Fleetondemand has appointed Andrew Cope as non-executive chairman, following its recent deal with Business Growth Fund (BGF).

The independent investment company acquired a minority stake in the fleet and mobility tech firm through a £5 million investment.

Cope is one of the fleet industry’s most renowned entrepreneurs. As the driving force behind vehicle leasing company Zenith, he steered the company through five successful private equity buyouts between 2003 and 2014.

In 2015, he was instrumental in the sale of FMG to Redde just four months after snapping up the firm in a backed management buyout. He also invested alongside Endless and acquired Essential Fleet services, merging it with Go Plant in 2017.

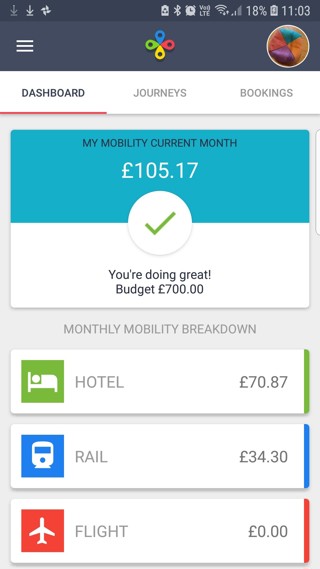

Cope’s involvement with Fleetondemand comes as the firm is experiencing significant growth in the UK and internationally, thanks to the rollout of its Mobility-as-a-Service (MaaS) platform, Mobilleo.

Prior to founding Fleetondemand, Justin Whitston, chief executive of Fleetondemand, created Nexus Vehicle Rental in 2000 and successfully established the firm as the UK's largest independent broker of vehicle rental to business.

Fleetondemand, meanwhile, features a multi-platform that connects thousands of business people to vehicle rental, car leasing, business travel and transportation services globally.

Whitston said: “Following our recent investment, the creation of a world-class executive board was paramount to our strategy.

“Andrew has an unrivalled track record in his field and we are incredibly excited about working with him to drive the future success of our business.

“With the support BGF and Andrew, we will be able to ramp up engineering and product development and rapidly accelerate our sales strategy in the UK and pan European launch in 2019.

“It’s a hugely exciting time for the business and we all look forward to working together to achieve the company’s growth potential over the next three years.”

Cope added: “Sometimes every once in a while, opportunity’s come along that you have to get involved in. For me, being asked to invest in and be part of the FOD story following the recent BGF investment was just one of those moments.

“Having known Justin for many years and watched with real interest and admiration the development of the company, the chance to become chairman at this ground-breaking juncture in the history of the company, especially with the recent launch of the Mobilleo platform was a real honour.”

BGF is the UK and Ireland’s most active investors in small and medium-sized companies. An established and independent company, it has £2.5bn to support a range of growing companies – early stage, growth stage and quoted – across every region and sector of the economy. Hundreds of companies are using its equity capital investments to accelerate growth.

With 14 offices, the investment firm has grown to a team of over 150 and a network that is made up of one of the largest pools of board-level executives. Collectively, the companies in BGF’s portfolio employ close to 50,000 people.

Login to comment

Comments

No comments have been made yet.