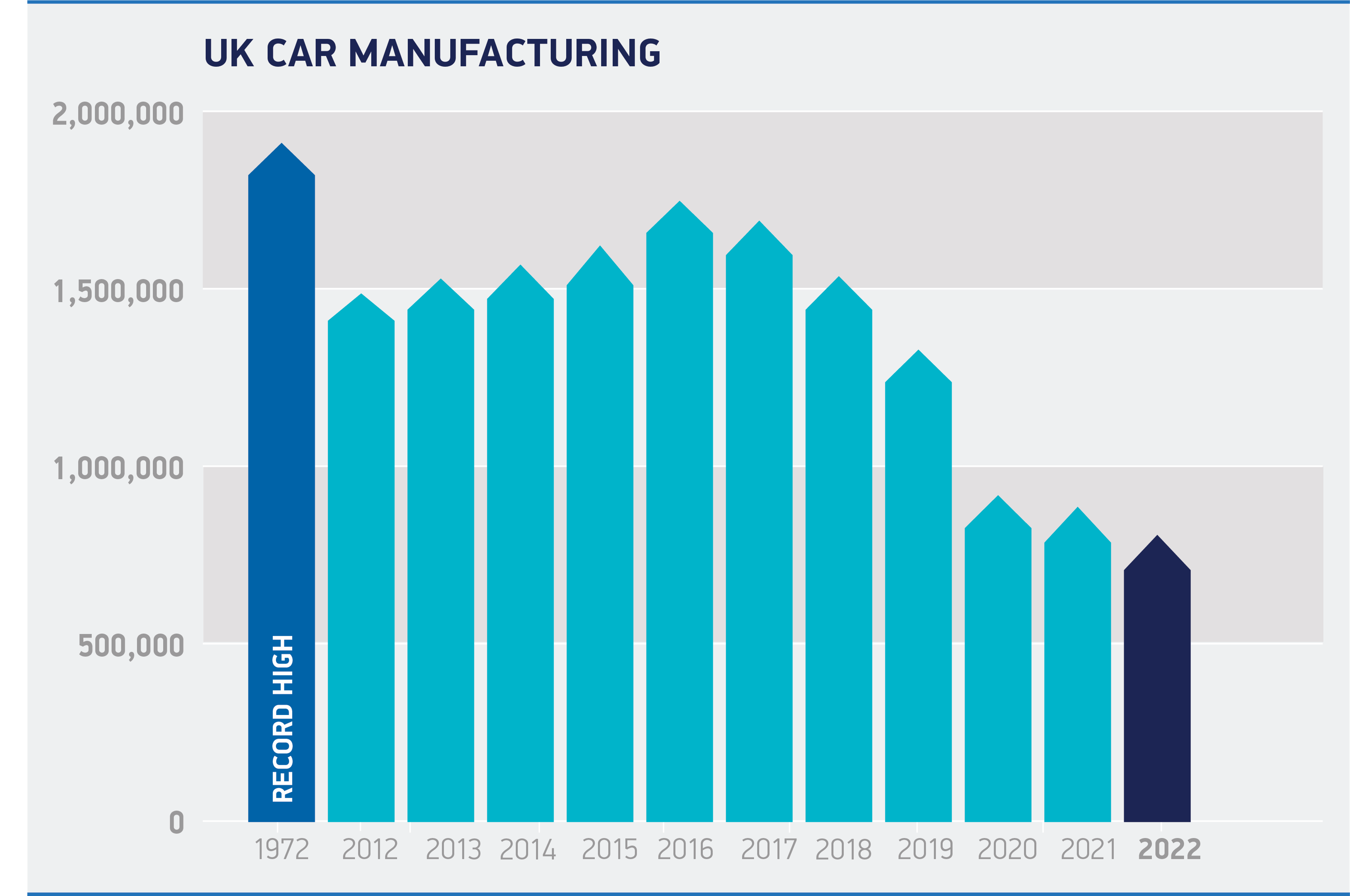

UK car production is at its lowest level since 1956, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

Last year, the UK produced 775,014 cars, only slightly more than the 707,594 units produced in 1956 which was the toughest post-war year for British manufacturers.

As well as the growth of strong foreign competition, the country was struggling with a credit squeeze, a growing reliance on exports hit by a clampdown on car imports by major markets and labour disputes.

