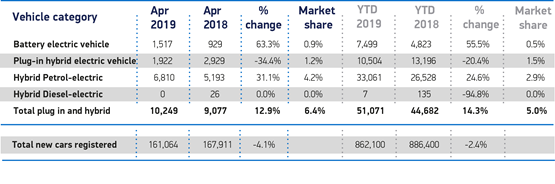

The alternative fuel vehicle (AFV) market rose by 12.7% in April, but zero emission-capable plug-in hybrids fell by 34%, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT).

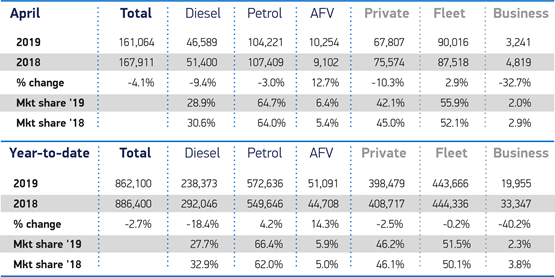

Overall, the UK new car market declined by 4.1% in April, with 161,064 units registered, the second lowest April volume since 2012, but following a double-digit increase the previous year.

Fleet and business registrations saw a 1% increase in April 2019, compared to April 2018, with 93,257 units registered compared to 92,337 last year.

However, year-to-date, the figures from the SMMT show 463,621 units were registered to fleet and business – a 6% decline on the 477,683 cars registered in the first four months of 2018.

Meanwhile, registrations by private motorists fell by 10.3%, after a rise of more than 26% in April 2018.

Zero emission-capable plug-in hybrids experienced a significant decline, down by a third (34.4%) in April and by a fifth (20.4%) year-to-date. SMMT says this is evidence of the consequences of prematurely removing upfront purchase incentives before the market is ready.

The Government announced in October 2018 that the plug-in car grant would be be cut by £1,000 and no longer apply to hybrid cars with a range of less than 70 zero emission miles, from November 9.

However, the Department for Transport (DfT) implemented the lower rate for the Plug-in Car Grant early after “exceptional demand” prior to the November 7 deadline.

Furthermore, there were problems with vehicle availability after some manufacturers struggled to get hybrids retested under the new emissions testing regime – the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) – introduced on all new cars from September 2018.

The SMMT says that manufacturers are investing heavily to bring ultra-low and zero emission cars to market, with some 40 plug-in models now available in showrooms, and over 20 more expected to arrive in 2019.

However, if this still emerging sector is to reach meaningful levels, measures and incentives that build business and consumer confidence will be vital, it said.

Mike Hawes, SMMT chief executive, explained: “While it’s great to see buyers respond to the growing range of pure electric cars on offer, they still only represent a tiny fraction of the market and are just one of a number of technologies that will help us on the road to zero. Industry is working hard to deliver on this shared ambition, providing ever cleaner cars to suit every need.

“We need policies that help get the latest, cleanest vehicles on the road more quickly and support market transition for all drivers. This includes investment in infrastructure and long term incentives to make new technologies as affordable as possible.”

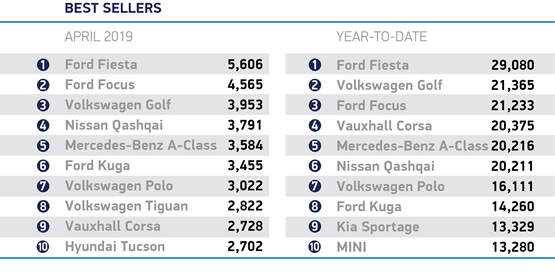

Declines were recorded across most vehicle segments, with registrations of popular supermini and small family cars falling most significantly, down 14.1% and 10.6%.

Demand for lower volume luxury saloons and sports cars rose while the dual purpose segment also grew, by +18.4% to 40,580 units. These vehicles are now the third most popular body type, with registrations tripling since 2012.

Diesel registrations fell again, but the pace of decline slowed significantly, down 9.4%. Petrol demand also dropped, by 3.0%.

Overall, alternatively fuelled vehicle (AFV) registrations grew by 12.7%, with 10,254 leaving showrooms. Petrol electric hybrids remained the most popular choice, up 31.1% to 6,810 units. Battery electric cars also recorded a strong uplift, from 929 to 1,517 units, which still only represents 0.9% of the market.

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, said: “A 34.4% decline in purchases of zero emission-capable plug-in hybrids would suggest that the removal of subsidies is threatening buyer confidence.

“With our recent research finding that 78% of people believe vehicle emissions are a significant problem in the UK, the appetite is there but, as the SMMT rightly highlights, further measures and incentives are needed to encourage consumers to switch to AFVs.”

John 4870 - 07/05/2019 11:22

Perhaps the real reason is that drivers are realising that most plug-in hybrids (such as BMW 330e) don't give anywhere near the fuel savings that are claimed - unlike a small few such as the Prius PHEV which can give excellent benefits if driven properly by a knowledgeable driver! Thrashing it as some might with a diesel will kill any fuel figure benefits.