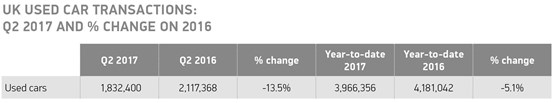

UK used car transactions declined in the second quarter of 2017, according to figures released by the Society of Motor Manufacturers and Traders (SMMT).

The data shows that 1,832,400 used cars changed hands in the period, a fall of 13.5%, on the back of a record 2016 and turbulence in the new car market following changes to VED rates on new cars introduced in April.

Superminis remained the most popular used vehicle type in Q2, with more than 600,000 buyers accounting for a third (32.7%) of the market, followed by small family cars, with almost half a million changing hands. Minis and SUVs were the only two segments to show growth – up 5.7% and 3.5% respectively, echoing the trend in the new car market.

Meanwhile, black took top position as most popular colour for used cars, chosen by a fifth (21.0%) of motorists and knocking silver off the top spot after several years at number one. Cream, white and brown were the only colours to grow in popularity, up 18.2%, 10.6% and 5.4%.

Figures for the first half of the year also showed a small decrease in demand to 3,966,356 sales, -5.1% lower than the record levels seen in H1 2016 – again reflecting the trend in the new car market.

In the first six months, demand for diesel cars remained strong, with some 1,628,045 changing hands, a small 0.1% year-on-year decline.

Meanwhile, petrol sales decreased 8.9% to 2,291,328 units, while alternatively fuelled vehicles (AFVs) rose 24.2% with electric cars enjoying particularly strong growth – up 79.3%. However, volumes remain low with AFVs currently accounting for just 1.2% of the market.

Mike Hawes, SMMT chief executive, said: “With used car sales closely mirroring what we see in the new car market, last quarter’s decline comes as no surprise – and with demand easing over recent months, this could offer motorists the opportunity to get some great deals.

“However, although the market remains at an exceptionally high level, given the softening we’ve seen in registrations of new cars in more recent months, looking ahead it is vital that government secures the conditions that will maintain consumer and business confidence if we are to see both markets continue to prosper.”

Simon Benson, director of motoring services at used car website AA Cars, said that the sales of used cars have closely reflected the slowdown in activity the new car market has experienced.

“The public are clearly taking talk of scrappage schemes, Clean Air Zones and the toxin tax seriously,” continued Benson. “Drivers are now questioning their purchases more widely and making more carefully considered car buying decisions than they might have in the past.

“However, demand for used diesel vehicles has been largely unaffected, contradicting the sharp decline in diesel registrations we’ve seen in the new car market. This suggests that many motorists who rely heavily on diesel - those driving frequent, long distances, for example - are choosing to purchase a second-hand vehicle instead.

“Dealers ought to approach this as an opportunity to advise customers on buying the fuel that’s most appropriate to their specific needs.”

Graham Hill, car finance expert at the National Association of Commercial Finance Brokers, added: "Consumers might also be putting off used car buying decisions as they wait for September's new plate registration when a glut of part-exchange cars hit the forecourts - and there's an inevitable price drop.

"With such a sharp downturn though, you have to consider whether the negative narrative around car finance is actually starting to impact buying confidence.

"Specifically, the criticism of PCPs, which consumers use to fund both new and used cars, is becoming increasingly widespread and misplaced - and could be driving this slump in activity.

"While the FCA is right to be looking into the dubious selling practices of certain dealerships, car finance products are robust routes to car ownership. It's the lack of transparency around what these deals actually entail that really needs to be investigated."

Login to comment

Comments

No comments have been made yet.