In 2022, the SMMT says the global shortage of semiconductors was, in part, to blame for the poor production figures.

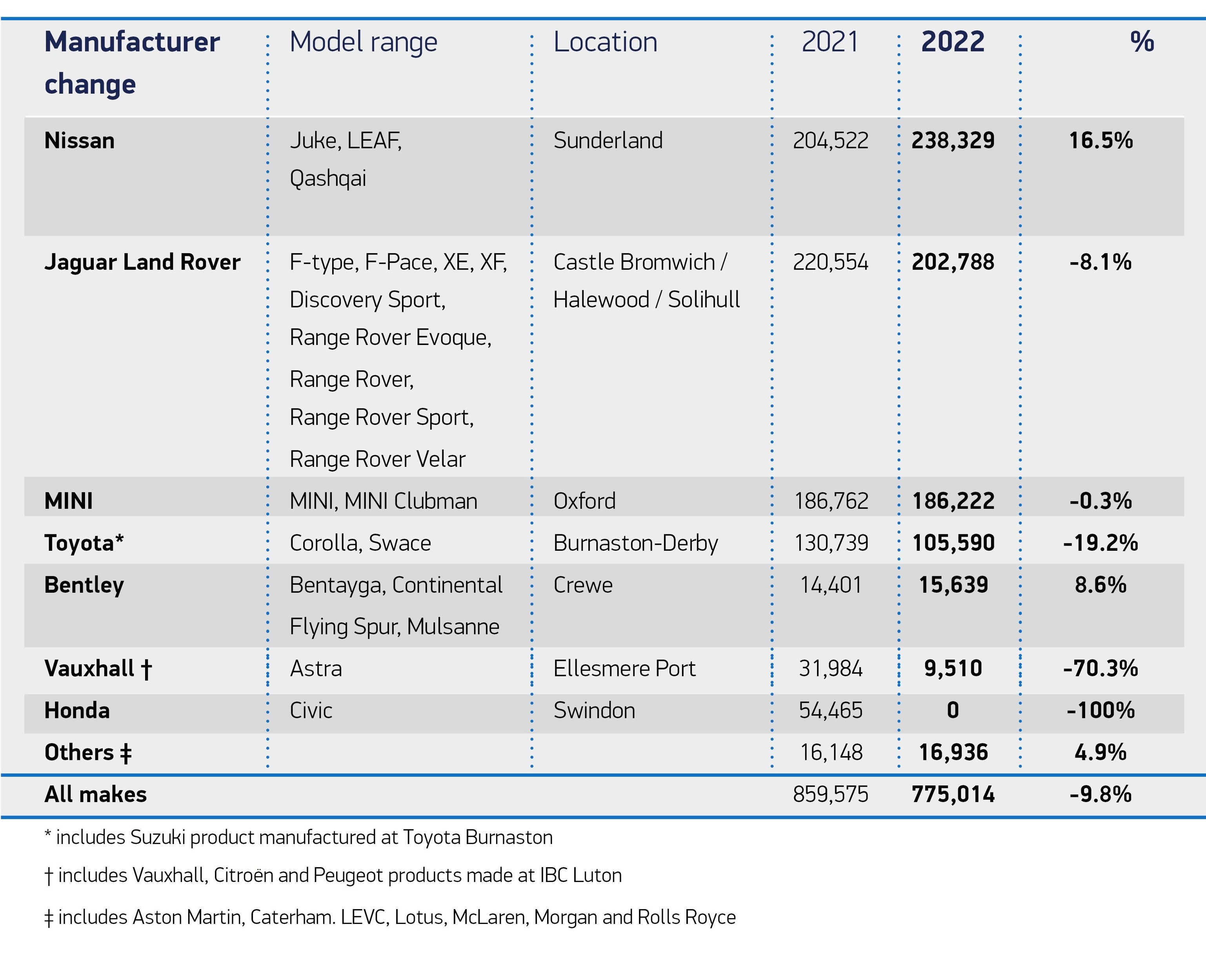

Significant structural changes, with the loss of production at two volume manufacturing sites; and the impact of supply chain pauses in China due to Covid lockdowns, also played their part.

