Some used battery electric vehicles (BEVs) and internal combustion engine (ICE) cars have started to reach price parity, according to new analysis by Indicata.

In a new white paper called ‘Reaching used BEV and ICE car price parity’, Indicata shows prices of used BEVs peaking in Q3 2022, when demand and the chip shortage weakened supply.

Prices subsequently fell as manufacturers pushed discounted new and nearly new used BEVs into the market, which coincided with the first used BEVs coming back in higher volumes from two and three-year personal finance, leasing and salary sacrifice contracts.

In 2023, demand could not keep up with this increased supply which led to used BEVs crashing and prices falling by over 20% in just six months.

The fall in used BEV prices, says Indicata, was eventually matched by other fuel types in Q3 and Q4 2023 as the market made its best attempt yet to get back to pre-Covid levels.

However, in Q1 2024, there have been signs that used BEV prices have stabilised as prices fell by just 1.3% during the three-month period, which has helped close the gap between BEV and ICE prices.

Dean Merritt, UK head of sales for Indicata, explained: “Price parity is vital for BEVs in the used market as consumers are now being offered all the latest fuel types at similar prices, where before used BEVs were commanding a 25-30% price premium which put buyers off going electric.”

He added: “Price parity is fuelling demand just as the volumes of used BEVs, particularly ex-fleet cars, are increasing which is good news for the entire industry.”

Indicata has taken data for the Hyundai Kona, Citroen C4, MG ZS, Peugeot 208 and Vauxhall Corsa to examine on how the used prices of BEV models compare with an equivalent ICE model.

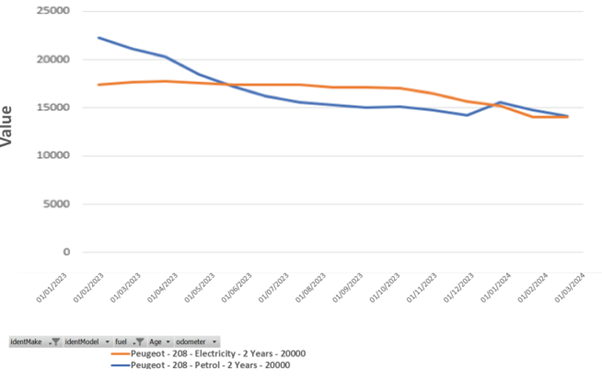

Peugeot 208 BEV v 208 petrol at two years and 20,000 miles

Peugeot 208 BEV and petrol models reached price parity in June 2023 at which point BEVs became worth more than equivalent petrol models. That is how it stayed until both fuel types reached price parity again in March 2024 at £14,250.

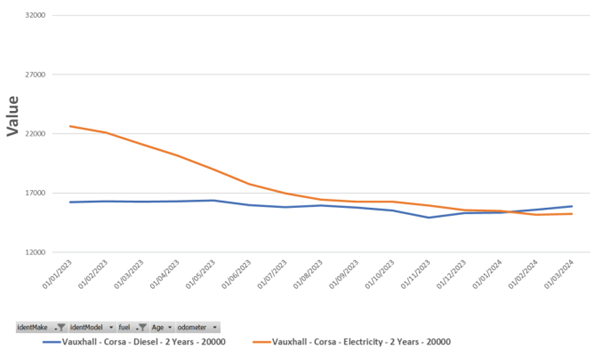

Vauxhall Corsa BEV v Corsa petrol at two years and 20,000 miles

From January 2023, the Corsa BEV was worth more than the equivalent diesel model by around £7,000. As of March 2024, the diesel Corsa was worth £16,000 and the Corsa BEV £15,250, which reflects how far market prices have moved on certain models in a short space of time.

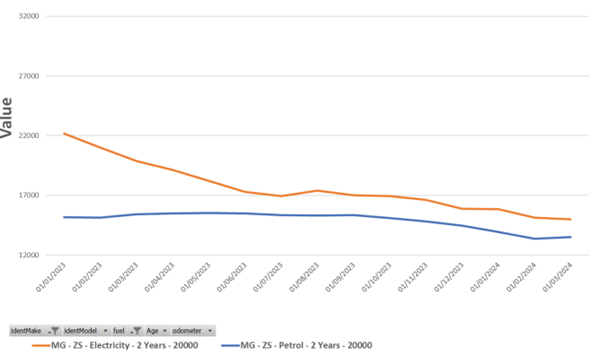

MG ZS BEV v ZS petrol at two years and 20,000 miles

Electric ZS prices have been consistently ahead of used ZS petrol prices by around £1,250 since June 2023. This trend has continued into 2024 with the ZS BEV worth £15,000 compared with £13,750 for the petrol model.

