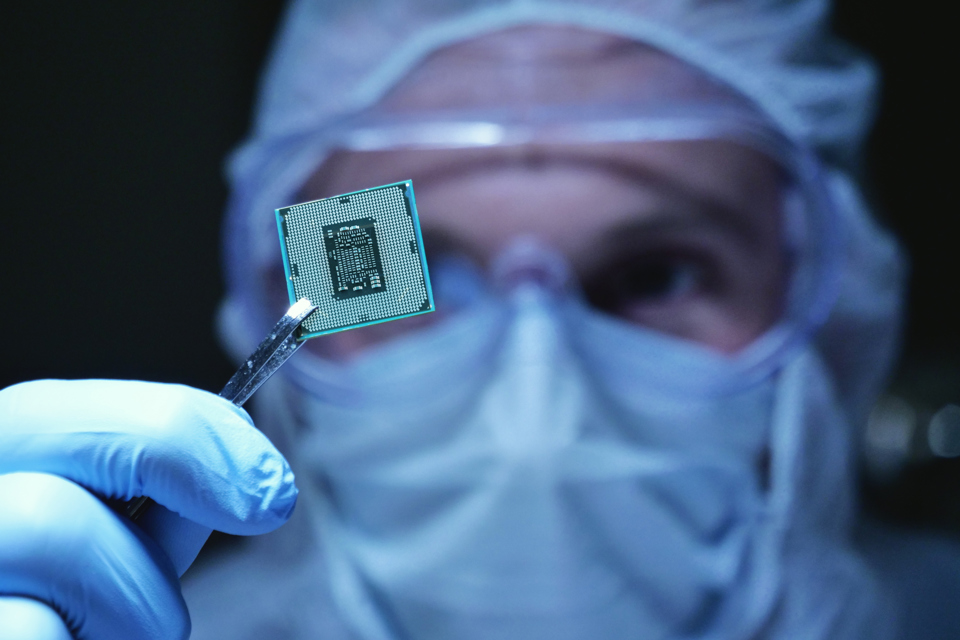

Used cars are in high demand as the supply of vehicles remains restricted by the global semiconductor shortage.

Fleets and leasing companies are holding on to vehicles for longer, as new models are increasingly delayed – meaning fewer vehicles are entering the used car market.

The issue is compounded by retail buyers, who are facing the same challenges to acquire new vehicles.

A survey by What Car? found 31% of used car buyers were originally in the market for a new car, but switched to the used market for better access to vehicles and to reduce their spending. This is an increase of 7% since June.

Steve Huntingford, editor, What Car?, said: “The microchip shortage is causing a substitution effect in the new and used car market, with new car buyers increasingly switching to the used market in search for better deals and availability.

“The consequence of this has been increased upwards pressure on used prices, as well as stock limitations for some dealers, which in return is making it harder for some used buyers to find the right car. It’s a negative cycle which can only be expected to ease once the microchip shortage is resolved.”

Every car- and van-maker is being impacted by the computer chip crisis, with some delivery times for cars lengthening from three to six months, and many new vans not expected to be delivered until 2022.

The influx of buyers to the used market has caused stock issues for used car dealers, with 67% of used buyers stating that they are finding it hard to find the right used car for them. Half of the used buyers surveyed also said they had seen prices increase for models they were interested in.

Used car prices continued to rise in July marking five months of growth, according to Cap HPI.

Its Live trade values reported an overall increase of 3.1% at the three-year point during the month of July, equivalent to more than £425 per car.

Used car values have been rising since April and have jumped by 16.6% in the last four months alone.

What Car? also surveyed new car buyers and found 39% had been informed by dealers of possible delays to vehicle orders, while 51% said they are finding it harder than before to find the right new model.

Login to comment

Comments

No comments have been made yet.