Massimilano Messina, automotive lead at KPMG

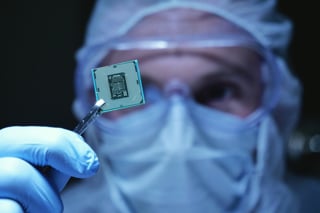

The semiconductor shortage is placing a stranglehold on production while shunting the auto industry’s postpandemic recovery back into first gear.

Chip shortages are now expected to last for the next 18 months - forcing manufacturers, which had hoped for the issue to be resolved by this point in the year, into new plant closures and limiting production in the near term.

It’s an issue expected to cost carmakers billions in potential revenue. And, while reports that manufacturers are contemplating stripping old washing machines for chips should be taken with a pinch of salt, it points to the level of concern in the sector. Indeed, there’s no quick fix solution.

The production of semiconductors, which are used in everything from touchscreen displays to collision avoidance systems, is a highly complex and capex-intensive business. It takes nearly five years to fund and build a new chipmaking plant.

Carmakers will need to chase down the chip capacity allocated to other industries for the picture to improve any time soon. But this is a big ask. OEMs cut orders for all parts including for semiconductors when demand for vehicles collapsed in spring 2020. And, after prioritising cost reduction over risk management, many carmakers were slow to re-order once demand recovered.

So, chipmakers were already committed to supplying bigger consumer electronics and data centre customers. As a result, auto players have a weak hand for buying-in these crucial chips. Their hand is made weaker when you consider there’s also a shortage of raw materials needed to manufacture the semiconductors themselves.

Naturally, this all holds implications for fleet buyers. Tight demand is forcing the price of semiconductors higher, and it will be interesting to see if prices will be passed on to customers.

But the over-capacity in the market, which fleet buyers have typically been the cure for, is also at risk. SMMT data shows that demand for cars is steadily returning, while production is being squeezed.

High demand and low supply could force prices upwards for fleet buyers as well as consumers. The issue could also stall progress towards hybrid and EV adoption too. Cars with electric powertrains typically need more semiconductors compared with their combustion engine counterparts.

Given many manufacturers are a long way off delivering new electric ranges, the issue could be a convenient excuse for auto players to further delay such plans.

Ultimately, the semiconductor shortage represents a major headache to an industry that ought to be on the up after being battered by Covid-19.

We need to see how chipmakers will manage in ramping up capacity over the next few months, and whether carmakers will be able to muscle in to get supply ahead of other industries. But it may not be until H2 2022 that the industry shifts back into a higher gear.

Read more from Fleet News about how the semoconductor shortage is impacting the fleet industry by clicking here.

Login to comment

Comments

No comments have been made yet.