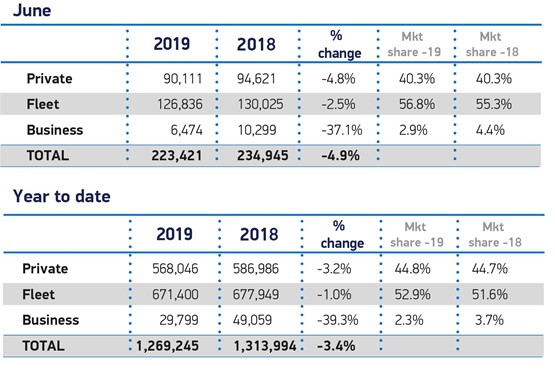

Fleet and business registrations declined for the second month in a row, while the overall new car market was down for the fourth successive month, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

There were 133,310 new cars registered to fleet and business during June, a 5% fall when compared to the 140,324 units registered during the same month last year.

Year-to-date, the market is also down, with 701,199 company cars registered to fleet and business in the first six months of the year, compared to 727,008 units from January to June in 2018 – a 3.4% fall.

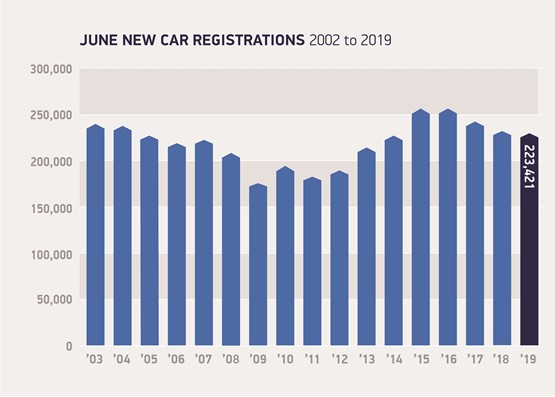

The decline in company car registrations mirrored that of the overall new car market, with year-on-year demand falling by 4.9% to 223,421 units, and the 1,269,245 new cars registered in the first half of the year, down 3.4% on 2018’s figures.

SMMT blames the ongoing confusion over low emission zones and diesel, the removal of key ultra low emission vehicle incentives and an overall decline in buyer confidence affected the market.

Declines were also seen across every vehicle segment, except Dual Purpose which grew 9.1% in June and 7.3% year-to-date to take 22.6% of the market. However, Supermini remains the UK’s best-selling segment, making up 31% of all registrations in the first six months.

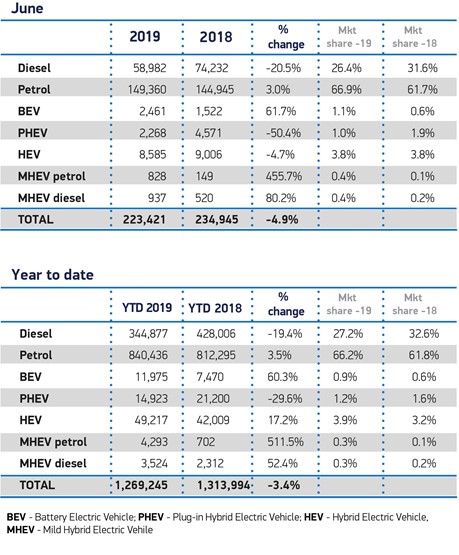

The month saw growth for petrol and battery electric registrations, up 3% and 61.7% respectively, but this was not enough to offset the continuing decline of diesel, which fell for the 27th month in a row (-20.5%).

Significantly, plug-in hybrids continued the recent downward trend, falling by a massive 50.4%, while hybrids also fell, by 4.7%.

The performance tipped the overall alternatively fuelled vehicle sector into negative growth for the first time since April 2017, undermining efforts to reduce emissions through fleet renewal of the latest ultra low emission vehicles.

Mike Hawes, SMMT chief executive, said: “Another month of decline is worrying but the fact that sales of alternatively fuelled cars are going into reverse is a grave concern.

“Manufacturers have invested billions to bring these vehicles to market but their efforts are now being undermined by confusing policies and the premature removal of purchase incentives.

“If we are to see widespread uptake of these vehicles, which are an essential part of a smooth transition to zero emission transport, we need world-class, long-term incentives and substantial investment in infrastructure.

“Fleet renewal remains the quickest way to address environmental concerns today and consumers should have the confidence – and support – to choose the new car that best meets their driving needs, whatever the technology, secure in the knowledge that it is safer and cleaner than ever before.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, believes that the appetite is still there for AFVs.

“It’s concerning that AFVs demand has fallen in June as this had represented a real bright spot in 2019 amid the UK car market’s overall decline,” said Lawes.

“With our recent research finding that 78% of people believe vehicle emissions are a significant problem in the UK, the appetite is there but, as the SMMT rightly highlights, further measures and incentives are needed to encourage consumers to switch to AFVs.

He continued: “It’s clear that the decision to exclude many plug in models from qualifying for the grant is having an impact. With the recent arrival of more plug-in models, reviewing policies and purchase incentives for all AFVs must be Government priorities for the health of the UK car market.”

Karen Johnson, head of retail and wholesale at Barclays Corporate Banking, says that another dip in overall sales is “no surprise”, but the first fall in AFVs for more than two years will be “more of a shock, and should make policymakers sit up and take note”.

“There are two main factors hitting new car sales,” she continued. “One is the broader economic environment that is affecting consumer and business confidence across the retail sector, with big-ticket items particularly affected. The other is the continuing confusion around fuel types and the impact of new regulation on the future value of vehicles.

“People are having to guess what the next policy move will be and this is affecting the used car market, with some book values down in part due to fears about future prices if further regulatory changes are introduced. This has a knock-on effect on appetite for new vehicles.

“Steps to make our roads cleaner are essential, but as evidenced by falling AFV sales in June, unless the message around cleaner cars is clarified we won’t achieve real change.

“The industry needs to have access to the right incentives to encourage drivers to get their older, more polluting vehicles off the road and invest in new AFVs and cleaner petrol and diesel models.”

rosco7 - 09/07/2019 08:18

The story behind these figures is interesting. The fall in AFV registrations is due to the drop of in PHEV sales. This isn't surprising, A lot of PHEV's hit the road last summer as the manufacturers were getting rid of stock ahead of the full WLTP implementation in September 2018. Since then, availability of PHEV's has been a problem and this will certainly be a part of these figures. WHilst I can hold the treasury to account for the damage being done to company car renewals, I don't think I can complain about how PHEV's are now more realistically taxed and accounted for. Too many PHEV's with charging leads still in the original wrappers. People without charging facility at home having a PHEV for taxation purposes. Its a shame for those few people who legitimately use a PHEV, and in that segment they are an excellent solution. The term Alternatively Fueled Vehicles, is now insufficient to set policy to. Mild Hybrid's are now blurring this further. Over the coming years the technology will settle down and we will have more of an idea what is going to work for our fleets in terms of a mix of powertrains.