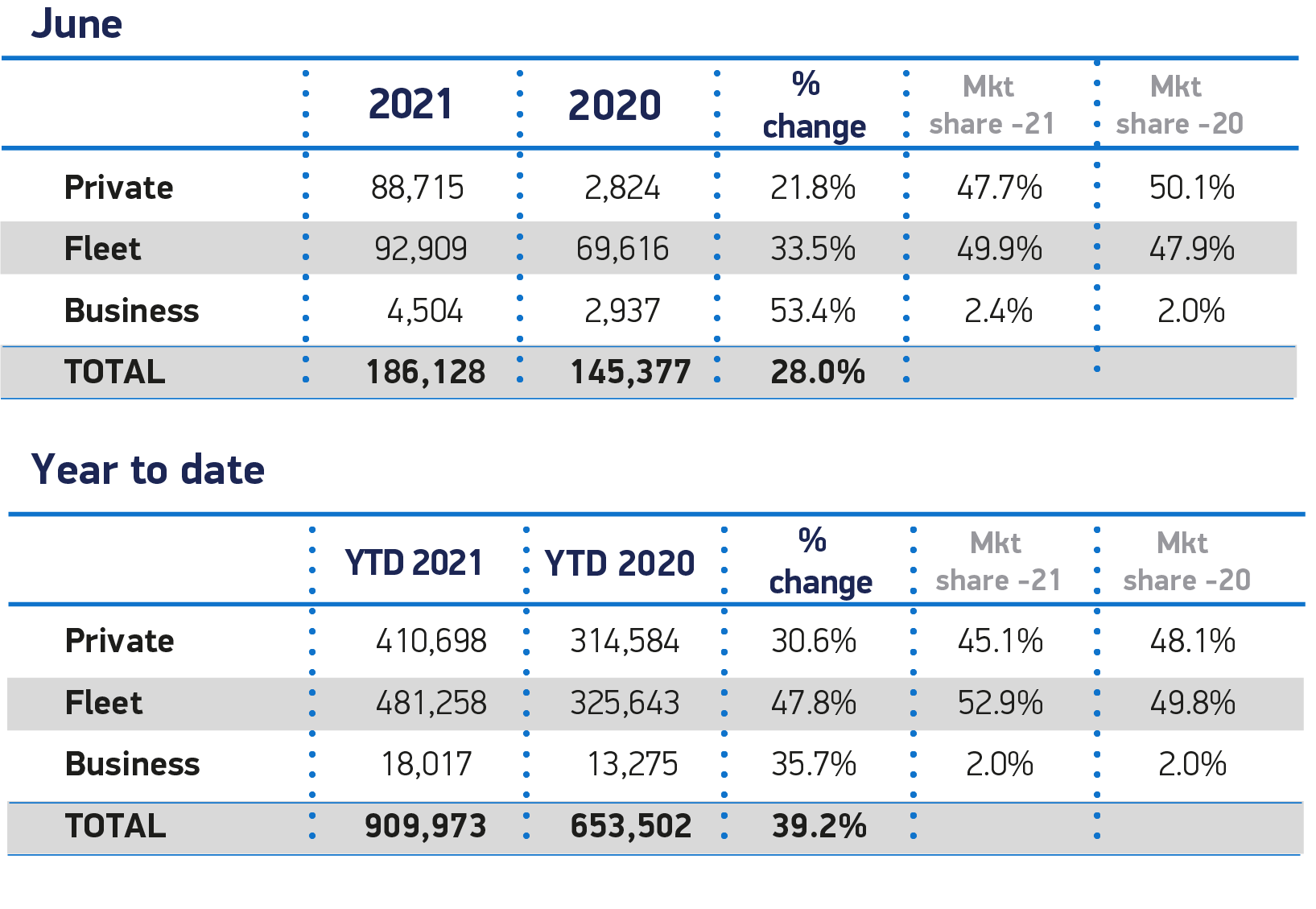

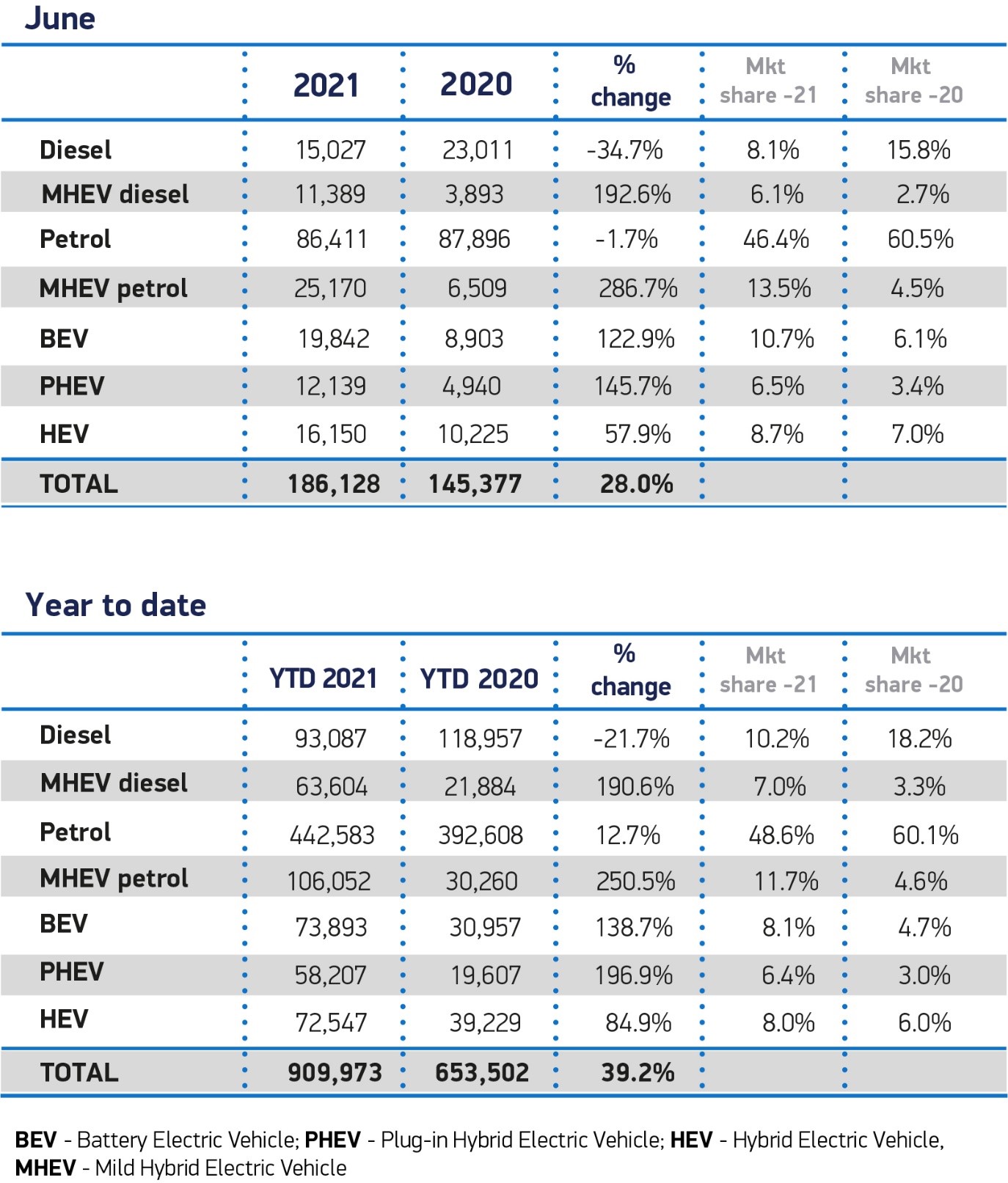

New car sales in the UK were down by more than 16% in June and down by almost 27% in the first half of the year, when compared with averages from the previous decade.

Fleet and business registrations were a combined 97,413 units for the month, more than a third up (34%) on the same month last year, when the UK began to emerge from the first pandemic lockdown and showrooms in England opened up at the beginning of the month.

Year-to-date fleet and business registrations now stand at 499,275 units, a 47% uplift on the first six months of 2020 (338,918 units), according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Combined, battery electric (BEVs) and plug-in hybrid vehicles (PHEVs) accounted for 17% of new vehicles sold (31,981 units), including retail sales. BEVs accounted for more than one in 10 registrations (10.7%).

PHEV uptake, however, continued to grow faster than BEV uptake for the third month running.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “Momentum is beginning to build along the road to recovery from the pandemic, but today’s half-year figures still represent a drop on pre-Covid levels, indicating that the car industry isn’t out of the woods just yet.

