UK car production fell for the second consecutive month, in August, as the global semiconductor shortage continued to affect the automotive sector.

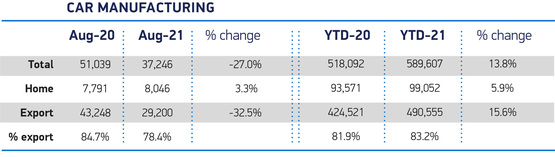

Figures from the Society of Motor Manufacturers and Traders (SMMT) show that 37,246 cars were built in UK factories during August, a decline of 27%.

While manufacturing for the UK market increased by 3.3% in the month, the rise was equivalent to just 255 additional units and exports fell by 32.5%. The decline was driven by falling exports to faraway markets including Australia, the US and China. Exports to the EU held up better, down 4.9%, accounting for almost seven in every 10 cars exported in August.

Despite the challenges, production of the latest electric, plug-in hybrid and hybrid cars surged to a new high, representing more than a quarter (27.6%) of all cars made. Since January, UK car factories have turned out 137,031 alternatively fuelled cars - 51,679 more than the same period in 2020.

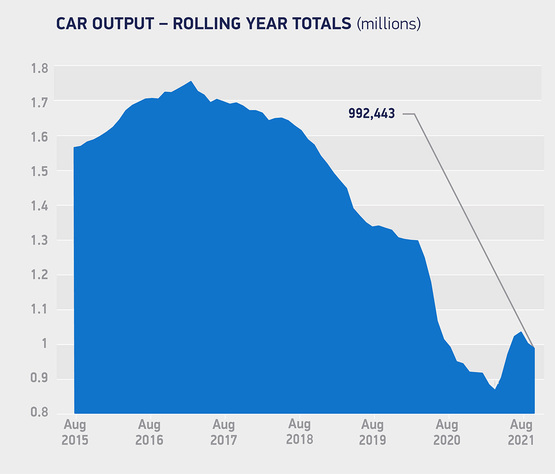

Production in the year-to-date remains up, by 13.8%, to 589,607 cars. The performance, however, must be set in context against a Covid-hit 2020 as it remains significantly lower, by 32%, than in 2019.

The total is 42.8% down, equivalent to 440,920 fewer units, when compared against the five-year average for the first eight months of the year.

Mike Hawes, SMMT chief executive, said: “Another significant decline for UK car production is extremely worrying both for the sector and its many thousands of workers nationwide. While not the only factor at play, the impact of the semiconductor shortage on manufacturing cannot be overstated. Carmakers and their suppliers are battling to keep production lines rolling with constraints expected to continue well into 2022 and possibly beyond.

“Job support schemes such as furlough have proven such a lifeline to automotive businesses yet its cessation today comes at the worst time, with the industry still facing Covid-related stoppages which are damaging the sector and threatening the supply chain in particular. Other countries have extended their support; we need the UK to do likewise.”

Richard Peberdy, UK head of automotive at KPMG, added:

“Chip shortages continue to bite, but manufacturers will no doubt be reviewing how many cars they make - so lower levels of production will likely persist.

“Fewer cars rolling out of plants has helped to bump-up retail prices and carmakers, alongside retail networks, will want to hold on to the margin they’ve gained since the start of the pandemic.

“While production disruption will be hurting efficiency, a reduced volume focused on more profitable models will be an attractive balance that manufacturers won’t want to let go of. Over the short term, it’s helping to cover the costs of huge underutilised plants while they review options to right-size.

“Bigger price tags on forecourts could help to open a window for Chinese-owned carmakers in the UK, which may be more competitive on cost. At the Munich mobility show last month we saw this potential for a shake-up in the market, with an impressive exhibit of SUV, electric, autonomous and hydrogen models.”

Login to comment

Comments

No comments have been made yet.