Author: Rupert Pontin, director of valuations, Cazana (pictured)

The fleet industry has been left in a state of anticipation thanks to the October 29 Budget which offered little to sector.

The silence is exacerbated by the current Brexit position, with no deal yet in place and conflicting discussion around whether the country will be in a ‘no deal’ scenario in March.

Equally, there are some rumours that the whole Brexit exercise may become subject to a further public referendum and there may be a slim chance we will return to a European status quo and if so, in all likelihood a new prime minister.

Finally, the surprise removal of the Plug-In Car Grant may have an impact on the used car demand for hybrid and electric vehicles.

With this level of economic disruption and the automotive sector under pressure overall, it would be logical to assume that the retail consumer is also in a state of confusion with general apathy towards buying anything at all, even with the festive season approaching.

"The caveat here is that this position may change quite rapidly if the fickle consumer reflects a change in popularity. This might happen if the national press is careless on how they handle the messaging given by the Government and other potential market sources as to the validity of older hybrid technology."

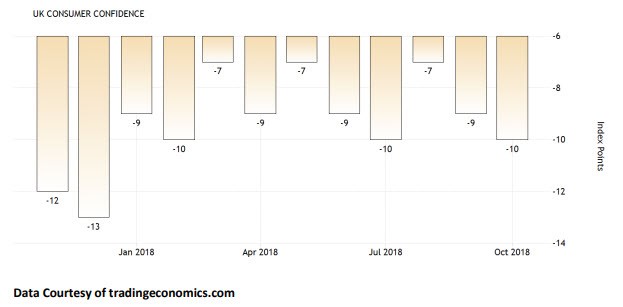

The chart below shows how consumer confidence levels have tracked over the course of the year to date:

Used market - renewed interest from buyers

However, the used car market is in an interesting position with good levels of retail consumer demand perhaps higher than normal for this time of year.

With new car sales struggling to both private and fleet customers, buyers that may have been seeking new cars have found themselves looking to the used car market instead.

As manufacturers continue to struggle to be able to supply new car product in the wake of the introduction of WLTP, lead times have extended and the plethora of pre-registered vehicles are beginning to look great value as alternatives.

Volkswagen Group has been hardest hit and this is not really a surprise given their position in the wake of ‘dieselgate’ and their commitment to ensuring future diesel technology is as clean as possible and at the forefront of the market.

New cars sales are down 7.2% year to date and look set to finish the year at around 6.5% behind 2017, which is as predicted by Cazana at the end of 2017.

The good news is that the used car market has still been generating good retail consumer demand and this is excellent news for fleets looking to return end of contract cars to the used car market.

This has resulted in some robust demand in the wholesale market and pricing has been at its worst for most cars.

In fact, this position is likely to get better for wholesale vendors who are beginning to struggle to balance defleet supply with retail and therefore wholesale demand.

This has been driven by retail pricing and most sectors and age and mileage profiles have seen an increase in retail pricing performance as a percentage of original cost new when compared to the same month last year.

But it is the removal of the Plug-in Car Grant that has continued to generate the most discussion in recent weeks and this perhaps somewhat blinkered action by the chancellor has been of significant interest to the fleet sector.

Considering the fact that new hybrid sales had been skewed by grant and benefit in kind advantages for business drivers for many years, there is now concern over whether hybrid technology will continue to see the level of new unit sales increase that the Government needs to meet its emission targets.

In addition to this, there is also a concern as to how ex-fleet product will perform in the used market as the focus and benefit of buying a new car has disappeared.

There are two views on the subject, the first being that a drop in new car demand may be reflected in the used car market by a reduction in retail prices as there may be an impression that hybrid technology is no longer relevant.

The second view is that potential used car buyers may look to the used car market to get a better value alternative to a new car.

This could potentially drive values up in the short to medium term at the expense of other fuel types.

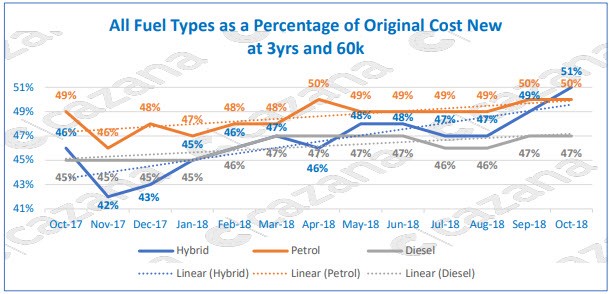

The chart below shows how hybrid models coming back at three years and 60,000 miles have compared with traditional fuel types at the key three-year, 60,000 mile profile:-

Date source: Cazana.com

Date source: Cazana.com

This chart shows retail pricing performance as a percentage of original cost new over the last year and it is interesting to note straight away that all fuel types have shown an uplift in performance.

It is also clear that hybrid retail pricing is increasing at a greater rate than either petrol or diesel with a five percentage-point increase over the same month last year compared to two percentage points for the other fuel types.

Also, of note is that diesel retail pricing performance appears to be have been the most stable over the last year with no indication of the collapse in diesel sales experienced in the new market.

Most importantly, this chart shows that at present the second pricing scenario is the current reality.

The caveat here is that this position may change quite rapidly if the fickle consumer reflects a change in popularity.

This might happen if the national press is careless on how they handle the messaging given by the Government and other potential market sources as to the validity of older hybrid technology.

As such it would be wise to watch retail pricing activity very carefully to ensure there are no consumer demand driven surprises.

In summary, the fleet market may be struggling in terms of new car sales but the remarketing operations teams are ideally placed to make improved returns when remarketing end of contract stock.

The opportunity to improve margin on ex-fleet product can be maximised by using live real-time market pricing data and intelligence.

Login to comment

Comments

No comments have been made yet.