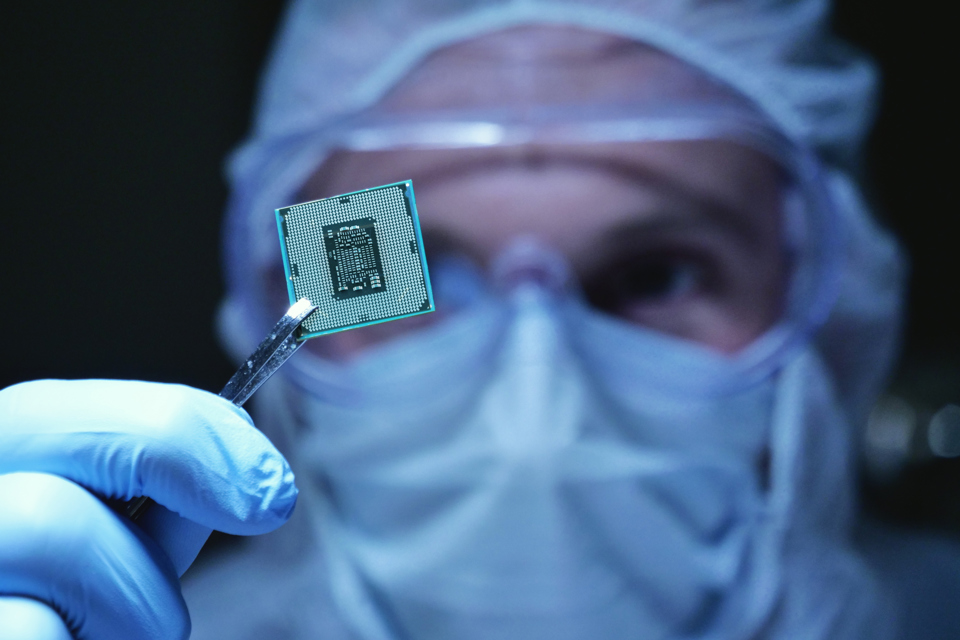

“We’ll no doubt see the impact of vehicle supply issues and semi-conductor shortages unfold in the coming months, but if we’re serious about leading the EV charge then sustained investment from policymakers to accelerate the UK’s electrification plans has to stay at the top of the agenda.”

All vehicle sizes – bar executive and multi-purpose – saw growth in June, with the strongest growth seen in the mini segment, which had been relatively weak for several months. Superminis were the most popular car class, accounting for 34% of registrations, followed by lower medium (27%) and dual purpose (24%).

Mike Hawes, SMMT chief executive, said: “With the final phases of the UK’s vaccine rollout well underway and confidence increasing, the automotive sector is now battling against a ‘long Covid’ of vehicle supply challenges.

“The semiconductor shortages arising from Covid-constrained output globally are affecting vehicle production, disrupting supply on certain models and restricting the automotive recovery. However, rebuilding for the next decade is now well underway with investment in local battery production beginning and a raft of new electrified models in showrooms.

“With the end of domestic restrictions later this month looking more likely, business and consumer optimism should improve further, fuelling increased spending, especially as the industry looks towards September and advanced orders for the next plate change.”

Every car- and van-maker is being impacted by the computer chip crisis, with some delivery times for cars lengthening from three to six months, and many new vans not expected to be delivered until 2022.

EVs becoming ‘increasingly mainstream’

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, says that the latest figures from the SMMT “unequivocally” demonstrate that BEVs are now an “increasingly mainstream” option for motorists.

“We’ve seen this sustained uptake in EVs first-hand, with HCVS seeing a 368% increase in EVs across our fleet in the last financial year – a remarkable figure during the lowest year of new car registrations since 1992,” he said.

“EVs will increasingly become front of mind as consumers and businesses look to replace their vehicles in the coming years and ensuring there are viable options in place for all lifestyles and budgets is vital to future-proof the industry as the 2030 ICE ban approaches.”

Richard Peberdy, UK head of automotive at KPMG UK, highlighted how the supply and demand imbalance has created the unusual situation of used cars rising in value, rather than depreciating.

However, he said: “Recovering fleet sales will eventually replenish the used car market and clip inflation, following 18 months of stifled investment.”

Meanwhile, Jamie Hamilton, automotive director and head of electric vehicles at Deloitte, echoed the SMMT’s concerns over the semiconductor shortage and its impact on UK new car sales.

“The ongoing global semi-conductor shortage has had a direct impact on consumers with manufacturers unable to fulfil orders in a timely manner, especially on the less popular models they have had to deprioritise,” he said.

“The ripple effect of this shortage has seen unusual activity in the used car market. Demand is high, but the limited availability of new cars means that there are even fewer used cars coming onto the market. As a result, prices have shot up. In an attempt to secure stock, some dealers have looked beyond the auction houses, turning their attentions to private sellers.

“Unfortunately, there is little respite for the industry, with the semi-conductor shortage expected to continue causing issues throughout the rest of the year and maybe even into 2022.”

Login to comment

Comments

No comments have been made yet.