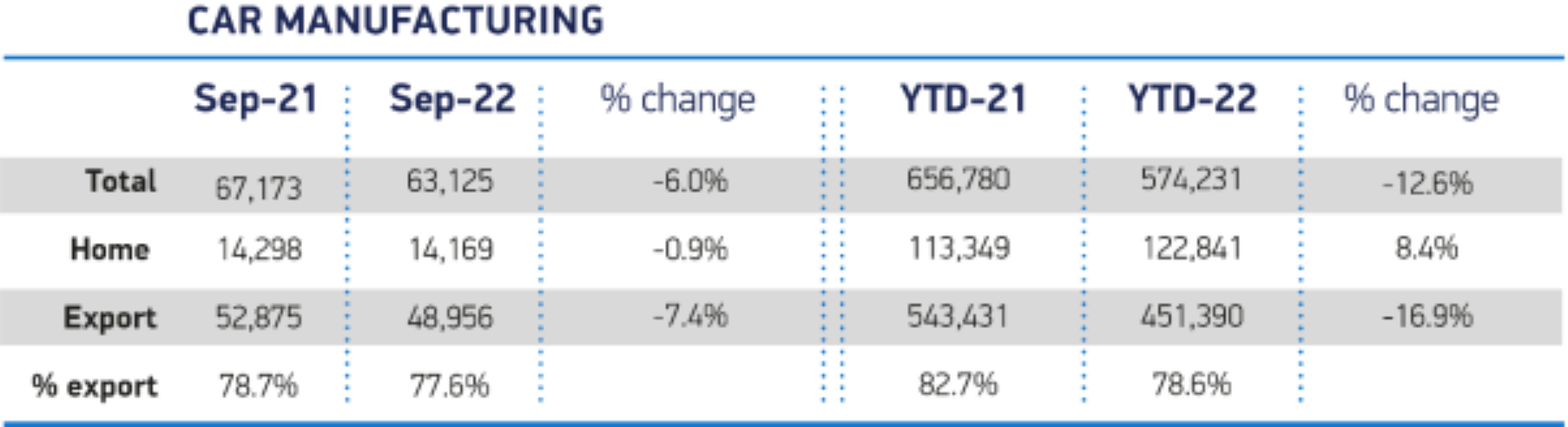

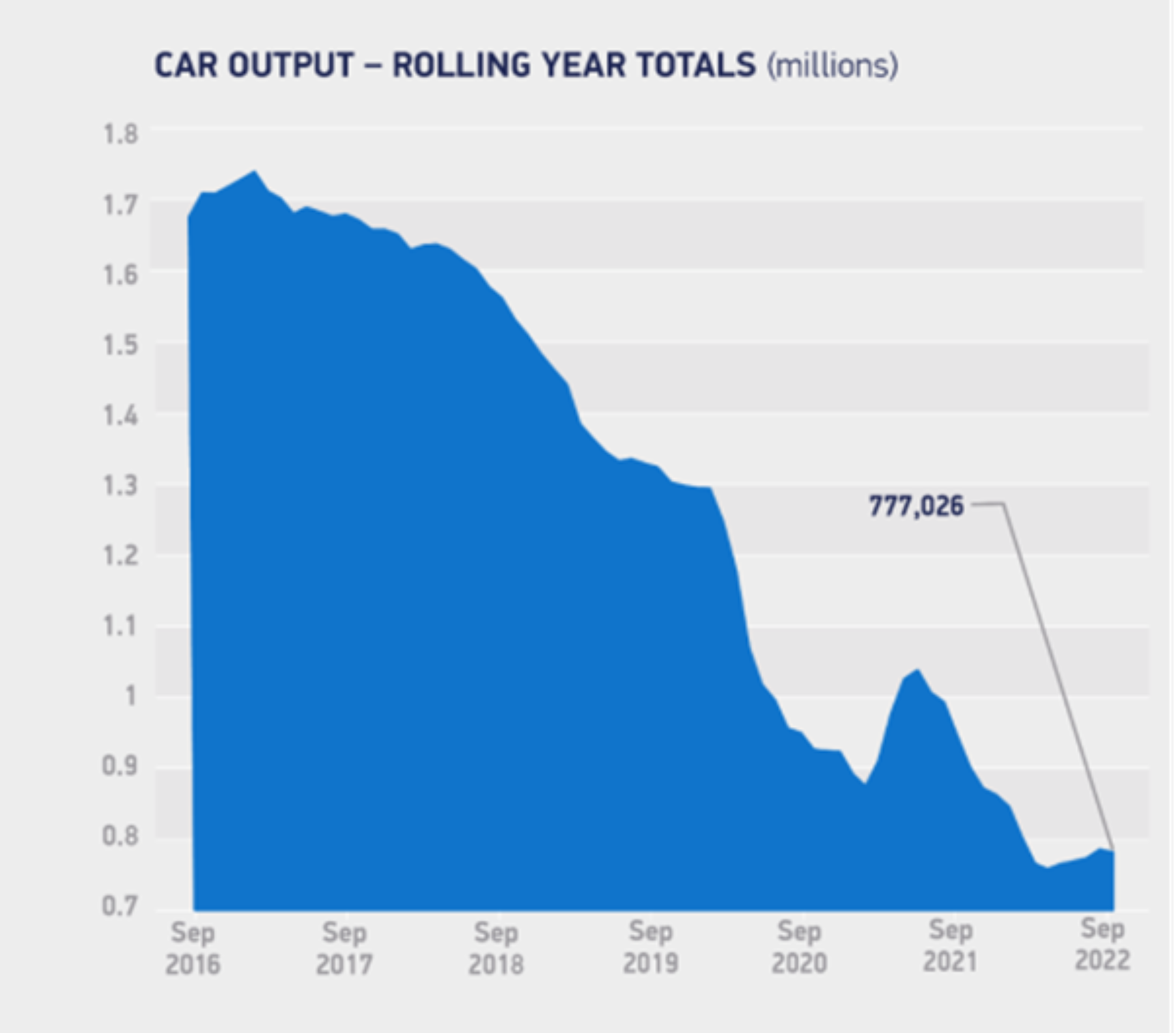

The was a 6% decline in UK car production in September, with 63,125 models rolling off factory lines, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Following four months of growth, SMMT says that output was again restricted by “severe supply chain issues affecting manufacturers”.

Volumes were down by 47.7% from the 120,729 cars built in the same month in pre-Covid 2019.

Exports also declined in September, down by 7.4% to 48,956 units, driven by reductions in shipments to the EU, US and China, although exports increased to South Korea, Australia and Turkey.

The number of cars built for the UK market, meanwhile, also fell slightly, down 0.9% to 14,169 units.

Richard Peberdy, UK Head of Automotive, KPMG, said: “UK automotive manufacturing remains in a perilous state, with businesses worrying about high and sustained inflation in energy, material and logistics costs.

“All this from a base line of throttled supply chains in key components and of course the costs and disruption of the covid years.

“I worry about the UK sector’s ability to invest in key technology development and skills.

“Both are critical for the UK to retain any position of strength in the medium term, as the global automotive and mobility industry reshuffles itself around energy transition and new global platforms.”

Despite the overall decline, UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles continued its recent upward trajectory, with combined net 9.9% growth to a record share of 37.8%.1

BEV output, in particular, grew strongly, up 16.6% to 8,856 units and representing more than one in seven (14%) of cars made in September.

Year-to-date, UK car factories have turned out a record 52,888 BEVs, up almost a fifth (19.3%) on the first nine months last year and evidence of the UK’s capability in making cutting-edge, zero emission vehicles that are in strong demand around the world, with 78.4% shipped to markets overseas.

