Two years ago, Siemens operated the country’s largest fleet of plug-in hybrid cars, as the company built its zero-emission transition strategy around a powertrain technology viewed as a vital stepping-stone to full electric.

Having converted more than 1,000 of the then 2,300-car fleet to PHEV, in addition to operating 200 hybrids and 80 full electric vehicles, head of mobility services Wayne Warburton switched his attention to phase two of the development pathway, under Siemens’s global vision of achieving carbon net zero by 2030.

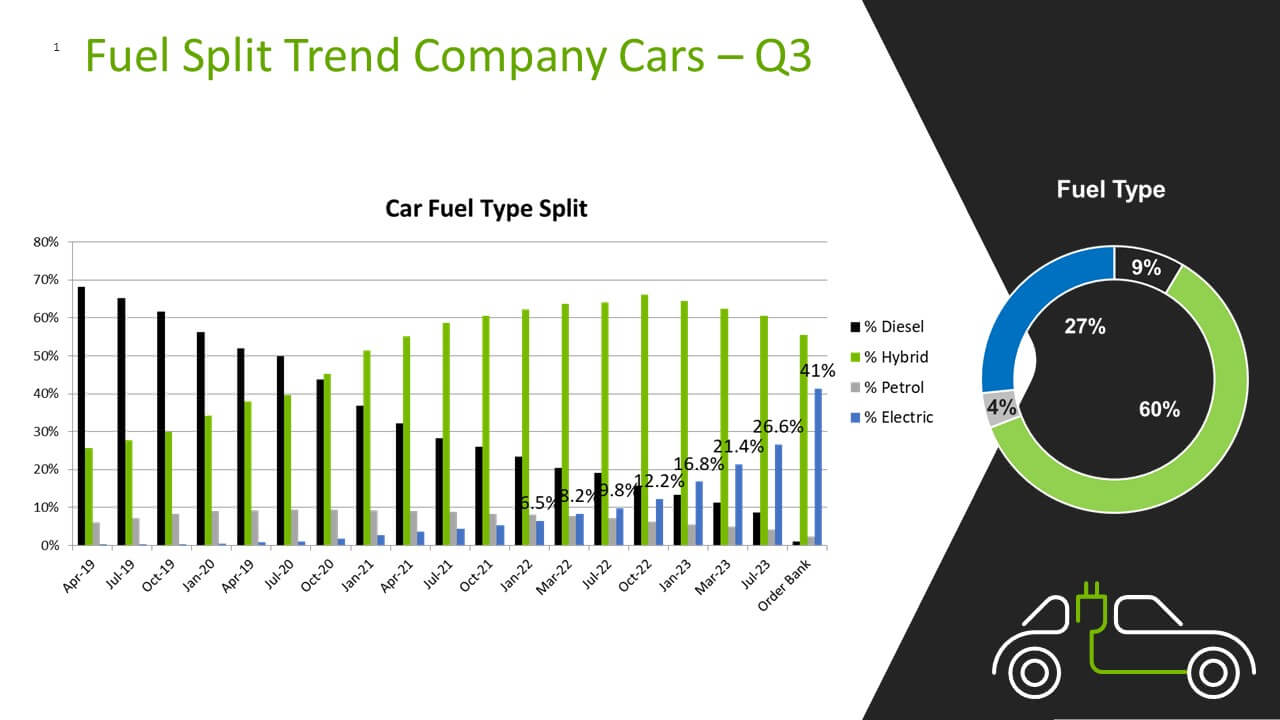

“We have peaked on PHEVS at around 1,300 vehicles and are now starting to see orders fall and full electric ramping up quarter on quarter,” Warburton said.

“Our live fleet, which is now 2,348 cars, is 31% BEV (733 cars), and the order bank is 41% electric. If we continue that trend, BEV will overtake PHEV within six months.”

In the past six months alone, Siemens has taken delivery of 349 BEVs, as manufacturer supply lines started to free up. It now runs just 241 petrol or diesel cars, which tend to be doing the high mileage, but they are also on run out – just six were ordered in the last quarter.

Sustainability targets are being reviewed with a view to stop ordering any internal combustion engine (ICE) cars or vans.

The two biggest challenges Siemens is confronting in its transition to full electric is the cost of the cars to the business and lead times.

Warburton has addressed this in various ways, including policy changes such as reducing contracted mileage and working closely with leasing provider Lex Autolease, manufacturer partners and suppliers on order expediting.

Siemens also increased the personal usage contribution allowance percentage, utilising the low benefit-in-kind taxation of electric cars, which opened more options for drivers.

While lead times have been steadily improving – in the last quarter it averaged seven months; the current order book averages six months – Siemens has also taken steps to position itself much closer to the manufacturers as part of a strategic alignment.

Supply chain expert Priya Kanda – one of two recent appointments to the fleet team alongside Kate Ball – is responsible for manufacturer partnerships, ensuring Siemens is kept up to date on availability, including cancelled orders.

She has also been the catalyst for an overhaul of the pricing review policy. Previously carried out annually, Siemens now assesses prices formally on a bi-annual basis.

Kanda said: “Due to our close partnership with Lex Autolease, we are able to gain market insights to ensure price competitiveness. As a global organisation, we are able to leverage our volumes, as well as incorporating demand planning to get an idea on our forward orders over the next year.”

She added: “We have also worked hard on our relationships with our account managers, so they understand our priorities, and we stayed close to them during the difficult times with the lack of supply. That network building has been key.”

