BVLRA has welcomed the Government’s decision not to introduce an emissions-based regime for van vehicle excise duty (VED) until at least April 2021.

The Government published a consultation in May on reforming VED for vans which explored creating a graduated first year rate for new vans, as is already in place for cars.

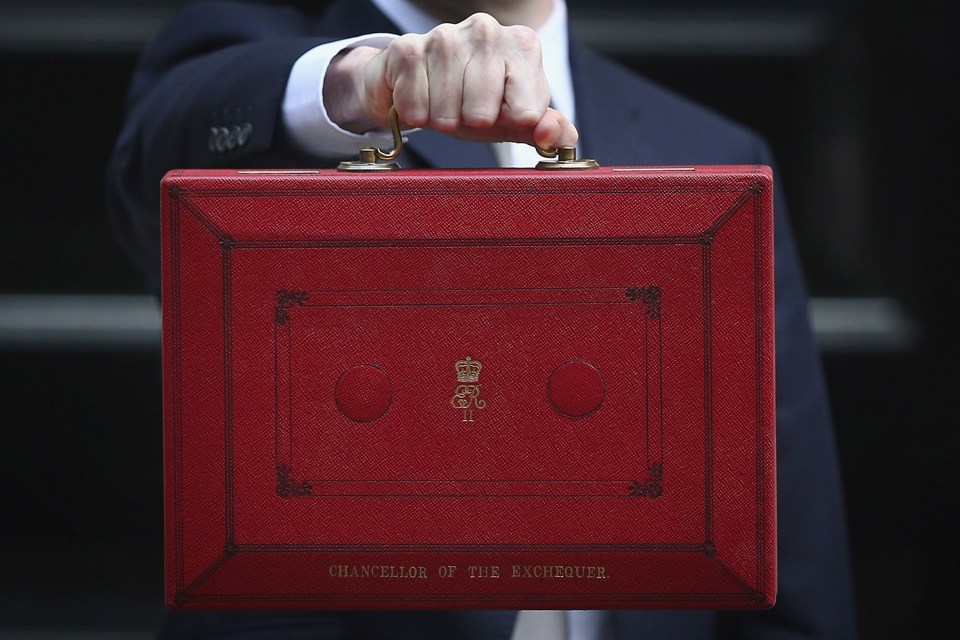

Yesterday’s Budget said the Government will shortly publish a summary of responses from the consultation, when it will set out proposals to introduce environmental incentives from 2021.

Bands and rates will be set out ahead of Finance Bill 2019-20.

The Chancellor also revealed that from April 1, 2019, VED rates for cars, vans and motorcycles will increase in line with the Retail Price Index.

Gerry Keaney, chief executive of the BVRLA, said: “This decision to postpone a CO2 based van VED regime is great news for fleets.

“Tax incentives can be a very powerful tool in driving businesses to use cleaner vehicles, but it is no use having these until we have enough low-emission van options on the market.

“The BVRLA is pleased that the Government has listened to its feedback on this issue and decided to take a pragmatic, business friendly approach to greening the van fleet."

Login to comment

Comments

No comments have been made yet.