The figures come as fresh SMMT analysis confirms the increasingly important role of electrified vehicle production to the UK economy, especially the value of exports.2

Over the past five years, the value of BEV, PHEV and HEV global exports has risen six-fold, from £1.3 billion to £7.9 billion meaning they now represent more than a third (36.1%) of the value of all UK car exports, up from a mere 4.1%.

BEVs, in particular, are critical to the future prosperity of the UK, with the value of their exports up a significant 1,457%, from £81.7 million to £1.3 billion, since 2017, says the SMMT.

The data also reveals that, in 2021, the value of BEV, PHEV and HEV exports to the EU alone totalled £4.11 billion, just surpassing the value of internal combustion car exports (£4.09bn). So far in 2022, almost six-in-10 of the UK’s car exports (57.4%) have been for markets in the EU.

Mike Hawes, SMMT chief executive, said: “Billions of pounds and thousands of jobs are dependent on the automotive sector and, increasingly, on electrified vehicle production.

“Despite the current challenges, our car makers remain resilient and are well placed to ramp up output of the latest, zero emission vehicles which will help drive an economic recovery, create jobs and boost growth.

“Success is not guaranteed, however, and to realise its potential the UK sector must attract new investment – which means creating competitive investment conditions.

“Stability, combined with a plan that tackles critical skills shortages, delivers regulatory certainty and brings down the cost of energy in the long-term can help put the UK at the forefront of next generation automotive manufacturing.”

Login to comment

Comments

No comments have been made yet.