This editorial feature appears in the July 25, 2019 issue of Fleet News and is sponsored by Hitachi Capital PLC Vehicle Solutions

The year-on-year reduction in true fleet registrations has accelerated in the second quarter of 2019 with just a handful of manufacturers enjoying growth, primarily on the back of new product launches.

Uncertainty over future company car tax rates has affected the market, with anecdotal evidence suggesting some employees have become disillusioned with company cars as a benefit and are now opting to take cash. The full extent of this migration will not be revealed for a couple of years, until HMRC publishes its updated benefit-in-kind (BIK) stats.

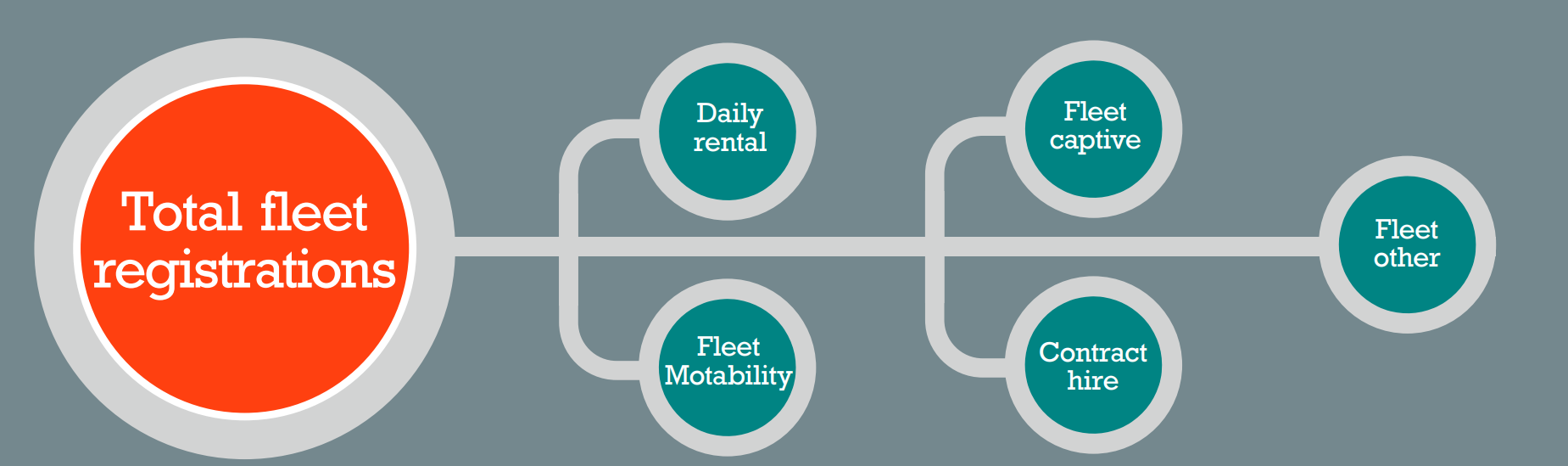

In a total market down 4.6% in the second quarter, true fleet sales (leasing/contract hire plus fleet other) dropped 8.8% with the majority of the reversal (15,680 units) coming from ‘fleet other’ – registrations to end-user fleets, plus some direct sales such as bodyshop courtesy cars. Leasing/contract hire registrations were more robust, slipping just 1.9%.

Read the sponsor's comment by Jon Lawes, managing director, Hitachi Capital Vehicle Solutions

Vauxhall was the majority contributor to the fall in ‘fleet other’ registrations, with an 83% drop, equating to 7,532 units. It continues the trend from Q1 when the company took the tactical decision to withdraw from courtesy car supply.

Vauxhall has now pulled 18,126 cars from ‘fleet other’ this year, a decision made palatable by significant improvements in its retail sales, up 40% (10,611 units) in the first six months of 2019.

Top 10 true fleet YTD (year-on-year +/-)

| 1 | Volkswagen | 40,807 | (-5.9%) |

| 2 | Mercedes-Benz | 40,687 | (-19.9%) |

| 3 | BMW | 35,323 | (-8.7%) |

| 4 | AUDI | 31,901 | (-9.2%) |

| 5 | Ford | 21,865 |

(-18.8%) |

| 6 | Kia | 18,946 | (-2.6%) |

| 7 | Toyota | 17,105 |

(-5.1%) |

| 8 | Hyundai | 16,279 | (10.8%) |

| 9 | Nissan | 15,769 |

(-14.2%) |

| 10 | Skoda | 15,026 | (-2.2%) |

Just two manufacturers in the top 10 true fleet table – Toyota and Hyundai – have increased their true fleet registrations in the first half of the year, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

They are joined by six other ‘main fleet’ manufacturers (those with more than 1,000 registrations year-to-date in true fleet): Volvo, Suzuki, Seat, Renault, Mazda and Lexus.

