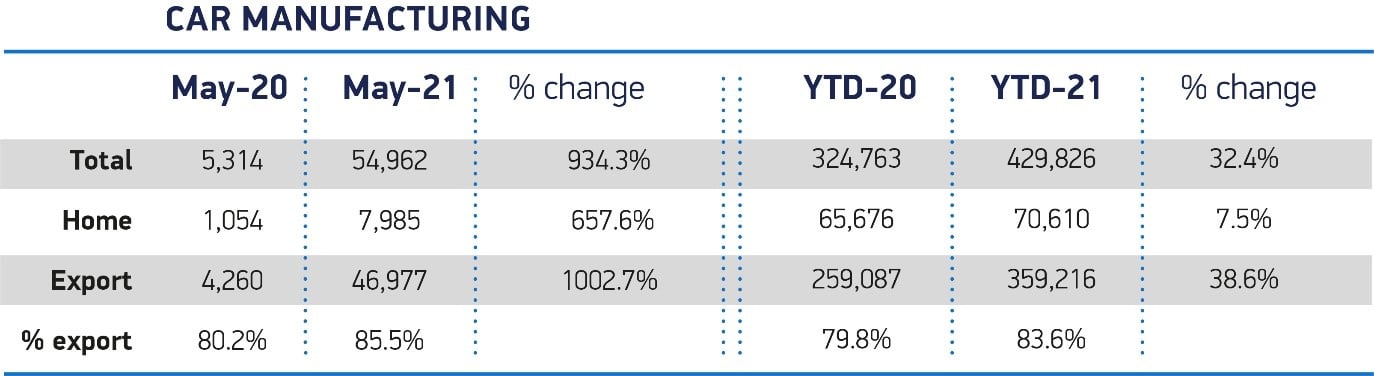

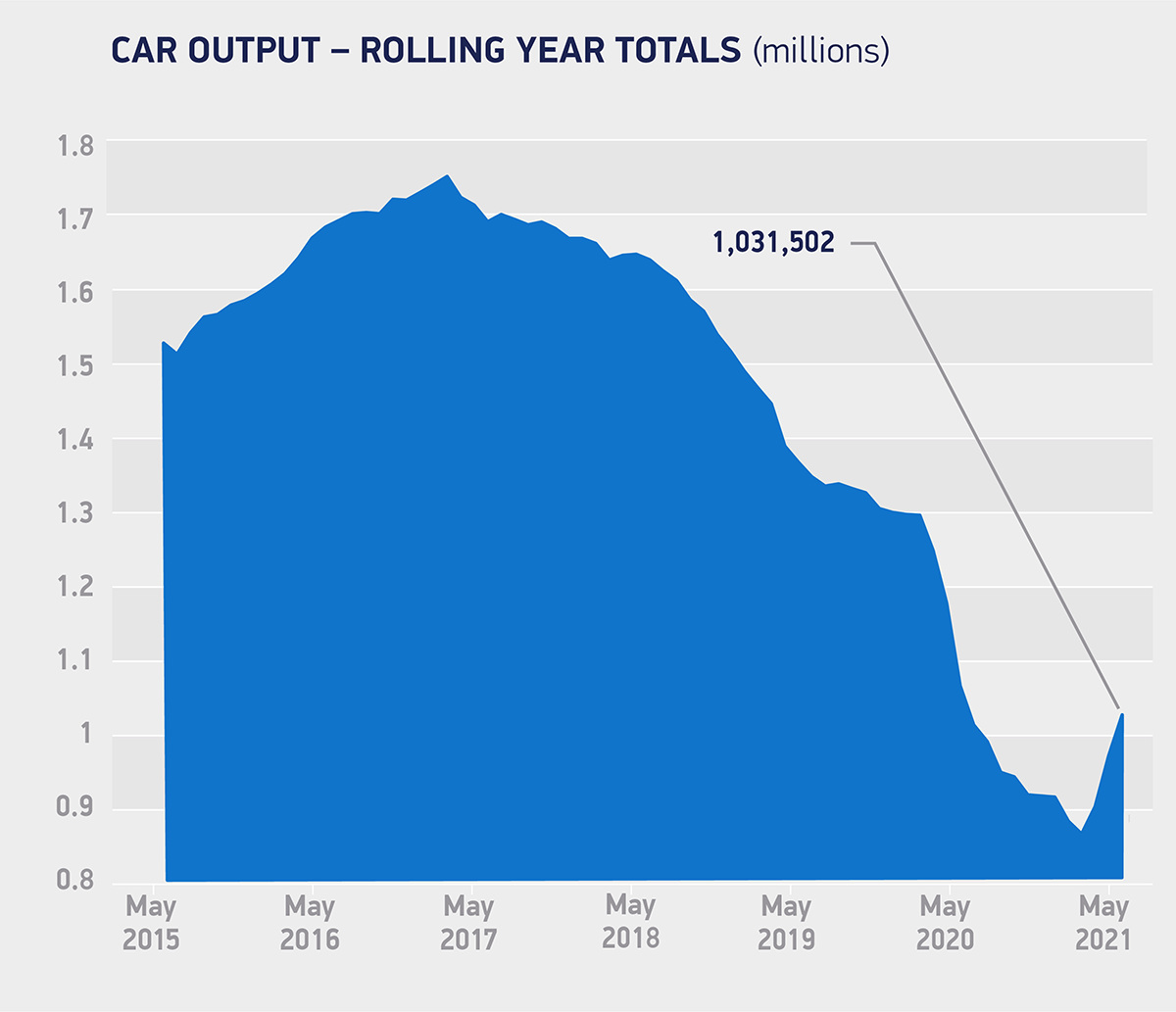

There was a tenfold increase in UK car production in May compared to the same month last year, but new data from by the Society of Motor Manufacturers and Traders (SMMT) shows it is still well below pre-pandemic levels, down 52.6% on the same month in 2019.

The SMMT says that 54,962 cars rolled off production lines in May compared to just 5,314 a year ago, when coronavirus halted manufacturing.

So far this year UK factories have turned out 429,826 cars, up some 105,063 units on last year, the majority (95.3%) of the additional volume built for export, but overall output remains down 22.9% on the same five-month period in 2019.

The SMMT says that this reflects the scale of the challenge facing the industry as it seeks to recover from the pandemic while grappling with global supply shortages.

Every car- and van-maker is being impacted by the computer chip crisis, with some delivery times for cars lengthening from three to six months, and many new vans not expected to be delivered until 2022.

The new data from the SMMT shows that, when compared with a five-year average, production was down by more than half (58%) for the month and over a third (36.3%) for the period January – May.

Mike Hawes, chief executive of the SMMT, said: “May’s figures continue to look inflated when compared to last year’s near total standstill of production lines.

“The recovery of car production is, however, still massively challenged here and abroad by global supply shortages, particularly semiconductors.

“If the UK is to remain competitive, therefore, it must ensure it has a globally attractive policy framework for both vehicle production and the supply chain.

“Accelerating zero emission car production is part of this package, so while one in five models made here this year is alternatively fuelled, we need to drive investment in R&D, charging infrastructure and the market to ensure we can deliver the net zero future society demands.”

