The country’s top 50 vehicle leasing companies collectively reported a record-breaking year, according to the latest available figures.

However, while some saw year-on-year profits rise, others recorded a reduction, blaming a challenging used car market.

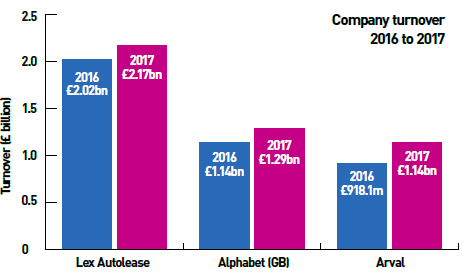

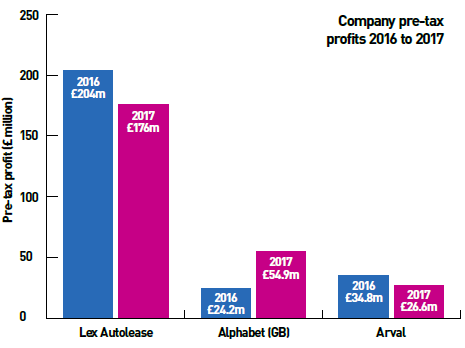

The country’s biggest leasing company – Lex Autolease – saw revenues rise 7.3%, while profits fell by 13%. Due to its size, its figures dwarf those achieved by most FN50 leasing companies.

It reported revenues of £2.17 billion, up from £2.02bn in 2016, but pre-tax profits for the leasing giant fell £28 million, from £204m to £176m, in 2017.

In its annual report, Lex Autolease said the fall was “primarily due to increased underlying depreciation charges of the growing funded fleet and lower profit on the disposal of motor vehicles due to market conditions in the secondhand car market.”

Nevertheless, looking at the FN50 as a whole, combined turnover for the country’s top 50 leasing companies reached a record-breaking £11.3bn* – breaking the £10bn barrier for the first time, last year. Turnover for the FN50 in 2016 stood at £9.1bn.

Combined pre-tax profits were also up, hitting a new high of £708m*, a £40m increase on the 2016 figure.

Responsible for 22% of the FN50’s risk fleet, it is perhaps no surprise that Lex Autolease is responsible for some 19% of the FN50’s turnover and 24% of pre-tax profits.

In fact, the top five companies – Lex Autolease, Volkswagen Financial Services, LeasePlan, Arval and Alphabet (GB) – are responsible for the lion’s share of both turnover and profits.

Funding 61% of the FN50’s risk fleet, they are collectively responsible for 60% of turnover – some £6.86bn – and more than half (54%) of pre-tax profits, a staggering £383m.

The leasing industry’s importance to UK coffers should not be underestimated. With 5.7 million vehicles, the leasing and rental industry accounted for 15% of all vehicles on the UK’s roads in 2017. Some 27 vehicles in every 200 were leased.

A report commissioned by the British Vehicle Rental and Leasing Association (BVRLA) puts total turnover for businesses operating in the sector at £37.3bn in 2017.

It is estimated that businesses operating in the industry, and its employees, paid a total of £1.1bn in taxes to the Exchequer, comprising £500m in corporation tax, £200m in employers’ national insurance contributions, £300m in employees’ income tax, and £100m in employees’ national insurance contributions.

An Oxford Economics report, commissioned by the BVRLA, says the industry, its supply chains, and the wage-financed spending of their employees, generated a gross value added contribution to UK GDP of £40.3bn in 2017. This supported the jobs of some 334,200 people and raised £5.3bn in tax receipts for the Exchequer.

Furthermore, it says that when the industry’s purchases and disposals of vehicles are also considered, its impact grows further still. Including these channels, in total the industry contributed an estimated £49bn to UK GDP in 2017.

Mixed fortunes

Record-breaking figures also suggest an industry in rude health, but in what is a highly competitive sector some firms are faring better than others.

In terms of profitability, Alphabet (GB) stood head and shoulders above other FN50 leasing companies.

It saw revenues rise by £150m (13%), from £1.14bn to £1.29bn, while pre-tax profits increased by a massive 125%, from £24.2m in 2016 to £54.9m, last year.

That will have been helped, in part, by termination revenues increasing by 23% from £596m in 2016 to £735m, in 2017.

Meanwhile, rising revenues for Arval UK could not be matched by increased profits. Its turnover increased by £229.3m from £918.1m in 2016 to £1.14bn last year. The number four FN50 company said that was “primarily due to the impact of a full year’s contribution from the previously acquired GE Leasing… and Leasecontracts sales in October 2016”.

However, operating profit margins fell from 6.9% in 2016 to 5.8% in 2017, while pre-tax profit fell 23% from £34.8m to £26.6m.

Like Lex Autolease, Arval highlighted pressure on residual values (RVs). “The UK used car market has continued to remain challenging, with continued uncertainty surrounding diesel emissions and the general economic outlook,” it said in its latest financial report.

The used car market expanded at a quicker rate than new car registrations in 2017, with used car demand proving comparatively resilient, falling by 1.1% compared to the 5.7% contraction in new car demand.

However, data analyst Autovista explains that sustained increases in registrations of new cars in recent years have caused sizeable overcapacity in the used car market.

Coupled with large volumes of used car returns, major discounting and attractive financing packages on new cars have been major factors in pushing down RVs, it says.

Residual values of 36-month-old cars are forecast to fall by 1% in both 2018 and 2019, although it predicts stability in values of 12-month-old cars as the deterioration in new car demand limits supply (for more on RVs see page 32).

It says that both petrol and diesel values are forecast to perform in this way, and although the sharp decline in new diesel sales will reduce supply, demand in the used car market remains robust, despite the negative publicity.

In fact, used diesel transactions increased 3.3% in 2017 compared to a 14.7% decline in registrations of new ones.

Brexit impact

Brexit impact

In terms of the wider economy, Brexit negotiations are finely poised, while any deal struck between the EU and the UK Government may be impossible to get through the House of Commons.

LeasePlan, which reported a 4% rise in turnover last year, from £939m to £977m, and a massive 39% in pre-tax profit, from £33.4m to £46.3m, partly helped by a strong management focus on cost control, said used car values had “largely been unaffected”.

However, on Brexit, the company warned: “As the details of Brexit unfold it becomes increasingly likely that the weaker pound will continue to mean that new car prices are adjusted upwards and discounts reduced.

At the same time, inflation will drive up high street prices, reducing consumer wealth.

“Weighting the supply and demands impacts together, it is likely that we will see used values come under more pressure in 2018.”

Forecasting body EY Item Club says the economy faces three years of weak economic growth which could be dented even further in the event of a no-deal Brexit.

It has downgraded its outlook for 2018 to 1.3% – which would make it the slowest expansion since the height of the recession in 2009 – and expects growth of just 1.5% in 2019.

The forecast is based on the assumption that the UK and EU will ultimately reach a transition agreement on Brexit, which Howard Archer, chief economic advisor to the EY Item Club, says “will help limit the shock to businesses and the economy”.

However, he added: “Heightened uncertainties in the run-up to and the aftermath of the UK’s exit could fuel business and consumer caution.”

A no-deal scenario could see trade hit by tariff and other barriers and a slump in the pound – while boosting exports – would push up inflation.

The UK’s Office for Budget Responsibility has compared the possible impact of a no-deal Brexit to that of the three-day week in 1974.

* The combined pre-tax profit and total turnover figures are an estimate based on reported figures for 76% of the risk fleet.

Login to comment

Comments

No comments have been made yet.