In Europe, registrations of Chinese-made cars achieved record levels of year-on-year growth last month.

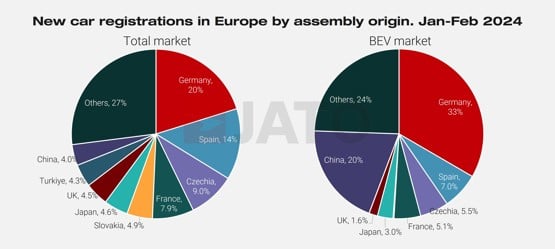

Sales of Chinese built models were up by 45%, in February, accounting for 4% of the total market.

In the electric vehicle (EV) market, Chinese models are even more prevalant. One in five EVs sold in Europe, in February, came from China, according to the latest figures from Jato Dynamics.

In contrast, registrations of EVs made in Germany increased by just 8% in the first two months of this year.

Felipe Munoz, global analyst at Jato Dynamics, said: “The growth is partly explained by action taken by some Chinese OEMs to accelerate imports ahead of the EU decision on the anti-subsidy investigation. Increased tariffs could slow the growth of China’s OEMs, but as a knock-on effect it could also prompt them to accelerate their deliveries to Europe.”

While these results are impressive, it is notable that approximately 44% of all the volumes of made-in-China cars were registered by Western brands including Tesla, Volvo, and Dacia, while 40% were registered by MG – fully Chinese-owned and designed, but positioned as a UK brand in the West.

This means that Chinese brands accounted for just 16% of Chinese-made cars registrations, reinforcing the fact that these manufacturers continue to face challenges related to perception and awareness in Europe.

Munoz added: “Chinese brands still have a long way to go before they occupy a significant part of the European market. Despite the strides they have made in regard to performance and affordability, increasing awareness and shifting long-standing perceptions will take time.”

The European Commission has claimed it has evidence the Chinese government is subsidising electric cars exported to Europe through the “direct transfer of funds” and other means.

It launched an investigation into whether Chinese-built EVs are receiving unfair subsidies last September. It is due to conclude by November, although the EU could impose provisional duties in July.

European registrations record 10% growth

February was a positive month for the new car market in Europe. According to JATO Dynamics’ data from 28 European markets, a total of 988,116 passenger cars were registered during the month. This marks a 10% rise in volume compared with February 2023, bringing the year-to-date total to nearly two million units – an increase of 11%.

EVs are not driving growth as they historically have done. In contrast, petrol-powered cars performed almost as well as they did before the Covid-19 pandemic. JATO’s data revealed that these vehicles were responsible for 61% of total registrations in February 2024, in comparison to the 62% registered in February 2019.

This success comes at the expense of diesel cars, with the market share of these vehicles falling from 35% of registrations in February 2019 to just 15% last month.

Munoz said: “Despite the noticeable shift towards EVs, many European consumers are not ready to turn away from ICE cars. While we’re seeing a clear decline in demand for diesel models, drivers are opting for gasoline alternatives, rather than switching to electric.”

Login to comment

Comments

No comments have been made yet.