Fleet News is urging the industry to support calls for the Chancellor to address key fleet concerns in October’s budget.

Fleet News is urging the industry to support calls for the Chancellor to address key fleet concerns in October’s budget.

We will join with the British Vehicle Rental and Leasing Association and the Association of Car Fleet Operators to make a joint representation to Treasury ahead of the Budget.

To show your support, please add your details at the bottom of this article.

And please ask your drivers to add their names too - many changes to the management of company vehicles directly impacts them too.

Your name will help make a difference.

A summary of the key points in our manifesto

![]() Realign BIK to take account of WLTP-based CO2

Realign BIK to take account of WLTP-based CO2

![]() Reconsider 4% diesel supplement

Reconsider 4% diesel supplement

![]() Bring forward the 2% BIK incentive for ultra-low emissions vehicles (ULEVS) to April 2019

Bring forward the 2% BIK incentive for ultra-low emissions vehicles (ULEVS) to April 2019

![]() Raise ULEV incentives through a long-term commitment to grants

Raise ULEV incentives through a long-term commitment to grants

![]() Commit to a longer-term view of BIK - four to five years

Commit to a longer-term view of BIK - four to five years

![]() Begin consulting on future and alternative company car taxation policies.

Begin consulting on future and alternative company car taxation policies.

Please give your support to our manifesto (more details below)

The Fleet Budget Manifesto

Author: Stephen Briers, Fleet News editor-in-chief

It has become a common refrain: “We don’t know how to advise our company on future policy.”

These are unprecedented times for fleet decision-makers.

A series of issues have come together to create a perfect storm, causing confusion and uncertainty among those responsible for deciding company car strategies as well as company car drivers themselves.

The new Worldwide harmonised Light vehicles Test Procedure (WLTP) for fuel efficiency and CO2 emissions, and the lack of clarity over future benefit-in-kind (BIK) taxation levels, VED and national insurance contributions (employee and employer) beyond tax year 2020/21 is central to the problem.

Added to this are:

- the ongoing uncertainty over Brexit (despite most organisations attempting a ‘business as usual’ stance while it affects vehicle supply and contract terms, according to some fleets)

- air quality regulations

- salary sacrifice apportionment rules

- mobility/urban transport policies.

Chancellor of the Exchequer Philip Hammond has an opportunity to address fleet concerns in his Budget on October 29 and we believe there are a number of topics that need his consideration (see below).

Consequently, Fleet News is launching a Fleet Budget Manifesto.

Working with the British Vehicle Rental and Leasing Association (BVRLA), fleet association ACFO, fleet operators via our Fleet200 and the wider fleet sector, we are highlighting the areas where action needs to be taken to provide clarity and certainty.

Here, we outline some of the broad brush elements composed after initial talks with the interested stakeholders.

These will be developed further next month in consultation with fleets and the industry, resulting in a policy document that will be shared with Treasury in October.

We understand those timescales fit in with the Chancellor’s own schedule for the Budget.

Key points in the Fleet Budget Manifesto 2018

1. Vital contributor to government revenue

The company car is a vital part of the UK economy, providing mobility for businesses and employees and contributing billions of pounds to the Treasury in the form of company car taxation (CCT).

Compared to private cars, new and (especially) used, company cars are cleaner (on CO2, NOx and other particulates), safer thanks to the latest technology, and result in more money going to the Treasury.

However, the latest Government figures show the number of employees paying BIK taxation fell by 20,000 in 2016/17 from 940,000 a year earlier.

Yet the amount of money paid in BIK and employer national insurance contributions increased by 19% (or £390 million) to £2.48 billion.

Company car numbers will inevitably fall in future as people opt for alternative forms of mobility or choose shared services or subscription-based services which mean they do not need a permanent car.

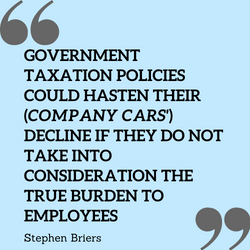

But government taxation policies could hasten their decline if they do not take into consideration the true burden to employees.

Ultimately, that will result in less money going to the Treasury.

The actions of the Chancellor in his next Budget can go some way to minimising the exodus.

How?

- By realigning BIK to take rising CO2 emissions caused by the new WLTP test into consideration.

- By providing clarity and foresight over future BIK levels, allowing drivers and companies to plan ahead with certainty.

- And by planning now for growth in ultra-low emission cars which will necessitate an overhaul of the CO2-based taxation system.

Fleet operators report that company car drivers are putting vehicle replacements on hold until they receive clarity over future BIK.

At energy company SSE, for example, only a third of drivers due to change their car this year have placed an order.

Meanwhile, Zenith has removed non-WLTP vehicles from its quoting platform – a move which was “very well received”, according to its managing director Ian Hughes.

He told Fleet News: “Now, we are seeing customers reduce any impact by extending their fleets and changing the fleet profile by adding an extra year to their term.”

