The average retail value of a used electric vehicle (EV) has increased in October following months of decline, new pricing data suggests.

The figures, from Auto Trader’s Retail Price Index, show that the average retail value of a used EV has increased 0.6% so far in October on a month-on-month and like-for-like basis with prices at £32,203.

In September prices were flat month-on-month, which followed 12 consecutive months of decline.

While prices are still down on a year-on-year basis, the stabilising market leaves prices 19.6% down YoY - the shallowest rate of decline since June.

A combination of increasing consumer demand for greener vehicles, fuelled by attractive prices, and a softening in the recent surge in supply of second-hand vehicles entering the market, are believed to be behind the increase.

Demand for used EVs is up 78.4% so far in October – far ahead of petrol (up 2%) and diesel (down -1.1%). What’s more, used EVs are taking just 23 days to leave the forecourts, the fastest since December 2018 and almost a week faster than the 28-day average for the used market overall.

Crucially, whilst demand growth is accelerating, the overall rate of supply growth of used EVs is softening, falling from an increase of 115% year-on-year in August, and 57% in September, to an increase of just 24.3% so far this month.

This imbalance is not only helping to stabilise prices, but also improve potential profitability.

At 0.6%, the monthly price growth for EVs is slightly ahead of the 0.2% month-on-month improvement for petrol values, but just below the 0.7% monthly increase for diesels.

On an annual basis internal combustion engine (ICE) vehicles remain well ahead of their electric counterparts, with current petrol and diesel prices up 1.3% year-on-year (£16,315) and 0.8% year-on-year (£16,000) respectively.

Richard Walker, Auto Trader’s data and insight director, said: “The continued realignment in used electric pricing is the real stand-out so far in October, with another month of improvement after a year of decline.

“For the moment we’re seeing the stars align for second-hand EVs; greater affordability and rising prices at the pumps is helping to make them a more viable alternative to their ICE counterparts which are still increasing in value.

“The combination of accelerating demand with softening supply is good news for the industry; although the market remains volatile, for those who follow the data to find and price the right stock, EVs currently represent real profit potential.”

Top 10 used car price growth (all fuel types) October month-to-date (October 17) 2023 vs October 2022 like-for-like

|

Ranks |

Make |

Model |

Sept 23 MTD Average Asking Price |

Price Change (YoY) |

Price Change |

|

1 |

Volkswagen |

Beetle |

£8,199 |

16.2% |

2.4% |

|

2 |

Peugeot |

Partner Tepee |

£9,844 |

12.6% |

0.5% |

|

3 |

Dacia |

Sandero |

£8,325 |

10.2% |

1.2% |

|

4 |

Hyundai |

i30 |

£10,338 |

8.8% |

0.9% |

|

5 |

Mercedes-Benz |

M Class |

£12,054 |

8.6% |

1.4% |

|

6 |

Mazda |

Mazda3 |

£12,612 |

8.5% |

1.7% |

|

7 |

Volkswagen |

up! |

£8,877 |

8.4% |

1.8% |

|

8 |

Volvo |

V70 |

£7,289 |

8.4% |

2.3% |

|

9 |

Mitsubishi |

ASX |

£11,479 |

8.3% |

-0.6% |

|

10 |

Fiat |

Panda |

£6,310 |

8.0% |

1.2% |

Top 10 used car price contraction (all fuel types) month-to-date (October 17) 2023 vs October 2022 like-for-like

