By Rupert Pontin, director of valuation, Cazana

Another month of indecisive Brexit discussion has passed culminating in a perhaps surprising vote of confidence for the embattled prime minister as the struggle to bring a sensible deal across the line continues.

The political battlefield is doing little to help the automotive industry and continues to damage the economy and national consumer confidence.

With a new vote coming for the House of Commons in early January the country is perilously close to a ‘no deal’ scenario.

However, it is interesting to note the number of automotive fleet businesses who claim not to have a fall-back plan for a no deal scenario.

Many state that there are currently so many unreliable variables that extensive planning would be time-consuming and perhaps largely irrelevant.

The new car market remains at a lower level than last year and the influences of WLTP, Brexit and the withdrawal of the Plug in Car Grant are continuing to confuse new car buyers whether they be private or business focussed.

Some OEM’s have significant supply problems that have both pushed lead times out and also motivated customers to look at competitive brands.

Looking forward and the December new car market is likely to be tough but there will be some strategic registrations before the end of the month to ensure that targets are met and bonuses gained.

A full year reduction of 6.5% in registration volumes is the anticipated outcome.

Diesel boost

With so much media attention on Brexit there has been quite a welcome reduction in diesel coverage in the media and this is perhaps part of the reason that new diesel registrations for November fell when compared the previous year but not as heavily as they had done in previous months.

It is a possibility that the lower drop in November was attributed more to the fact that WLTP has severely restricted diesel engine availability from certain key OEM’s, the extent of which was clear for all to see in the SMMT registration data.

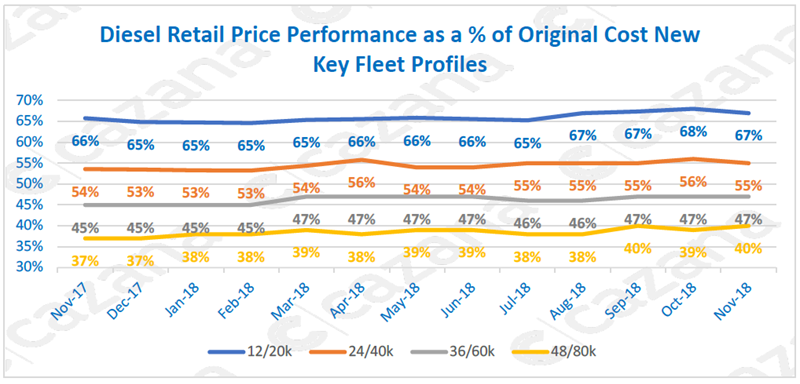

However, diesel may be an issue in the new car market but concerns have still not reached the cost conscious used buyer and the chart below highlights diesel engine performance in the used market for key fleet age and mileage profiles:

This chart shows that diesel retail pricing performance has remained consistent across the key fleet profiles with a largely similar pattern across the year.

The most interesting point is that not only has the pricing trend been almost constant, but the pricing points have also increased at all profiles when compared year on year.

In addition, the delta between the age and mileage profiles has remained very consistent.

It is worth highlighting the fact that the younger profiles have seen a lower improvement in pricing possibly due to the proximity of new and pre-registered cars in the market.

As such this chart provides confirmation of the validity and popularity of diesel cars to the used car consumer who really does appear to be more cost-conscience than they are eco-minded.

If used diesels were bad news, retail demand would have diminished and retail pricing followed suit and this has not happened and shows little signs of doing so.

Retail pricing as a percentage of cost new in 2018

The premium upper medium sector has been a key market for the fleet sector for many years and has been one of the most adversely affected by the availability of WLTP compliant cars.

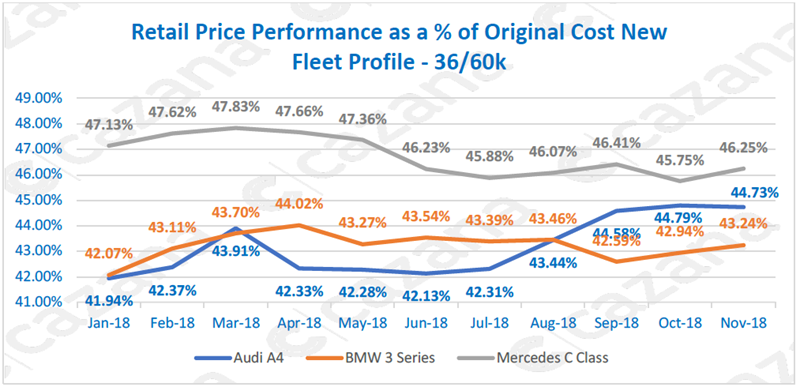

With new car orders at a lower level and some users extending contracts, pricing for key models in the used car market have anecdotally been under pressure. The chart below gives some clarity to retail pricing as a percentage of cost new during 2018.

This chart is interesting as it shows some key trends for each brand.

BMW v Mercedes v Audi

Firstly, it would seem that Mercedes pricing is on a downward trajectory and year on year the C Class retail asking prices are 0.9 of a percentage point lower than they were last year.

Conversely BMW 3 Series has increased by 1.17 percentage points and perhaps controversially Audi A4 has improved by 2.79 percentage points.

Secondly, the improvement for Audi and BMW is in line with general market performance although the decline for Mercedes is surprising.

The improvement in retail pricing for Audi and BMW has come towards the end of the year and for Audi this could be because of the restrictions on the availability of new cars.

With less pre-registration activity and fewer defleets, the impact on retail pricing has been clear.

BMW have managed WLTP in a much better way and this helps explain why the retail pricing increases have been less pronounced.

However, the key point of interest to many will be why the Mercedes C Class is so much higher than either of the other brands in residual value terms.

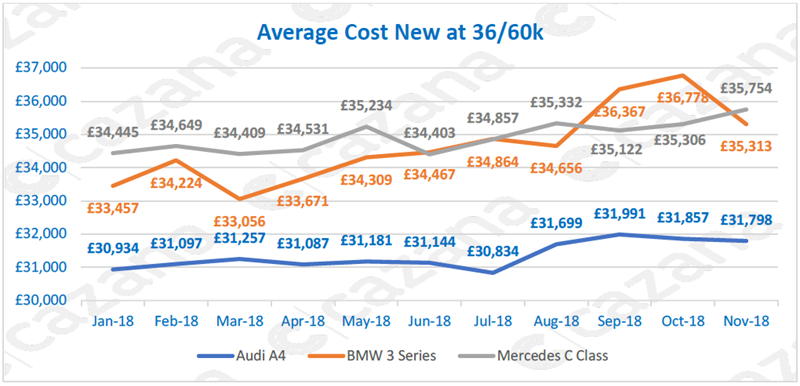

The answer lies in the type of cars coming to the market and the next chart highlights this by looking at the average cost new for those cars included in the data:-

It is immediately clear that the Audi A4 data contains lower specified cars than both BMW and Mercedes which is a reflection of the type of cars that are sold new suggesting that many higher spec cars may not come back to the market at this age and mileage.

Conversely, the data shows that BMW and Mercedes sold higher value cars to the market when new.

This chart, therefore, suggests that retail price performance as a percentage of cost new for Mercedes has been stronger than BMW during 2018 although that delta has closed during the second half of the year.

To summarise, the used fleet market in November continued to perform well and there were plenty of opportunities to improve the return on investment.

The premium upper medium sector has also been a strong performer although detail is king and some of the high-level conclusions that can be drawn here may look very different with closer defined criteria.

December will be a challenging month for both new and used car markets and although part of this will be Brexit driven there will still be seasonable factors at play.

All data from Cazana.

Login to comment

Comments

No comments have been made yet.