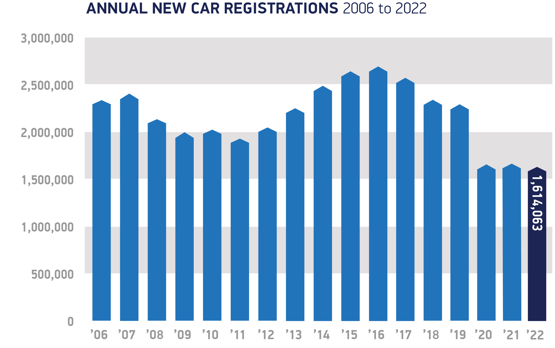

The new car market contracted by 2% last year, despite recording its fifth consecutive month of growth in December.

Figures from the Society of Motor Manufacturers and Traders (SMMT) show a total of 1.614m new cars were registered in 2022. Despite underlying demand, pandemic-related global parts shortages meant the new car market ended 700,000 units below pre-Covid levels.

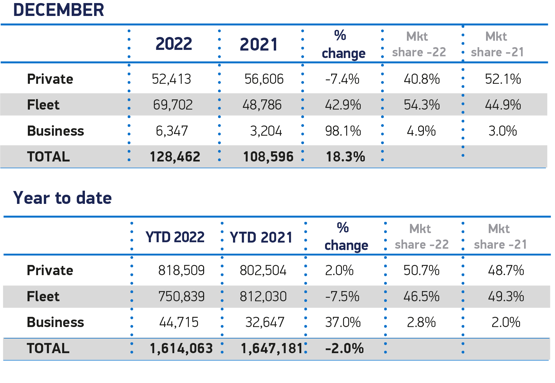

Fleet and business registrations accounted for 49.3% of the total, falling from 51.3% in 2021. However, fleets and business buyers were responsible for the lion’s share of battery electric vehicles (BEVs), accounting for two thirds (66.7%) of all BEV registrations and 74.7% of the volume gain in 2022.

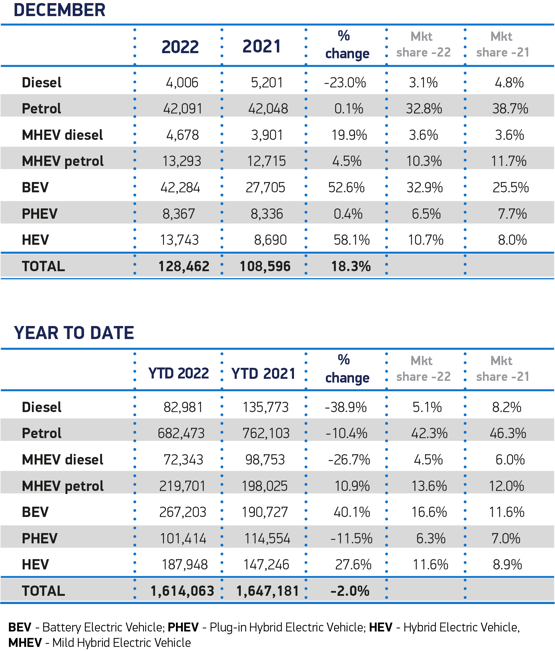

December saw battery electric vehicles (BEVs) claim their largest ever monthly market share, of 32.9%, while for 2022 as a whole they comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain choice.

December saw battery electric vehicles (BEVs) claim their largest ever monthly market share, of 32.9%, while for 2022 as a whole they comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain choice.

Plug-in hybrids (PHEVs) saw their annual share decline to 6.3%, meaning that combined, all plug-in vehicles accounted for 22.9% of new registrations in 2022 – a record high.

Mike Hawes, SMMT chief executive, said: “The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023.

“To secure that growth – which is increasingly zero emission growth – government must help all drivers go electric and compel others to invest more rapidly in nationwide charging infrastructure.

“Manufacturers’ innovation and commitment have helped EVs become the second most popular car type. However, for a nation aiming for electric mobility leadership, that must be matched with policies and investment that remove consumer uncertainty over switching, not least over where drivers can charge their vehicles.”

Volkswagen achieved the largest number of registrations in 2022, with 131,850 new cars sold. It was followed by Ford, with 126,826 registrations.

Kia achieved more than 100,000 sales in one year for the first time in its 32-year UK history. Delivering 3,450 new vehicles in December saw Kia’s full year sales result hit an all-time high of 100,191 for 2022.

The brands hybrid, plug-in hybrid and BEV sales topped 42,988 in 2022, 43% per cent of its overall sales.

In the premium market, Audi was the best-selling brand having registered 110,144 new cars. BMW followed with 108,624.

Supply chains are beginning to stabilise and although the shortage of semiconductors is expected to ease, erratic supply is likely to impact manufacturing throughout 2023. The SMMT’s most recent market outlook, published in October 2022, anticipates around 1.8 million new car registrations in 2023.

Jon Lawes, managing director of Novuna Vehicle Solutions, said: "Last year ended with a better-than-expected increase in EV ownership, with the number of EV registrations reaching a record market share of 32.9%, ending the year as the second most popular powertrain after petrol. We expect this positive trajectory to continue into the new year, despite supply issues continuing to hamper the industry’s ability to meet demand.

"However, as we enter 2023, the road to net zero remains bumpy, with EV infrastructure failing to keep pace with adoption. Our analysis shows that to hit Government targets, 30,000 new charging points will need to be built every single year for the next seven years, a tenfold increase in the number put in the ground in the past decade. Addressing the fragility of the current charging network, at scale and ahead of need, is critical to support mass adoption of EVs which requires urgent collaboration and investment from across the sector in the year ahead.”

Login to comment

Comments

No comments have been made yet.