In the month, 19.2% of all UK car output was battery electric and hybrid cars, while in the year-to-date one in five vehicles manufactured in the UK were alternative fuel models.

However, this share drops to one in 16 for pure battery electric vehicles and one in six for hybrid cars.

Meanwhile UK car production continues to be export-led, with 83.6% of all cars built so far in 2021 shipped overseas. The European Union remains by far the most important destination for British cars, taking 56.0% of all exports, followed by the US (18.3%) and China (7.3%).

Richard Peberdy, UK head of automotive at KPMG UK, said: “Global inflationary pressures affecting materials like copper, steel and oil are adding to the well reported issues surrounding semiconductor supply, which continue to clip UK automotive output. And while the Covid-19 picture is improving, new outbreaks have forced some port shutdowns in China, creating new blockages in the global supply chain.

“Inventories have fallen to very low levels as production remains stifled and demand recovers. Carmakers are responding by focusing production on higher margin models, while developing and rolling out electric vehicles to safeguard market share and competitive positioning in this fast-growing part of the market.

“As EV production sustains momentum, it’s encouraging to hear that multiple manufacturers are in talks with the UK Government over the construction of gigafactories. This won’t impact production in the near term, but their development will be crucial for the future of the UK automotive sector given the prohibitive nature of shipping heavy batteries from overseas.”

Fleet News recently revealed how the semiconductor shortage had forced Daimler and Volkswagen to cut the working hours at some of their plants.

Volkswagen chief executive, Herbert Diess, said last month that it was in "crisis mode" over the shortage, adding that the impact would intensify and hit profits in the second quarter.

Login to comment

Comments

No comments have been made yet.