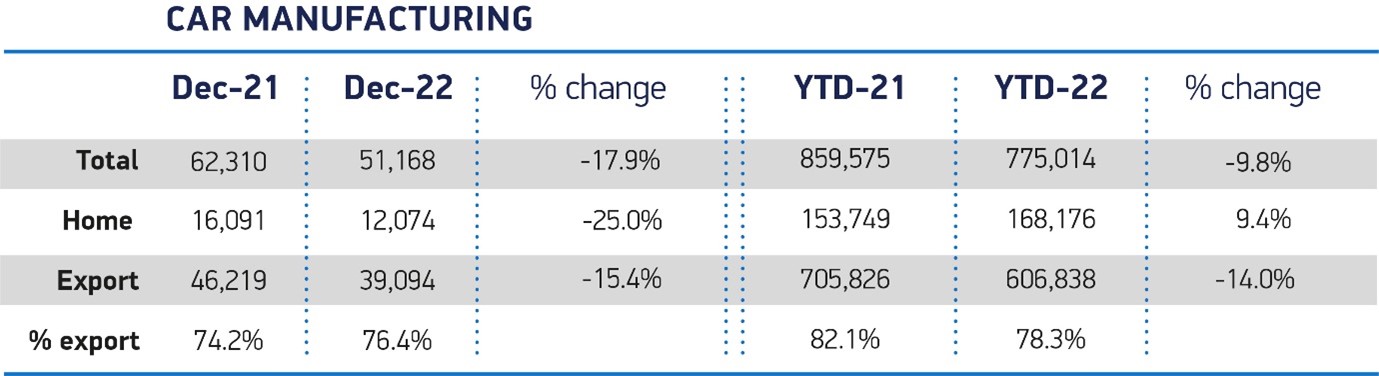

Year-on-year, UK car production declined by 9.8% in 2022, with 84,561 fewer units built on the previous year, and was 40.5% off the 1,303,135 cars made pre-pandemic in 2019, equivalent to a loss of more than half a million cars.

Mike Hawes, chief executive of the UK automotive trade body, the SMMT, said: “These figures reflect just how tough 2022 was for UK car manufacturing, though we still made more electric vehicles than ever before – high value, cutting edge models, in demand around the world.”

UK factories turned out a record 234,066 battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) electric vehicles, with combined volumes up 4.5% year-on-year to represent almost a third (30.2%) of all car production.

Total BEV production rose 4.8%, with hybrid volumes up 4.3%. The SMMT says that boosting output of these vehicles will be critical in the attainment of net zero, for both the UK and major overseas markets.

Hawes continued: “The potential for this sector to deliver economic growth by building more of these zero emission models is self-evident, however, we must make the right decisions now.

“This means shaping a strategy to drive rapid upscaling of UK battery production and the shift to electric vehicles based on the UK automotive sector’s fundamental strengths – a highly skilled and flexible workforce, engineering excellence, technical innovation and productivity levels that are amongst the best in Europe.”

Since 2017, the value of BEV, PHEV and HEV exports has risen seven-fold, from £1.3 billion to more than £10 billion. As a result, electrified vehicles represent 44.7% of the value of all UK car exports, up from a mere 4.1%.

Investment in UK automotive

BEVs, in particular, are critical to the future prosperity of the UK, with their export value up more than 1,500%, from £81.7 million to £1.3 billion, says the SMMT.

It argues that UK automotive is integral to ambitions on levelling up, delivering net zero and advancing global Britain.

In 2022, publicly announced investment for the sector reached a total of £4.5 billion, with major new commitments to electrification in Crewe and Merseyside.

This was down slightly from the potential £4.9bn announced in 2021, which included the proposed development of a new battery gigafactory in the West Midlands.

Councillor Jim O’Boyle cabinet member for jobs, regeneration and climate change at Coventry City Council, told Fleet News: “The West Midlands Gigafactory’s site in Coventry is ready to go – it has planning permission and a funding package to ensure we can deliver. But, if the Government does not move to back our site, and others, the country will be left behind the rest of the world when I believe we could, and should, be world leading.

“It is essential to create the right conditions to attract battery manufacturers to invest and support the large-scale industrialisation for an electrified UK in the future.

"In addition, it is now imperative to deliver the West Midlands Gigafactory project right here in Coventry to secure this future.”

Britishvolt, the firm behind a plan to build a £3.8 billion gigafactory in Blyth in the North East, entered administration last week, with about 300 job losses.

