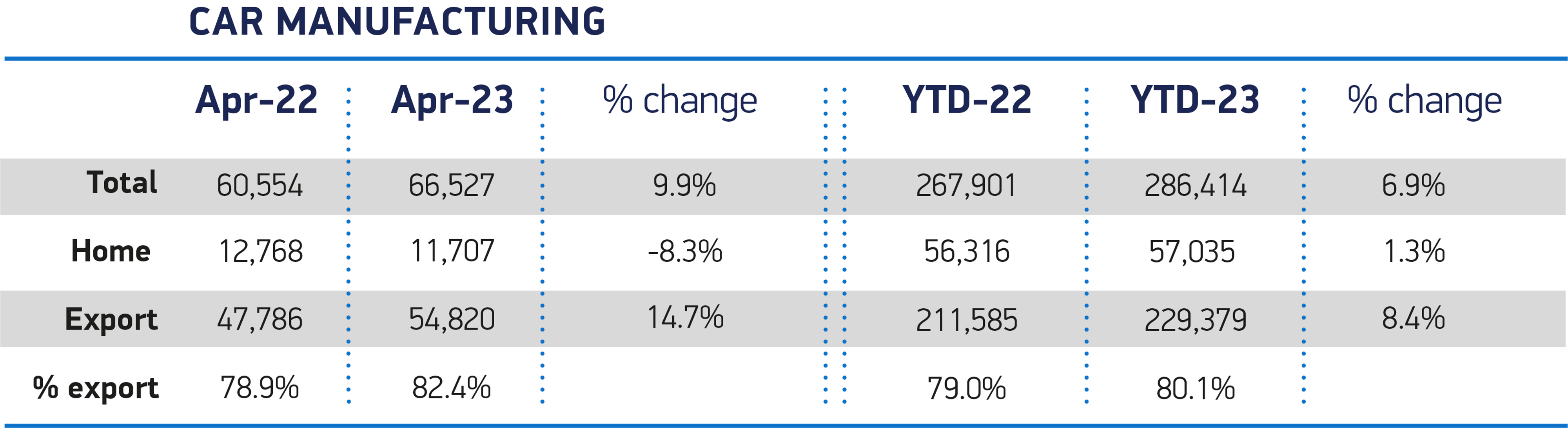

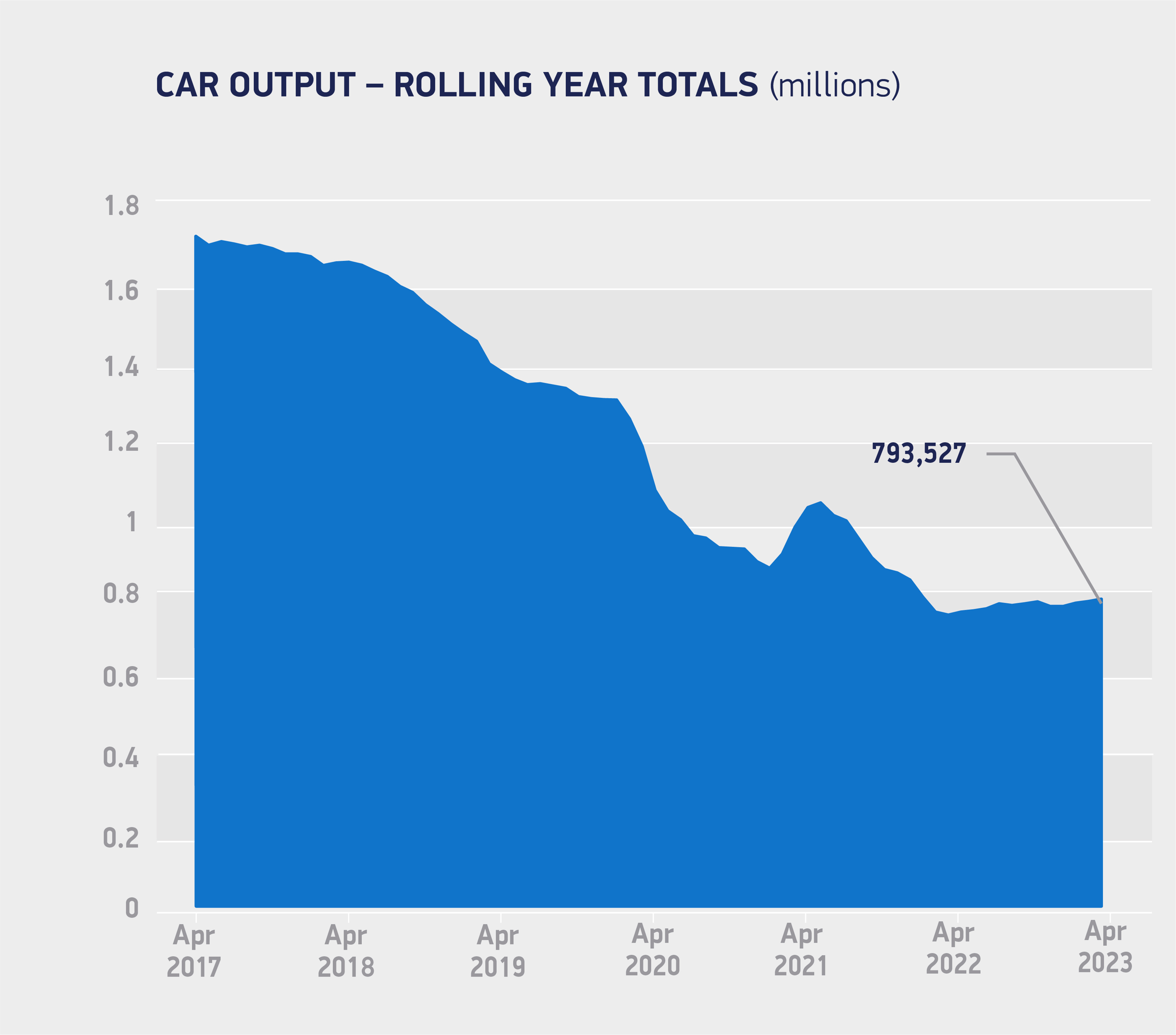

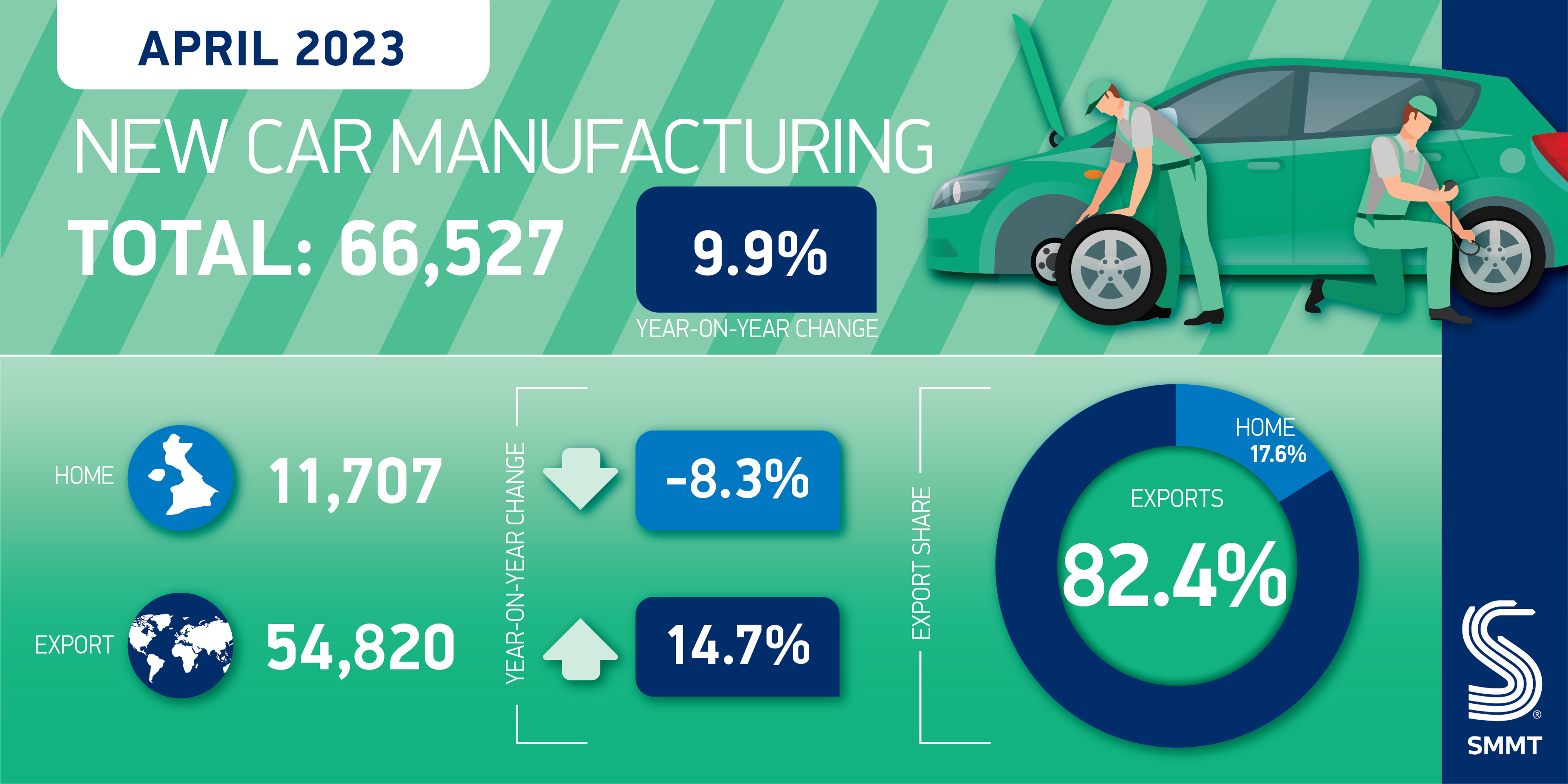

British car manufacturing made further gains in April, with output increasing by 9.9%, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

In total, 66,527 cars rolled of production lines, 5,973 more than in April last year as global supply chain shortages, most notably of semiconductors, continued to ease.

Exports drove volumes, rising 14.7% to 54,820 units, with more than eight in 10 cars (82.4%) heading overseas – the third month in a row that exports saw a double-digit rise.

The EU remained by far the most important global market, taking 58.4% of all exports, equivalent to 32,002 units with volumes up 12.2%, followed by the US, China and Australia.

The news comes as the UK and EU automotive sectors face a looming cliff-edge with rules of origin agreed in the UK-EU Trade and Cooperation Agreement, governing local content for electric vehicles and batteries, due to get tougher from January 1, 2024.

These rules pose significant challenges to manufacturers on both sides of the Channel and raise the prospect of punitive tariffs being applied to electric vehicles alone.

Earlier this month (May), Stellantis warned the Government its commitment to build electric vehicles (EVs) in the UK is at risk, unless Brexit trade rules are re-negotiated.

The car maker, which owns 16 car brands, including Vauxhall, said: "If the cost of electric vehicle manufacturing in the UK becomes uncompetitive and unsustainable, operations will close."

