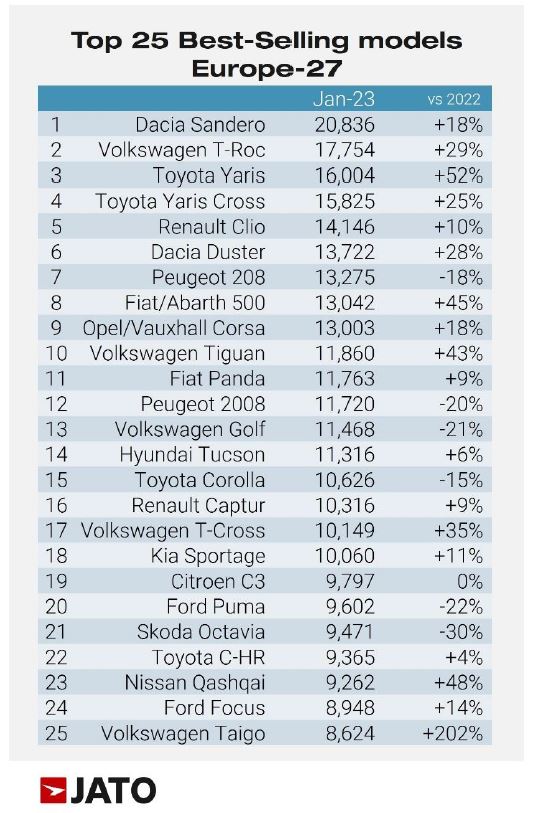

The Dacia Sandero was the best-selling car across Europe in January, followed by the VW T-Roc. When looking at the EV market, the Tesla Model Y remained the most popular.

Registrations of electric vehicles (EVs) increased by 14% to more than 92,700 units, however growth has slowed when compared with 2022.

Munoz, added: “Without affordable options from OEMs or more attractive incentives from governments across Europe, it seems that demand may be close to reaching a peak.”

Unlike in previous years, Tesla performed well during the first month of the quarter with a 1018% increase in volume to almost 9,400 units.

In the UK, 131,994 new cars were registered during January – a 14.7% year-on-year increase, with fleet and business sales equating to 55% of the market.

Login to comment

Comments

No comments have been made yet.