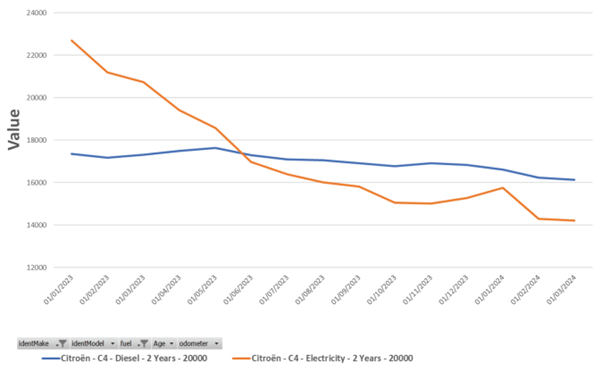

Citroen C4 BEV v C4 diesel at two years and 20,000 miles

The Citroen C4 BEV reached price parity with its diesel equivalent in May 2023 at £17,400 but prices continued to fall. As of March 2024, BEVs were worth £14,200 against £16,200 for the diesel.

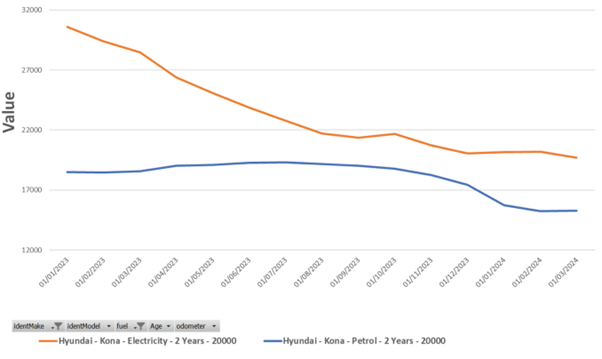

Hyundai Kona BEV v Kona petrol at two years and 20,000 miles

Hyundai’s strong zero emission reputation meant drivers paid more for used Kona BEVs during 2023. That trend continued into 2024, with Kona BEVs worth £19,700, £4,700 more than the equivalent petrol model.

“Our data shows prices in general have moved much closer together,” said Merritt. “In the case of Peugeot 208 BEV and petrol models, prices were identical at the end of March 2024 while there was just a few hundred pounds difference between the Corsa BEV and diesel models at the same age and mileage.”

Used hybrid cars ‘star performer’ in Q1

Hybrids were the star performing used cars in Q1 2024, according to separate analysis from Autorola, with sales more than doubling at the same time as prices rising by 3.7%.

Used hybrids increased their share of sales on Autorola’s MarketPlace online trade portal from 9.4% in Q4 2023 to 13.8% in Q1 2024.

Despite higher volumes of used cars being traded prices rose by 3.7% (£766) from £20,455 in Q4 2023 to £21,221 in Q1 2024, the highest price of any fuel type in the quarter.

Hybrid prices were helped by age and mileage reducing from 33 months and 21,337 miles in Q4 to 31 months and 20,468 miles in Q1 2024.

Petrol prices also rose by 6.6% in Q1 (£784) to £13,271 as average age and mileage reduced by five months and 3,207 miles to 42 months and 25,997 miles.

Autorola saw the used market bounce back in Q1 2024 by selling 43% more used cars than Q4 2023 where volatile prices forced many dealers to switch off from buying stock.

“Used car sales volumes are practically back to where they were in Q3 2023,” explained Jon Mitchell, Autorola UK’s group sales director.

“We have been pleasantly surprised by the number of hybrids we are now selling with our trade buyers reporting many consumers using them as a stepping stone before going fully electric.

“As always, we are looking to see how the March plate change is going to influence the used market.

“We will be analysing the volume and prices of used EVs coming back into the market, alongside how many new EVs were registered in the month,” he added.

Login to comment

Comments

No comments have been made yet.