In 2021, Stellantis announced it was investing £100 million in Vauxhall’s Ellesmere Port manufacturing plant to create a new electric vehicle (EV) factory. The plant produces commercial and passenger versions of the Vauxhall and Opel Combo-e, Citroen e-Berlingo and Peugeot e-Partner.

In a submission to a Commons inquiry into EV production, Stellantis outlined that its UK investments were centred on meeting the strict terms of the post-Brexit free trade deal.

Until January 1, 2024, the rules stipulate that at least 40% of the content of EVs and 30% of batteries must originate from the EU or the UK.

From 2024 until January 1, 2027, this increases to 45% of the vehicle and 50-60% of batteries. If this is exceeded, carmakers will have to pay a tariff of 10%.

The sector, both in the UK and EU, is calling for a pragmatic solution to be found urgently. This does not require a renegotiation of the Trade and Cooperation Agreement, says the SMMT, simply a common-sense approach to find agreement over a technicality, giving Britain and the EU more time to establish the local supply chains needed to drive a successful transition to zero emission mobility.

Mike Hawes, SMMT chief executive, said: “UK car production is starting to motor again, good news for the sector and the many thousands of jobs and livelihoods it sustains.

“These figures also show how exports, particularly to Europe, continue to be the foundation of British automotive manufacturing so we must do all we can to safeguard the competitiveness of these trading relationships.

“Most immediately, this means finding a solution to the rules of origin challenge faced by manufacturers on both sides of the Channel, else we risk the application of tariffs – and therefore unnecessary cost – on the very vehicles we are trying to encourage consumers to purchase.”

The latest production data from the SMMT also shows that UK factories continued to turn out increasing numbers of hybrid electric (HEV), plug-in hybrid (PHEV) and battery electric vehicles (BEVs), with combined volumes up 56.2% in April and representing well over a third of all production (37.7%).

Richard Bartlett-Rawlings, partner and automotive manufacturing specialist at RSM UK, said: “In the short-term, this growth is encouraging and shows that the industry is continuing to move in the right direction due to freeing up of supply chains where there were previously bottlenecks.

“However, despite current international relations appearing relatively strong, the UK and EU automotive industries wait with bated breath for tougher rules to be enforced as outlined in the UK-EU Trade and Cooperation Agreement from 1 January 2024.

“These changes will see much stricter governance of exports based upon where the underlying components originate, presenting challenges for both sides.

“Coupled with this risk, the EU and US have already announced their industrial strategies and investments in supporting the transition to green technologies, meanwhile the UK is yet to present its own version which continues to leave manufacturers uncertain about their long-term future.”

Login to comment

Comments

No comments have been made yet.