Author: Rupert Pontin, director of valuations at Cazana

New car registrations for June 2018 have shown another change in market performance with volumes down by 3.5% over the same period last year.

The half-year total rests at just over 1.3 million - a year on year drop of 6.3%.

Given the prevailing weather conditions and the football World Cup, this may not be such a surprise as it is common for the market to be adversely affected by such events.

Equally, it is worth remembering that the following month can often see a redress of the balance.

Diesel registrations continue to suffer from a further drop of 28.2% over June 2017.

With less negative press coverage during the month than experienced in earlier parts of the year, this suggests that new diesel car demand has found a level for the time being.

Recent weeks have seen further commitment to the fuel type from key manufacturers and surprise support from government sources which is good news.

However, year to date registrations are down 30.2% and the current market share is now just 32.6%, down 11.2 percentage points on 2017.

An improvement in registrations of 12.3% over June 2017 for petrol powered cars and a noteworthy 45% for AFV’s highlights the position and mind-set of the retail consumer.

With market share year to date for petrol running at 61.8% and AFV’s at 5.5% this picture is in many respects very different to what had been predicted as little as two years ago.

The coming months will be of great interest as the fuel type revolution continues to evolve and worthy of greater more detailed analysis.

Overall, the July new car market has been supported by the private retail buyer with a level of stability in comparison to June 2017.

Fleets are still reluctant to change cars, partly due to WLTP concerns, and the fleet market performance for the month was down 6.4% on last year.

However, business buyers returned to the market with an 11.3% improvement in registrations albeit to a market share of just 3.7% year to date.

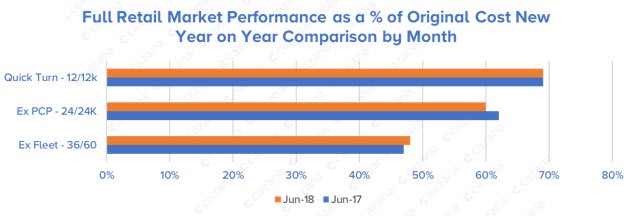

Reviewing the used car market as a whole and the Cazana data demonstrates some interesting changes in retail pricing in comparison to the data from June 2017.

The chart below looks at the performance of key market sectors.

This month the chart also shows the performance of the younger quick churn market that is under increasing scrutiny due to pre-registration activity.

It is interesting to learn that despite high levels of nearly new cars being placed in the market, values at one year have remained consistent with 2017.

This could be perceived as positive as it suggests that whilst new car registrations are enhanced for commercial reasons this actually has not caused an issue in the used car market.

However, there has been a shift in performance in the ex-PCP sector and here it would appear that retail pricing has been adversely affected year on year.

In a change to the stability demonstrated last month there has been a two-percentage-point drop in performance since June 2017 and the overall figure rests at 60% of original cost new.

Some industry pundits have been expecting this on the basis of increased volumes in the market, but it is wise to look at the greater detail to understand whether other factors such as fuel type and style of vehicle have been the drivers behind this change.

Ex-fleet cars have seen a small improvement in retail values with an upturn of one percentage point year on year.

This may come as a surprise given that at this age and mileage the sector is weighted in favour of diesel cars.

This could be indicative of the fact that the volume of fleet cars in the wholesale market has remained at best consistent as fleets continue to show reluctance to change product.

This is in part due to concerns of the impact of the forthcoming WLTP changes.

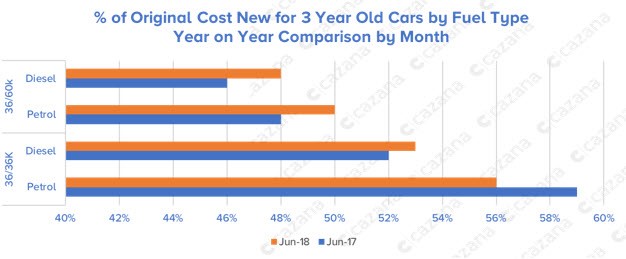

With new diesel registrations continuing to fall rapidly, the used car market remains under the spotlight and the chart below shows performance of diesel cars against petrol versions in the all-important three-year-old market.

This data is interesting because it demonstrates that for the same month in 2017, despite apathy for diesel cars in the new car market, the used car market in June 2018 is still generating demand for diesel power.

For lower mileage ex-PCP cars there has been a one percentage point increase in retail pricing for diesel taking it to 53% of original cost new, with petrol units showing a three percentage point drop to 56%.

The delta between the two fuel types last year was 7 percentage points in favour of petrol and has now reduced to 3 percentage points.

Higher mileage ex-fleet vehicles show strength for both fuel types with an uplift of two percentage points in the % of original cost new for both.

Of note is that the delta between the two is also consistent with the same period last year, at two percentage points.

This suggests not only strength in the retail market but also that stock is more difficult to find and this reflects the reduction in new car sales to the fleet sector overall.

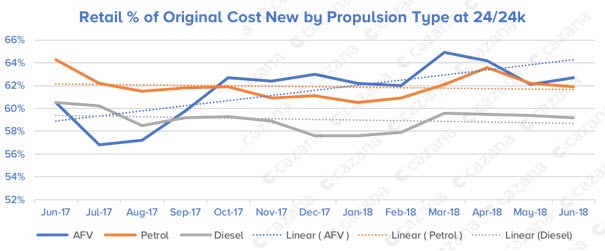

With new AFV registrations showing a mighty increase in June 2018 the chart below seeks to give a view of used car demand for these vehicles in comparison to traditionally powered cars.

This chart demonstrates the rise in retail pricing for AFV’s over the last 12 months.

Whilst the chart shows a level of volatility for AFV’s there is a clear upward trend not currently shared by ex PCP petrol and diesel product. Consideration must be given to the type of AFV appearing in the market which partly explains the volatility.

Of specific interest is that from August 2017 retail pricing, driven by consumer demand, took a marked upturn. This happened off the back of a decline in pricing for other fuel types and coincides with a period of intense media speculation around unclean fuel types.

To summarise, it is clear that the used car market in June has retained stability in the face of climatic and sporting disruption.

There have been less consumers on the pitches but those that show interest have not only done their research online using retail pricing data but have then been in the market to buy and not browse.

Login to comment

Comments

No comments have been made yet.