Author: Rupert Pontin (pictured), director of valuations, Cazana

Current press speculation on Brexit has reached a high watermark and the Government must either go with the deal on the table or have the strength to just walk away.

Deferring Brexit would be counter-productive for everyone and where the UK economy has suffered in recent months it must be noted that we are as a country still performing better than some of our European neighbours.

The coming weeks will be an important period for the automotive industry and specifically for the fleet sector as March brings the new registration plate and an opportunity for the sector to shine a little and make up some of the sales that have been lost or deferred for various reasons over the last six months or so.

It would seem that for many manufacturers supply issues of WLTP cars have improved and even RDE2 vehicles are now beginning to become available from certain OEM’s who are ahead of the game.

This means better choice and quicker availability which will give fleets and company car drivers confidence and the ability to select the car they really want without being compromised whilst at the same time understanding future costs.

That said some further clarity on the longer-term positioning of BIK taxation would also be helpful.

In the coming days there will also be some clarity over the Brexit position too.

Uncertainty is the problem and clarity will help everyone settle down and deal with the future that is before us.

As time passes it may also prove that decisions made by some companies to leave the UK were wrong and patience may have helped them strengthen their business based from the UK.

Diesels decline - electric vehicles continue to grow in popularity

Looking at the market as a whole and there remains a great deal of speculation about the severe decline in diesel registrations yet at the same time a high level of excitement about the growth in AFV registrations.

The February registration data shows a growth of 34% for AFVs which sounds like a great achievement although this is coming from a low base.

The question is what the development of the hybrid and electric demand pattern is like within the fleet sector.

Fleet consultants are reporting that there is a growth in interest in using alternative fuels but that often there is an expectation from the customer and end user that is not a reality at this particular stage in the evolution of the propulsion type.

There is a little doubt that the crossroads has arrived for many fleet users and the strength of the hybrid and electric proposition grows that bit more with the release of every new car with a greater range.

Choosing the right hybrid/electric vehicle

Identifying the right vehicle for the driver and their use is a different matter.

End users tend to believe that personal taxation will be low and therefore any hybrid will do the job for them.

Listening to and believing high level claims on fuel consumption and running costs has led many drivers to select the wrong car and then suffer the increase in running costs for themselves whilst at the same time burdening their company with higher fuel and insurance costs.

The only way to successfully identify the right car for the driver and for the purpose it is being used for at the moment is to spend some money and undertake appropriate research as to the usage pattern of individual vehicles.

This is currently the best way to identify whether diesel, petrol, hybrid or electric propulsion is right

Alternatively fuelled vehicles on the used market

AFV’s will ultimately find their way back to the used market and now is the time to begin to watch retail demand for used hybrid and electric vehicles very carefully.

The retail consumer decides what these will be worth and retail data is the best way to understand what the ROI will be like when these cars are de-fleeted and put into the retail driven wholesale market.

Volumes are still low and technology changes mean volatility in pricing as newer cars hit the market with better range and technology and these impact desirability immediately.

Real-time insight is critical to stay ahead of this market.

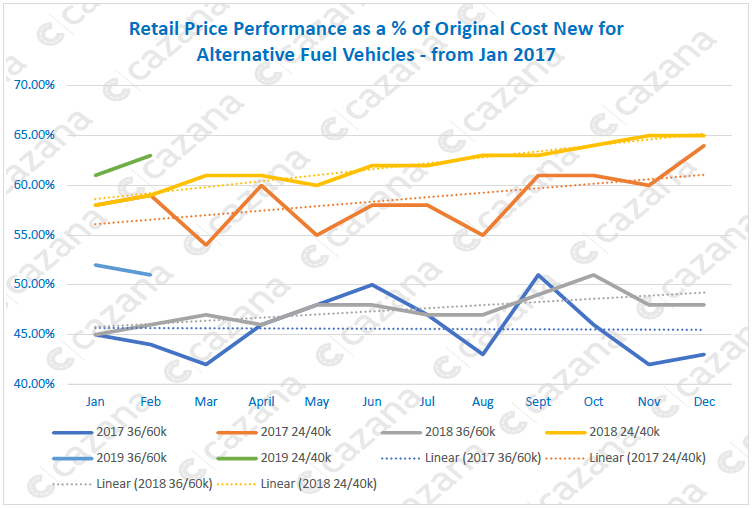

The chart below shows the retail pricing performance against original cost new for alternative fuel vehicles over the last two years:-

Data powered by cazana.com

This chart is both complex and fascinating and reflects some important trends.

The 2017 data for both age and mileage profiles shows an erratic behaviour which is due to the volume of data available in the used car market at the time due to low new car registrations in previous years.

The performance lines are also fairly well matched which is a sign of credible trending.

However, the 2018 data performance lines depict not only more stability but an even closer similarity to each other over the course of the year.

In all but one case the trendlines show positive increases in retail pricing.

The chart highlights greater retail consumer demand for this type of car and this will have subsequently been reflected in the wholesale market.

Additional Cazana data indicates not only that volumes are increasing but that days to sale are also falling and this is important to track as it clearly defines the demand for these cars in the used car market.

Real-time data is so important as it allows buyers, vendors and risk teams to make the most of market opportunities and yet have early warning of any market issues that may change demand, pricing and subsequent ROI.

Therefore, the fleet industry is facing a period of change during 2019.

The question is how this change is recognised, monitored, and the observations applied to the commercial strategy for the year. Investing some capital in appropriate research will help ensure cars with the right fuel types are being provided for the customers and end users.

Watching the retail market means greater awareness of how a volatile and growing sector is performing and investment in the right data will ultimately drive awareness and increase profit.

Login to comment

Comments

No comments have been made yet.