Renault is the fastest growing manufacturer in true fleet with registrations up 12.3%, from 6,053 to 6,799. The majority of its success has come from Clio, an incredible performance given this is the outgoing model, due for replacement this summer. Clio’s total fleet sales are up year-on-year by 27% (1,453 units).

The all-electric Zoe is also performing well, with a 500-unit rise to 647. However, not all EVs are enjoying similar success: Nissan’s market-leading Leaf dipped 17%, from 1,481 to 1,229.

Both the Leaf and Zoe – as well as all pure electric vehicles and plug-in hybrids with more than 130-mile electric range – have been given a fillip by the Government with the announcement of new zero rate 2020/21 BIK for cars registered from April 2020. Supply permitting, both should see a surge in demand from company car drivers.

Hyundai, which saw a 10.8% rise in true fleet registrations, will also hope to benefit from the new preferential EV tax position on the Ioniq, available as hybrid, plug-in hybrid and pure EV. It is already the carmaker’s third most popular model in fleet, trailing only the i10 and Tucson.

Top 10 rental fleet Q2, 2019 (YDY +/-)

| 1 | Vauxhall | 11,384 | 11.0% |

| 2 | Ford | 9,554 | 10% |

| 3 | BMW | 5,174 | 23.8% |

| 4 | Nissan | 4,867 | 320.3% |

| 5 | Mercedes-Benz | 4,086 | 20.9% |

| 6 | Volkswagen | 3,994 | -38.3% |

| 7 | Peugeot | 3,939 | 6.8% |

| 8 | Kia | 3,409 | -2.0% |

| 9 | Renault | 3,290 | -5.5% |

| 10 | Citroen | 2,941 | 40% |

Only one other manufacturer saw a double-digit rise in true fleet registrations – Volvo, which is up 11.5% to 14,235 (NB: Its own data claims growth of 43% in true fleet, at 8,500).

Contributions have come from across the model range, but especially the XC40, up from 641 to 3,270, S/V60, up from 1,320 to 2,306, and the S/V90, up from 1,806 to 2,249.

“Regarding rental, volume is 23% up YTD. We are very heavily weighted in H1, but the calendar year will again be less than the prior year in line with our stated strategy of reducing rental.” James Taylor, Vauxhall

Success in true fleet has enabled Hyundai to accelerate its withdrawal from the rental market, following up a 22% Q1 drop with a 49.5% reduction in Q2. So far this year, it has put 3,369 fewer cars into the short-cycle sector. Rental now accounts for 13.8% of total registrations, down from 19% a year earlier, and it has dropped from fifth to 10th in the rental table year-to-date.

Heading in the opposite direction is Nissan after a 320% surge in rental registrations in Q2 taking it to fourth highest. In the first half of the year, Nissan has registered 6,635 vehicles into the short-term hire market, a 128% rise over 2018’s 2,908. It sits eighth highest, up from 14th in 2018.

Almost 20% of its business now goes to rental (2018: 8.9%), almost double the market average across all manufacturers of 11% (2018: 10%).

Two premium makes are in the top five rental suppliers for registrations, revealing how the market has changed over the past decade: BMW and Mercedes-Benz.

BMW increased rental registrations by 4.6% to 10,338 (11.5% of total sales), after a big rise in Q2 more than offset a fall in Q1, but it has been leapfrogged by Mercedes-Benz following a 17% upswing to 10,406 (11.2% of its total for the year). Despite the increases, both carmakers’ proportions are bang on the market average.

However, BMW’s penetration is likely to fall in the second half of the year, according to general manager, corporate sales Rob East.

“We want to reduce our non-customer channels, such as demonstrator, rental and internal fleet volume,” he says.

Mercedes-Benz and BMW 2019 performances are in notable contrast to Audi, which has reduced its rental volumes by 34%. At 2,049, rental now accounts for just 2.5% of its total sales.

Audi head of fleet James Buxton has outlined his strategy to match the right level of supply to each target channel, with true fleet – specifically the end-user fleet - the priority. As a result, rental will remain a small part of sales volume; it also fell 17.5% last year.

“My focus is to grow the true customer channels in a responsible manner,” Buxton says. “This is key from a total cost of ownership perspective. With my background in used cars, I understand how decisions taken today, such as short-cycle channels, affect residual values three or four years out, so that is a key part of our strategy.”

Renault sits sixth in the rental table YTD after a 7.6% rise, with the highest proportion of rental-to-total sales, at 28%, up from 24.5% last year.

However, that is part of the company plan, according to Mark Dickens, Renault head of fleet.

“Our strategy for rental in 2019 was to heavily weigh the first semester due to the launch planning of our new B segment models (Clio, Captur, Zoe) in the latter part of 2019,” he says.

“This allows us to fulfil customer demand and maintain approved used vehicle supply into our network. Our aim remains focused on a balanced channel approach for the year.”

