Competition in the car market thanks to the increased presence of Chinese manufacturers could drive down the prices of battery electric vehicles (BEVs), according to Grant Thornton.

The Chinese new electric vehicle market has increased by 110% in the past year, while the broader passenger car market increased by 14%, figures from the China Association of Vehicle Manufacturers suggest.

BYD was the strongest-performing Chinese carmaker, selling 1.62 million BEV and hybrid models, an increase of 132% year-on-year.

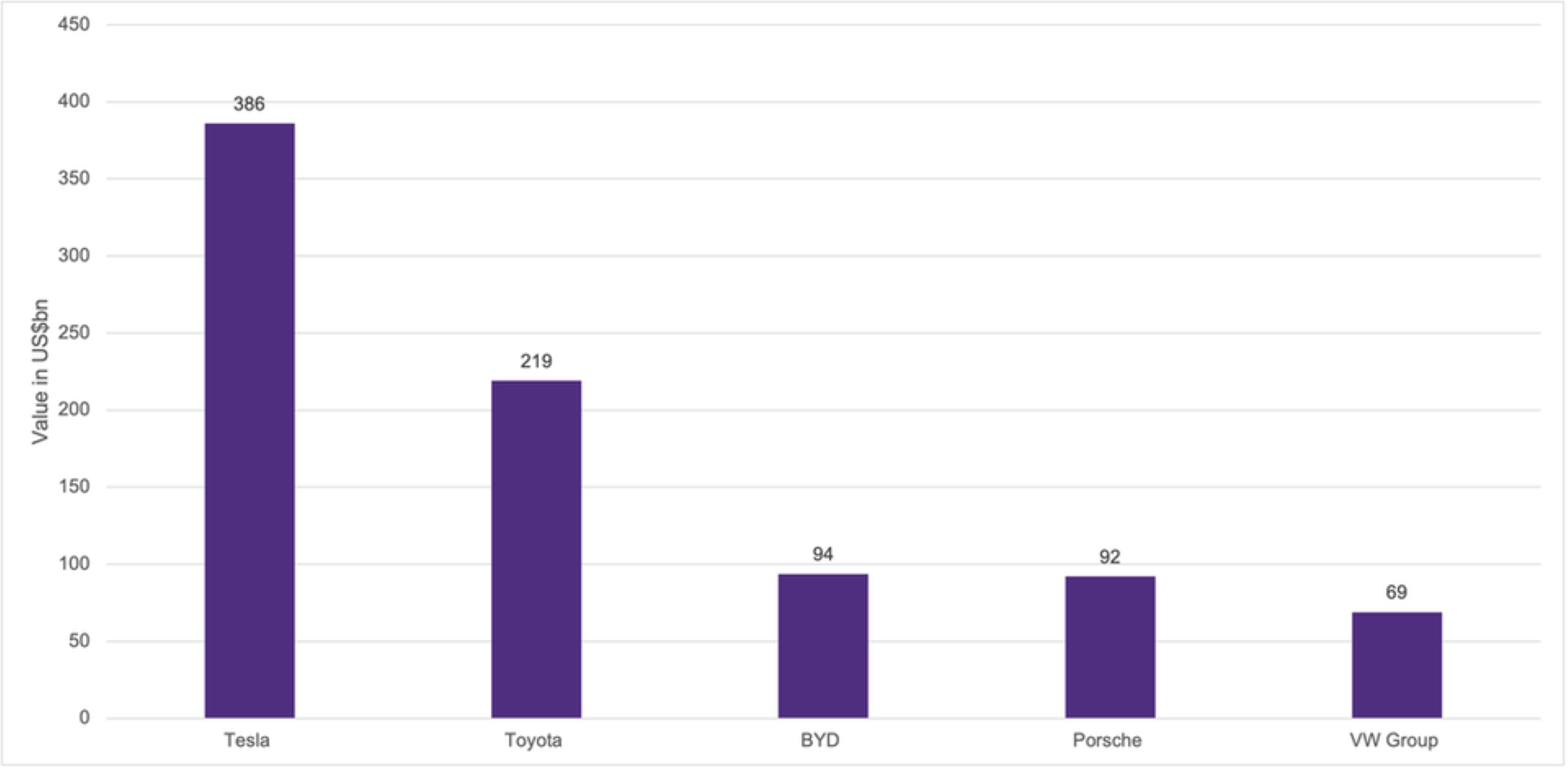

Such strong BEV sales have driven up BYD’s market value, making it the world’s third-largest automotive company by value after Tesla and Toyota.

Chinese OEMs are set to target the European market to keep their growth trend going, says Philip Nothard, insight and strategy director at Cox Automotive.

“Chinese brands are pricing aggressively in their home market and clearly show more willingness to compete on price than the European and American incumbent OEMs such as BMW, Stellantis, Mercedes Benz, Ford, and Tesla,” he explained.

“Currently, retail prices for Chinese brands are not significantly lower than European and American OEMs. However, they are substantially better equipped with full infotainment and ADAS systems.

“In contrast, the European and American OEMs are falling short in providing this as standard equipment for their vehicles.”

In the latest edition of Cox Automotive’s quarterly digital automotive insight update, AutoFocus, Grant Thornton says that Europe is expected to experience an influx of Chinese brands over the next two years months, with cut-price product offerings in the premium and mass market, aiming to gain market share quickly.

This, it argues, could push down BEV and internal combustion engine (ICE) vehicle prices and put European OEMs’ margins under pressure.

Owen Edwards, head of downstream automotive at Grant Thornton UK, said: “During 2022, fewer than 2,000 Jeep vehicles (ICE vehicles) were sold in China, with only one Jeep sold in May 2022.

“This suggests Chinese brands are taking the pricing war not only to BEVs but also to ICE vehicles.

“With China’s advanced battery technology, sourcing of raw materials and more advanced BEV supply chain, Chinese OEMs can manufacture BEVs at €10,000 cheaper than European automakers, representing a significant cost advantage.”

It is unclear whether the EU will react to the influx of Chinese vehicles in the region by imposing further tariffs on imported vehicles to protect their domestic OEMs, says Grant Thornton.

It is clear, however, that Chinese carmakers must consider this possibility when deciding their long-term manufacturing strategies for Europe.

“At present, OEMs’ profitability has remained robust in the face of supply chain disruptions as vehicle shortages meant retail prices for vehicles have remained high, allowing OEMs’ margins in 2021 and early 2022 to hold up well,” continued Edwards.

“However, the rise in raw material prices and further disruptions in the supply chain caused by gas shortages in Europe have meant the profits of many OEMs have started to suffer.

“In 2023, OEMs are likely to stabilise their earnings against a backdrop of lower costs for some raw materials and a less volatile supply and distribution chain.

“As a result, production in US factories is increasing, and production utilisation is heading back to more normalised levels of 76%.”

Nothard says that the growing influence of Chinese brands adds another potential headwind for UK OEMs to counter in 2023.

“It’s also likely that the supply and demand for vehicles could be affected by any trade disruption caused by intensifying protectionism and sanctions," he added.

“In addition, the UK's Department of Transport is consulting on its Zero Emissions Vehicle policy. This could mandate automotive manufacturers to register a certain number of zero-emission cars and vans in the UK by 2024, in preparation for a 2030 ban on new pure petrol and diesel vehicles.”

Grant Thornton’s complete analysis can be found in Cox Automotive’s AutoFocus insight update.

Login to comment

Comments

No comments have been made yet.