Fleet and business new car registrations were down by a third (33%) in July, compared to last year, as the semiconductor shortage and the ‘pingdemic’ impacted both supply and demand.

There were 63,455 company cars registered to fleet and business last month, compared to 94,955 units in July 2020, according to the Society of Motor Manufacturers and Traders (SMMT).

Year-to-date, however, there have been 562,730 company cars registered to fleet and business – a 30% hike on the 433,873 units registered from January to July, last year.

Including retail sales, July was down 22.3% on the average recorded over the past decade – the weakest July for new car registrations since 1998, prior to the introduction of the two-plate system.

Fleet decision-makers have been warned that the global semiconductor shortage will have a greater impact on the automotive industry than the pandemic.

Every car- and van-maker is being impacted by the computer chip crisis, with some delivery times for cars lengthening from three to six months, and many new vans not expected to be delivered until 2022.

Almost 95% of fleets responding to a Fleet News poll said they were experiencing vehicle delays.

Mike Hawes, SMMT chief executive, said: “The automotive sector continues to battle against shortages of semiconductors and staff, which is throttling our ability to translate a strengthening economic outlook into a full recovery.

“The next few weeks will see changes to self-isolation policies which will hopefully help those companies across the industry dealing with staff absences, but the semiconductor shortage is likely to remain an issue until at least the rest of the year.

“As a result, we have downgraded the market outlook slightly for 2021. The bright spot, however, remains the increasing demand for electrified vehicles as consumers respond in ever greater numbers to these new technologies, driven by increased product choice, fiscal and financial incentives and an enjoyable driving experience.”

