UK van registrations finished 2019 on a high, with a 2.4% increase on last year despite political and economic uncertainty for much of the year.

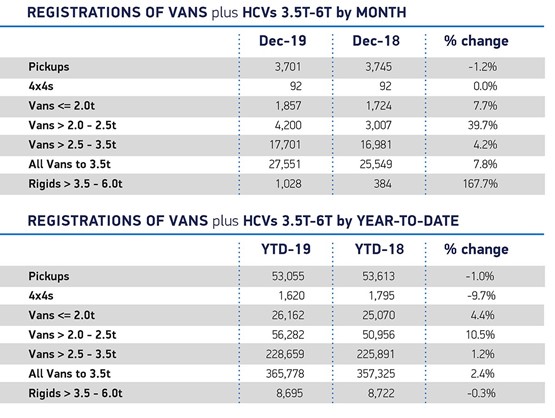

Society of Motor Manufacturers and Traders (SMMT) figures show the market grew 7.8% in December, as the impact of regulatory changes eased and attractive offers on new models helped stimulate orders with only pickups experiencing a fall in demand.

Mike Hawes, SMMT chief executive, said, “A healthy van market is good news for the industry, environment and exchequer and so the rise in 2019 registrations is very welcome. As we enter a new decade, however, we need this upward trend to continue if we are to address environmental concerns.

“The quicker these new vehicles become commonplace, the quicker their positive impact on air quality and climate change will be felt. Manufacturers will continue to invest in new, cleaner technologies but, ultimately, it is businesses that will determine the pace of change. Business positivity is essential to give companies the confidence to invest in their fleets.”

A total of 365,778 new commercial vehicles hit UK roads in 2019, the third highest total on record.

All van segments saw growth during 2019, with small vans weighing less than 2.0 tonnes up 4.4%, medium vans weighing 2.0-2.5 tonnes up 10.5% and larger vans weighing 2.5-3.5 tonnes up 1.2%.

Demand for new pickups and 4x4s, however, fell 1.0% and 9.7% respectively but the combined loss represented just 733 units.

Russell Adams, commercial vehicle manager at Lex Autolease, added: “2019 was another very good year for new vans weighing up to 3.5 tonnes. Demand for the delivery of goods and services continues to grow, and at the same time, the introduction of emissions-restricted zones in cities across the country means the latest, cleanest vehicle technology is required for the job.

“Diesel remains the most appropriate fuel type for higher-mileage users, who are upgrading to Euro 6 to keep emissions to a minimum, and to avoid city centre access charges. Many fleets are also starting to look at electric vans, but must first identify where they can be integrated seamlessly into business operations.

“Key practical considerations include vehicle range and access to charging facilities, which tend to mean that for the time being at least, electric vans are best suited to lower-mileage drivers operating in urban areas. It’s also important for fleets to ensure their drivers buy-into electric, to minimise downtime and maximise the cost and environmental benefits.

“As demand continues to grow, and with the promise of increased supply from leading OEMs, we look forward to seeing whether electric vans will challenge diesel’s dominance of the motorways for the first time in 2020.”

Vauxhall LCVs ended 2019 on a high, with a record 27% per cent increase in sales volumes boosting its van market share by two percentage points to a total of 9.7%.

The all-new Luton-built Vivaro’s popularity played a major part in the success, which saw Vauxhall LCV numbers grow by around 8,000 units in 2019, to a total of 36,000 sales.

Vauxhall had the highest growth in market share and volume of any LCV brand in 2019. In December alone, Vivaro recorded a 14.2% month-on-month segment increase versus 2018, with around 3,200 sales.

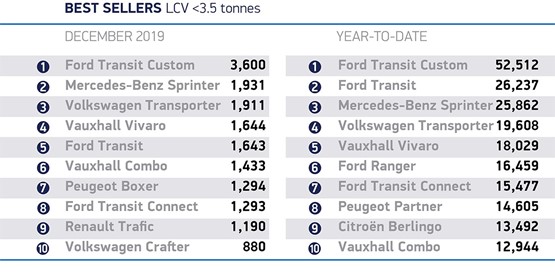

The Ford Transit Custom was the best-selling van in 2019, with 52,512 units registered. It was followed by the Ford Transit with 26, 237 and the Mercedes Sprinter (25,862).

Login to comment

Comments

No comments have been made yet.