While there are still hopes to revive the plan, the EV battery factory was expected to create 3,000 direct highly-skilled jobs and another 5,000 indirect jobs in the wider supply chain, and had been touted as an example of ‘levelling up’.

Given the global and domestic challenges, the SMMT says industry is looking for a dedicated framework to position the UK as one of the world’s most competitive locations for advanced automotive manufacturing.

This framework, it added, must address soaring energy costs and the threat of increasing global protectionism, provide fiscal measures to encourage investment in zero emission technologies and equip the UK’s talented workforce with the right skills to deliver these vehicles.

Looking forward, the latest independent outlook expects that, with easing semiconductor shortages, UK car and light van output should rise by 15% to 984,000 units in 2023 (842,200 cars and 141,800 light vans), an uplift worth some £3.9 billion.

By 2025, production volumes are projected to surpass a million vehicles.

Richard Peberdy, UK head of automotive at KPMG, said: “We remain in an era of significant challenge for the UK automotive sector, but yet a time of great opportunity.

Richard Peberdy, UK head of automotive at KPMG, said: “We remain in an era of significant challenge for the UK automotive sector, but yet a time of great opportunity.

“The market share growth achieved in the UK for electric vehicles is strong given the context, but the race for countries to be seen as world leaders in electric vehicle production is well underway.

“The UK’s position globally for manufacturing electric vehicles and parts in much higher volume still depends on investment in battery manufacturing and related skills. At this time, it remains uncertain where that is coming from.”

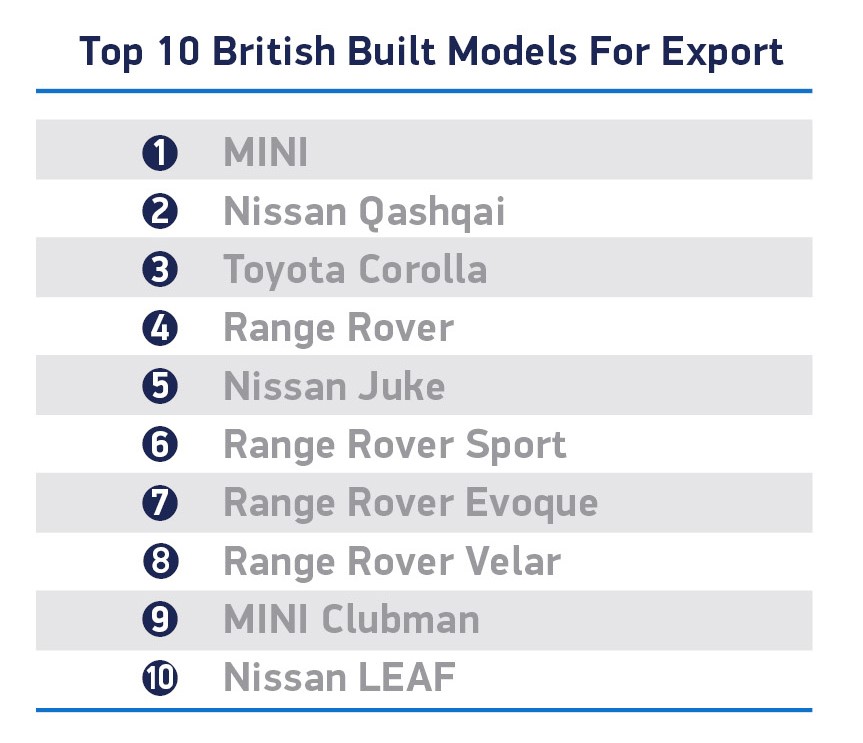

The EU remained by far the sector’s largest market, even as shipments declined 10%, with 57.6% of exports (349,424 units) heading into the bloc.

While exports to the US and China also fell, down 31.6% and 8.3% respectively, the number of cars sent to Japan (+5.7%), South Korea (+32.8%), Australia (+4.7%), Switzerland (+2.7%) and South Africa (+23.0%) all increased, although together these represented just 8.4% of exports.

Exports to Russia, a top 10 export market in 2021, meanwhile, fell by 78.3%, with shipments made before the outbreak of war in Ukraine and the cessation of business.

Login to comment

Comments

No comments have been made yet.