Providing further relief was a decision to extend the renewal consideration period to a year in line with components/lead time challenges. Not only does it allow staff more time to get EV demonstrators, it enables Siemens to place orders earlier to minimise the waiting time.

Kanda said: “As part of our renewal pack, we tell drivers about the most popular vehicles and the lead times – we give them more information to support them more.”

Changing face of fleet management

The appointment of Kanda, who has a master’s degree in supply chain and logistics management, and Ball, whose experience lies within finance, is symptomatic of the changing face of fleet management. Both were recruited for their supply chain skills not fleet management specialism.

“We changed the job profile because we need people that can think differently, be more innovative and have different skills sets,” said Warburton.

Siemens is divided into five business divisions which are now separate legal entities and, therefore, operate with a fair slice of autonomy. While all must meet the overarching goal of achieving net zero by 2030, the speed at which they are transitioning varies by unit.

“Some are more aggressive than others, with their policy; for example, one is electric-first for all drivers. It has reduced that division’s CO2 to just 8g/km on the order bank,” Warburton said.

“It does add complexity, but we are the fulcrum of knowledge and best practice.”

This expertise is disseminated and cascaded via quarterly fleet forums where each business is kept informed about group policy and can learn from each other’s experiences.

There are group-wide consistencies, of course. Siemens has one risk management policy and operates a single user-chooser scheme which gives drivers flexibility to choose their vehicle from a wide choice within their band. Two-, three- and four-year term options are offered, albeit 97% of employees opt for four years.

In April 2022, Siemens switched its group policy to whole life cost (WLC) to ensure greater consistency when comparing electric versus petrol/diesel with more accurate measurements. The fleet team was supported heavily by the consultancy team at Lex Autolease when making the case to the finance and HR teams.

Warburton’s BEV aspirations aren’t solely focused on the existing fleet; he is also working with rental provider Enterprise to get the 120 or so new starters currently sitting in petrol or diesel hire cars into electric instead if they have an electric company car on order. Around 30 have been moved across so far.

All drivers can attend drop-in sessions jointly held with Lex Autolease to find out more about electric cars and their suitability for their personal lifestyles and living accommodation.

A recent session with Siemens Energy saw 100 people join the call with questions including taxation, home charging and range.

All of this is aimed at supporting the drivers in making an informed decision around the change to electric vehicles.

Tackling the challenge of electric vans

The UK business operates 700 LCVs of which 30 are full electric. Vans present a bigger challenge than cars, but Warburton has worked with Allstar to launch a home charging solution and has introduced the Allstar One Electric card for drivers needing to access public charging.

He is currently analysing use cases across the fleet. Telematics data on journey distances has been overlayed with a driver survey on their home accommodation (all vans are return to home). It revealed that around 40% of drivers meet the criteria of suitable daily mileage and a driveway to have a home charger fitted.

“I was surprised it was so many,” Warburton said.

These drivers will be targeted first over the next 12-18 months. Charge points are fitted at no cost to the employee.

Fast forward a year, and Warburton expects to start looking at how the business operates at a local and national level in order to facilitate a further transition.

“We may look at sharing chargers with other companies or install more chargers at our own sites or encourage weekly rapid charging,” he said. “Our daily driving average on vans is 80-100 miles, so another hope is that the range of electric vans increases as well.”

Siemens deploys a booking system at several offices, with morning and afternoon slots, to ensure vehicles are charged and then vacate the unit. Electric vehicles can be prioritised over plug-in hybrids at sites with fewer chargers.

However, with most people still hybrid working, the company has encountered very few issues – it’s largely self-policing.

The majority of the charge points are 7kW. Siemens has 30 of these at Manchester alone, supplemented by a couple of 22kW units and one 350kW DC charger. Staff pay a discounted kWh rate, similar to the cost of charging at home.

The appeal of low benefit-in-kind taxation is continuing to gradually entice the 1,000 or so cash takers back into the company scheme.

In addition, several divisions also now have the option of an electric car salary sacrifice, which started being rolled out across the business in October 2022. By the end of 2023, 102 vehicles will have been delivered, many to former cash takers. The fleet team arrange the terms, but the scheme is managed by HR.

The grey fleet could naturally erode, as Warburton is seeing a lot of new starters jump straight into the company car scheme. This could be for various reasons including costs and lower risk.

“Around 70% of new starters who could take cash are taking the company car,” he said.

Mobility pilots in Europe

In addition to having a Siemens business division named Mobility, Warburton’s job title also contains the word – while colleague Kate Ball is MaaS commodity manager.

In Europe, the company is running a couple of mobility pilots which tap into the integrated transport systems, but the UK continues to employ a ‘watch and see’ policy.

“We have put in some low emission and BEV Enterprise car club vehicles at key sites which reduces the footprint of hire cars,” Warburton said.

“But our immediate priority is to continue the transition of our cars to electric, tackle the electrification of our vans, which will require some deeper thinking / changes, and continue our journey to carbon net zero.”

FACTFILE

- Company: Siemens

- UK head office: Manchester

- Head of mobility services: Wayne Warburton

- Time in role: 10 years

- Fleet size: 3,048 – cars: 2,348; vans: 700

- Funding method: contract hire

- Operating cycle: cars – mix of 2/3/4 years (97% are 4yrs)

Login to comment

Comments

No comments have been made yet.