Topping the rental table, as it has done for several years, is Vauxhall. Despite the company’s five-year strategy of reducing its rental registrations, which it had done by almost 12,000 units from 2013 to the end of 2018, it remains by far the biggest supplier of rental cars.

So far this year, Vauxhall has increased its rental registrations, to 26,232 (27.7% of total sales versus 21% last year), although the company insists this is not a reversal of its policy.

James Taylor, Vauxhall general sales director, says: “Regarding rental, volume is 23% up YTD. We are very heavily weighted in H1, but the calendar year will again be less than the prior year in line with our stated strategy of reducing rental.”

Citroën’s total volume increase in the first half of the year is primarily down to greater penetration into rental, up consistently over both quarters by more than 40%. Its 5,587 registrations account for 19% of total sales.

We are nearing a tipping point for the industry, and to support a smooth transition for manufacturers to develop more environmentally friendly options and encourage fleet renewal, the Government must review current policies, implement purchase incentives and introduce the necessary infrastructure.

The position is mirrored at stablemate Peugeot, albeit at a lower level. Peugeot’s year-to-date rental volume is up 9.6%, at 7,359 units – 16.6% of its total business.

It means all three PSA-owned brands have boosted their rental profiles so far this year, although all three also expect to bring this down in the second half in line with strategic plans.

Martin Gurney, PSA director of fleet and used vehicles, describes the Citroën and Peugeot position as a “calendarisation issue”.

He adds: “We tend to deliver our rental volumes earlier in the year (as requested by our customers) and this was even more the case this year, driven by concerns over a potential hard Brexit/import tariffs back in March. By year-end, I expect our mix of rental as a percentage of total sales to be close to industry averages and in line with our red/green policy, to which we remain wedded.”

The light commercial market continues to perform strongly in 2019, up year-to-date by almost 8% compared with 2018.

Eight of the top 10 manufacturers increased their sales, with just Nissan and Peugeot down year-on-year.

Three van makers account for the lion’s share of the increase: Vauxhall, Mercedes-Benz and Renault.

Buoyed by Combo (up from 1,405 to 6,373) and Movano (from 2,057 to 2,910), Vauxhall registered a near 31% rise to 16,333, putting it fifth. Renault enjoyed growth in all models, particularly Kangoo (up 54%), to boost registrations by 32.4%, while Mercedes-Benz surfed the success of Sprinter (up 57%) and Vito (up 44%) for a massive 43.5% increase, taking third place.

While its sales are largely static, there’s still no overlooking market-leader Ford, whose 65,895 registrations are more than the next three manufacturers combined.

Van regs Jan to June 2019 (YOY +/-)

| 1 | Ford | 65,895 | (0.7%) |

| 2 | Volkswagen | 22,670 | (4.2% |

| 3 | Mercedes-Benz | 19,241 | (43.5%) |

| 4 | Peugeot | 19,154 | (-4.3%) |

| 5 | Vauxhall | 16,333 | (30.9%) |

| 6 | Citroen | 15, 243 | (5.8%) |

| 7 | Renault | 10,827 | (32.4%) |

| 8 | Nissan | 6,632 | (-5.5%) |

| 9 | Mitsubishi | 6,287 | (12.5%) |

| 10 | Fiat | 6,201 | (9.7%) |

> To see further statistics please see the feature in the July issue of Fleet News.

> To see further statistics please see the feature in the July issue of Fleet News.

Sponsor's comment: Jon Lawes (pictured), managing director, Hitachi Capital Vehicle Solutions

It has been a bumpy ride for the UK car market in the past three months, with a continual fall in fleet registrations and a decrease, after 26 months, in demand for alternatively fuelled vehicles (AFVs).

There have, however, been some brighter moments. Registrations of light commercial vehicles performed strongly, cementing their role as a staple part of business fleets, up 8.7% compared with last year and with more than 200,000 new vans registered since January this year.

Alongside this, manufacturers such as Ford and Vauxhall continue to lead, with smaller models remaining best sellers and making up 31% of all registrations in the first six months. We must not ignore the decrease in AFV registrations, and it’s clear that the decision to exclude many plug-in models from the subsidised grant is having an impact for consumers and businesses alike.

The Government has taken additional steps towards the uptake of fully electric cars among fleets, following the recent announcement that electric company car drivers will not pay any benefit-in-kind (BIK) tax during the next financial year.

With continued investment from manufacturers, such as BMW, technological innovation is growing the range of low emission and safer options for both petrol and diesels, and an increasing range of AFVs.

We are nearing a tipping point for the industry, and to support a smooth transition for manufacturers to develop more environmentally friendly options and encourage fleet renewal, the Government must review current policies, implement purchase incentives and introduce the necessary infrastructure.

Login to comment

Comments

No comments have been made yet.