Tata, the owner of Jaguar Land Rover (JLR), has confirmed it will build a £4 billion electric vehicle (EV) battery factory in the UK.

The new gigafactory in Somerset, one of the biggest in Europe, will have the capacity to produce 40GWh of cells annually. It will make batteries for JLR and expects to supply other manufacturers, with production starting in 2026.

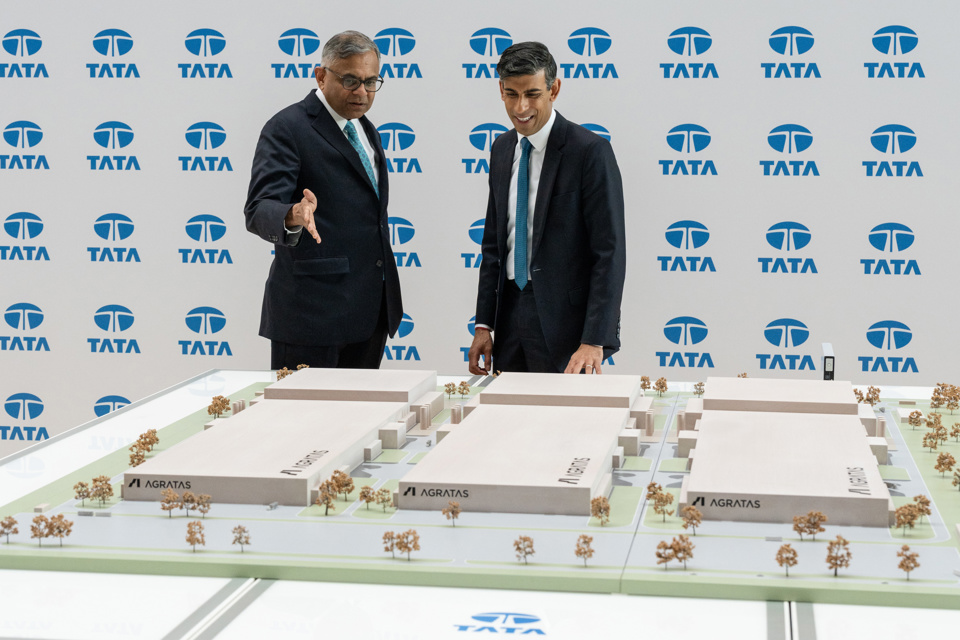

Prime Minister Rishi Sunak said: “Tata Group’s decision to build their new gigafactory here in the UK – their first outside of India – is a huge vote of confidence in Britain. This will be one of the largest ever investments in the UK automotive sector.

“It will not only create thousands of skilled jobs for Britons around the country, but it will also strengthen our lead in the global transition to electric vehicles, helping to grow our economy in clean industries of the future.”

The plant is Tata's first outside India and is expected to create 4,000 UK jobs and thousands more in the wider supply chain.

Natarajan Chandrasekaran, chairman of Tata Sons, said: “Our multi-billion-pound investment will bring state-of-the-art technology to the country, helping to power the automotive sector’s transition to electric mobility, anchored by our own business, JLR.

“With this strategic investment, the Tata Group further strengthens its commitment to the UK, alongside our many companies operating here across technology, consumer, hospitality, steel, chemicals, and automotive.

“I also want to thank His Majesty's Government, which has worked so closely with us to enable this investment."

As well as owning JLR, Tata has extensive steel interests in the UK including the Port Talbot plant in South Wales.

Mike Hawes, chief executive of UK automotive trade body, the Society of Motor Manufacturers and Traders (SMMT), says that the announcement is a “shot in the arm” for the UK car industry, the economy and British manufacturing jobs, which demonstrates the country is open for business and EV production.

“It comes at a critical moment, with the global industry transitioning at pace to electrification, producing batteries in the UK is essential if we are to anchor wider vehicle production here for the long term,” he added.

“We must now build on this announcement by promoting the UK’s strengths overseas, ensuring we stay competitive amid fierce global pressures and do more to scale up our EV supply chain.”

Jon Lawes, managing director of Novuna Vehicle Solutions, believes that Tata's decision is a "milestone moment" for the UK on the road to creating resilient, domestic next generation supply chains required to scale up EV production.

“Whilst China continues to dominate EV battery manufacturing globally," he said, "this move goes a long way to reducing our reliance on external markets and mitigate the long-term impact of EU tariffs which are hanging over the industry.”

The UK currently only has one plant in operation next to Nissan's Sunderland factory, while another proposed battery manufacturer, in the north-east of England, Britishvolt, went into administration earlier this year.

By contrast the EU has 35 plants open, under construction or planned.

UK director of Transport and Environment UK, Richard Hebditch, welcomed Tata’s decision to build its gigafactory in the UK. However, he said: “This one small step is not the giant leap we need - France has got four gigafactories while the UK has just secured its first.

“In order to spark a robust and ambitious industry for electric vehicles and battery supply in this country we’re going to need ten similar announcements. Then the UK automotive sector will be in a position where it can shine in the electric age.”

He argues that the UK also needs to go beyond deals for gigafactories and secure the wider parts of the supply chain from processing to critical metals to recycling.

“Without these, gigafactories in the UK won't even be built,” he said. “For the UK to truly compete globally it’s critical that we better link up with the EU, notably by implementing measures to ensure tariff free trade in EVs.”

Suzanna Hinson, battery workstreams lead at the Green Finance Institute, says that, while the investment is an important foundation for building a thriving battery industry in the UK, “further finance must be crowded in to enable the many innovative businesses that will support this ecosystem to scale”.

She explained: “The UK Government must adopt a holistic and sustainable critical mineral strategy to enable its net zero commitments.

“There is an opportunity to achieve this through reactivation of production scrap and end-of-life batteries within the UK’s borders.”

Login to comment

Comments

No comments have been made yet.