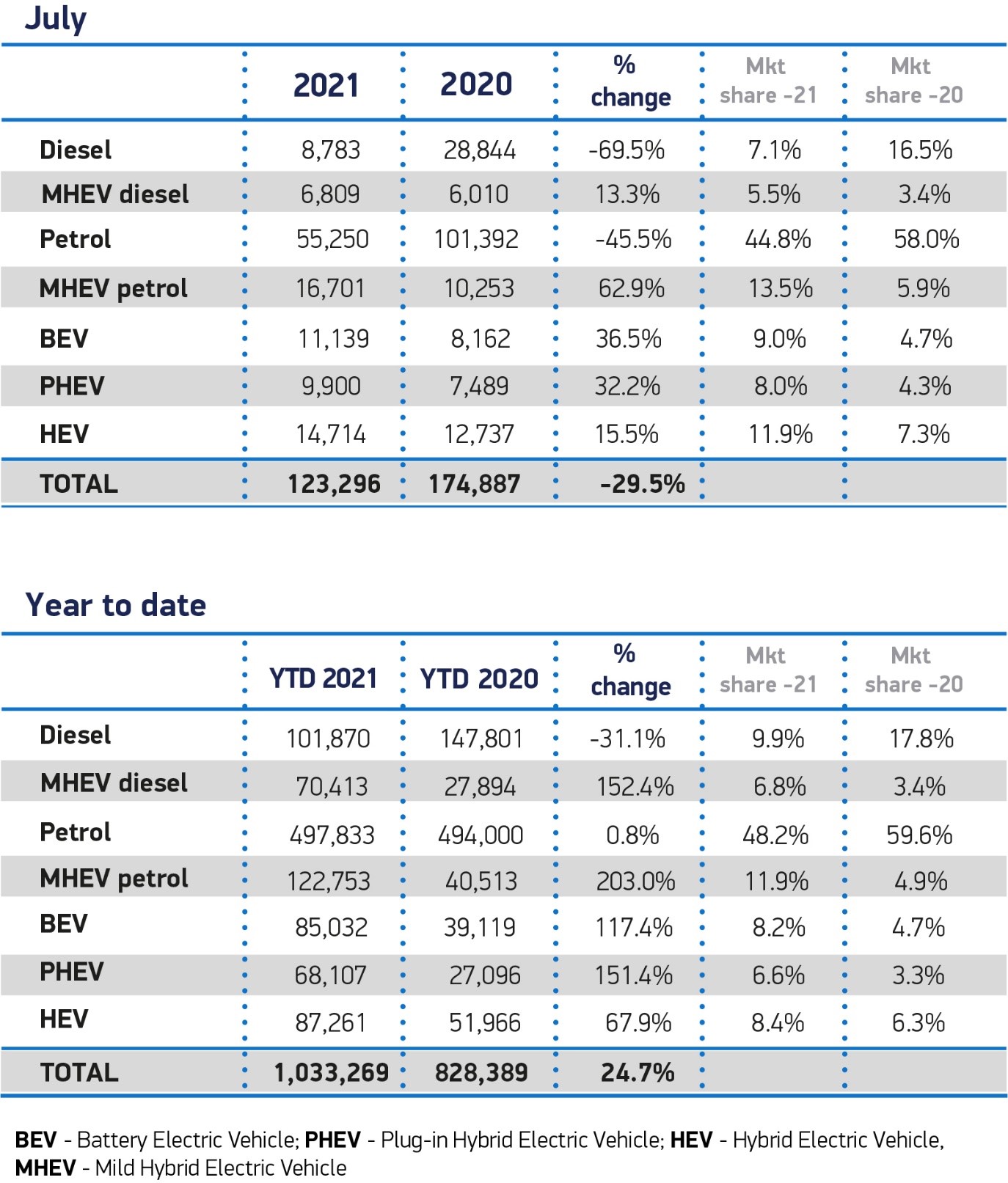

Battery electric vehicles (BEVs) accounted for 9% of registrations, while plug-in hybrids (PHEVs) reached 8%.

All new car segments experienced declines, but Britain’s most popular types of cars remained superminis (32.9% of registrations), lower medium (28%) and dual purpose (27.3%).

While the UK’s economic outlook continues to strengthen, with most consumer indicators suggesting a greater appetite for spending, including on so-called ‘big ticket’ items, supply challenges continue to throttle growth with the weaker market conditions expected to continue in August – traditionally a quiet month for registrations – before modest growth returns in Q4.

As a result, the latest SMMT outlook has been revised downward and now forecasts registrations to reach around 1.82 million units in 2021.

This is still some 11.7% up on 2020, but down from the 1.86 million forecast in April, and down around 21.8% on the average new car market recorded over the past decade.

More positively, however, given the continued strengthening of the electric vehicle market, SMMT now estimates that BEVs will account for 9.5% of registrations by year end, while PHEVs are forecast to comprise 6.5% of the market, collectively totalling around 290,000 units by the end of the year.

Meryem Brassington, electrification propositions lead at Lex Autolease, part of Lloyds Bank Motor Finance and Leasing, said that today’s figures demonstrated “great progress” towards net zero and puts the UK well on track to surpass the 108,000 electric vehicles registered in total in 2020 by autumn this year.

“The recent Transport Decarbonisation Plan and other commitments are a strong signal of intent from the Government to keep the UK as a world leader in electrification,” she added. “But there’s no time for complacency to creep in.

“Policy makers and manufacturers must continue to work together to address charging infrastructure and the second-hand EV market to ensure that battery vehicle adoption is both accessible and affordable for everyone.”

Richard Peberdy, UK head of automotive at KPMG, says it is clear that supply chain challenges have supressed production and extended carmakers’ delivery times.

“Quite simply, fewer cars are getting onto forecourts,” he said. “Electric models are growing their market share, which reflects how the economics are increasingly stacking up for consumers.

“More companies are offering salary sacrifice schemes to their staff for these vehicles, often making the choice as affordable as petrol or diesel, which is a major tipping point for the battery electric vehicle sector.

“Interestingly, demand for electric vehicles may drive a bigger shift towards leasing and subscription models in the medium term versus outright ownership.

“The technology is advancing quickly, with increasingly efficient and longer-range vehicles set to roll off production lines soon. This risks a faster depreciation of today’s models for consumers. Customers may want greater visibility and assurance over resale values and the total cost of ownership.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, was also encouraged by the increasing uptake in EVs.

“The trajectory for EV uptake continues to be positive and these latest figures prove that barriers to entry are falling, whilst driver confidence is rising,” he said.

“Investment in infrastructure is crucial to accelerating the transition as quick as possible and the government spotlight on potential zero emission vehicle mandates, as well as the recent transport decarbonisation report, will only improve this further.”

However, he added: “Supply chain is an increasing challenge, so it is integral that fleets remain agile to increase volumes in a sustainable manner.”

Login to comment

Comments

No comments have been made yet.