|

Rank |

Make |

Model |

Sept MtD 23 Average Asking Price |

Price Change |

Price Change (MoM) |

|

10 |

Volvo |

XC40 |

£30,243 |

-10.6% |

0.0% |

|

9 |

Toyota |

C-HR |

£21,431 |

-11.3% |

1.1% |

|

8 |

Toyota |

Corolla |

£19,903 |

-11.8% |

0.8% |

|

7 |

Hyundai |

KONA |

£19,795 |

-12.2% |

0.6% |

|

6 |

DS AUTOMOBILES |

DS 3 CROSSBACK |

£16,977 |

-13.1% |

-0.3% |

|

5 |

MG |

MG5 |

£23,230 |

-15.4% |

3.5% |

|

4 |

Hyundai |

IONIQ |

£16,559 |

-18.7% |

-0.7% |

|

3 |

Vauxhall |

Corsa-e |

£19,914 |

-19.8% |

0.9% |

|

2 |

Citroen |

e-C4 |

£22,372 |

-22.9% |

0.4% |

|

1 |

Porsche |

Taycan |

£88,114 |

-23.8% |

-1.9% |

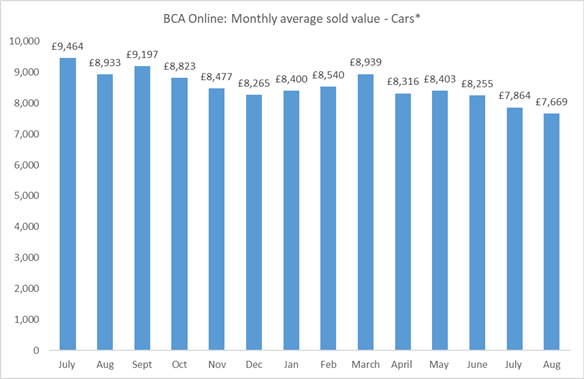

BCA average values remain fluid

With an acceleration of the changing mix of vehicles reaching the remarketing sector, average used car values remained fluid over the summer months, according to BCA.

After an initial positive first quarter earlier in the year, average values have now declined for three consecutive months, with August values at BCA averaging £7,669, down by £195 (2.5%) from the £7,864 recorded in July.

The pace of decline has slowed however, as July was down on June’s average value of £8,255 by £571 (6.9%).

Despite the moving market, demand has remained reasonably consistent, and sold used car volumes at BCA in August rose to the highest point since March of this year.

The shortage of desirable 3 to 4-year-old product continues to be a significant factor impacting mix and as a result competition remains strong for the best examples, it said.

BCA UK chief operating officer, Stuart Pearson, explained: “The well documented shortage of three to four-year-old product continues to drive a significant focus on the best graded stock that can be retailed quickly, with many of these vehicles reaching values well in excess of expectations.

“Conversely, the poorer graded vehicles have needed very close pricing attention with a clear focus on the remarketing basics required to find them a new home the first time they are offered for sale.”

Used car market is set for a fast start to 2024

The demand for used cars will increase in early 2024 predicts Shoreham Vehicle Auctions’ MD Alex Wright.

He believes that once consumers realise the UK economy is strong, supported by reduced inflation and retail prices they will be ready to invest in replacing their car.

“Once the penny drops with consumers that the economy is stable then the demand for used cars will return back to its seasonal winter level again for the first time for a few years,” he said.

“A seasonal winter used market sees prices and demand slowdown pre-Xmas and prices and demand rising again post-Xmas.”

“We anticipate demand increasing in January and February which will give the remarketing sector a strong start to the year,” he added.

Wright predicts the increased demand for used cars in early 2024 will break the cycle of gently falling prices the market has seen for the past 18 months.

“New car supply will carry on improving and it is only a matter of time before it gets back to pre-Covid levels,” he said.

“We predict used demand in Q4 will also remain consistent, particularly in the three to five-year sub-80,000-mile category.”

Growing new car sales flush older used cars into the market

The average age and mileage of used cars sold on Autorola’s online remarketing portal, meanwhile, reached a record high during Q3 as the improved supply of new cars flushed older ex-fleet and dealer part exchanges into the used market.

This is the first real sign that Autorola has seen of older cars being replaced in higher volumes since replacement cycles increased during the Covid pandemic. The September new plate change helped contribute to these higher volumes.

The average age and mileage profile of diesels in Q3 rose to 51 months/39,139 miles from 50 months/37,676 miles in Q2, while petrols rose to 45 months/26,473 miles from 44 months/25,130 miles.

Hybrids also experienced a rise in Q3 to 32 months/21,633 miles from 31 months/18,281 miles in Q2, while EVs rose to 31 months/19,899 miles from 28 months/17,277 miles.

Despite the rise in average age and mileage prices and the usual summer seasonal slowdown in Q3, ICE prices in particular have remained healthy.

Used diesel prices fell by just 1.5% (£276) from Q2 to Q3 to £17,580 and used petrol prices dropped by 1.8% (£272) to £14,703. Used EV prices saw the biggest price fall of 9.5% (£2,124) to £20,067, while hybrids fell by 5.4% (£1,295) to £22,246.

“With new car supply and sales continuing to improve it was only a matter of time before we saw the older cars reach the second-hand market in higher numbers,” explained Jon Mitchell, Autorola’s group sales director.

“The strong September new car plate market has made a big contribution to this trend. It looks likely to continue until replacement cycles are more into line with what we have been used to.”

Login to comment

Comments

No comments have been made yet.