2. Double-whammy – WLTP and BIK

Fleets and drivers are fearful about stepping into the unknown on future BIK rates and the potential double-whammy of higher CO2 emissions due to the new WLTP tests combined with tightening BIK thresholds.

During an interim period, from September 2018 until April 2020, WLTP is being converted to correlated NEDC figures using the EU-wide CO2MPAS equation.

On average, it is resulting in CO2 increases of between 10% and 20%, moving many cars up a couple of tax bands.

The Government has proposed that, from April 2020, full WLTP figures will be used for BIK, VED and employers’ national insurance contributions.

It is expected to confirm this date in the Budget.

Full WLTP could result in another 10-20% rise in CO2 emissions, further hitting company car drivers with higher BIK taxation deductions, exacerbated by the fact that the BIK thresholds themselves will have risen by four percentage points for most cars at that juncture.

However, it shouldn’t be this way.

The European Union gave a clear recommendation to member states that WLTP should not be revenue raising - but the UK has yet to give any indication that it will revise BIK and VED to take into account the higher CO2 emissions.

Meanwhile, other European governments are taking action, according to information from Fleet Europe magazine.

Netherlands

The correlated NEDC values will be used for taxation purposes until the end of this year.

From January 1, 2019, new tax levels will be introduced that compensate for the increase in CO2 emissions resulting from the new WLTP test.

Germany

It will make changes from January.

Details have not been announced, but the government will adapt tax bands to take WLTP into account.

Ireland

The government is also reportedly considering widening tax bands to account for higher emissions.

Belgium

Belgium has taken a different view and will base its taxation on figures derived from correlated NEDC until the end of 2020, except for road tax which is a regional affair.

Flanders, for example, will introduce WLTP values for road tax on January 1, 2020.

One fleet operator, commenting on a Fleet News story about company car tax revenues and a reduction in the number of employees paying BIK, said: “The Government needs to realise that the tax collection revenues will fall unless they make company car tax sustainable again.

“What’s needed is balance.

“Short term tax take is rising, largely as most company car drivers have a three- or four-year tie in to their current vehicle.

“However, many of those will give up the company car at their next renewal.

“Fewer company cars will see a falling tax revenue for the Government with drivers who previously had new economical company cars (that helped reduce pollution and supported the UK motor industry) swapping into older (secondhand), more polluting vehicles or new personal lease or PCP vehicles where the pressure on taking a low CO2 vehicle is relaxed.

“An effective company car tax regime promotes efficient vehicles and can provide a good income for the Government.

“But if it becomes (as it risks now) too greedy it will do neither thing as drivers vote with their feet.”

Those views have been confirmed by one company car driver who said: “From this year I will pay more in tax for my company car, which I use as a business tool, than I pay for my mortgage.

“That says it all.

“I will be opting out at the first opportunity.”

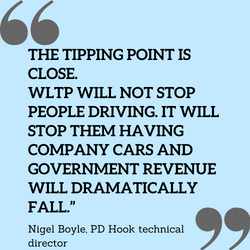

Nigel Boyle, PD Hook technical director, called on the Government to stop its year-on-year increases in BIK.

“The car I drove last year costs no more to run this year, yet they charge me more – the argument is flawed,” he said.

“If they want to increase revenue, they should increase the rate of income tax so everyone can see it.”

Boyle believes the Government is using WLTP as a “backdoor tax”.

“The tipping point is close.

“WLTP will not stop people driving, it will stop them having company cars and the Government revenue will dramatically fall.”

3. An alternative to BIK

Ultimately, as fleets gradually move to ultra-low emission vehicles, CO2 emissions will fall regardless of the number of company car drivers, affecting revenues from BIK taxation.

This is inevitable; therefore, the Treasury should start preparing now by considering alternative revenue schemes.

This could include implementing a blanket BIK charge for all vehicles, similar to the van benefit fee applied to commercial vehicles with private use.

Or, it could involve a road pricing scheme, which could link into other policies around reducing congestion by implementing different fees and different times of the day.

The eventual solution is a moot point; what’s vital is for Government to start consulting now, taking into consideration the views of business and the public, rather than resorting to a knee-jerk reaction when BIK taxation plummets.

John Pryor, chairman of fleet operators association ACFO, also urged the Government to involve the fleet sector in any discussion.

He said: “Please engage with stakeholders first – we have seen what happens when this does not happen.”

The company car tax regime has a proven track record of encouraging drivers into the lowest emitting vehicles, with the fleet industry being early adopters of cleaner technologies.

Hughes says it’s a trend evident in Zenith’s fleet, where average CO2 emissions have reduced by 40% since 2002/3.

He also agrees that collaboration will be key.

“Zenith encourages the Government to work collaboratively with the fleet industry to ensure the impact of any change is fully understood and company car tax can be used to drive a long and sustainable change in the way people use vehicles for the benefit of the UK’s air quality,” he said.

Philip Hammond. The Fleet News Fleet Budget Manifesto seeks to influence the chancellor to include measures in November's budget that acknowledge the importance of company vehicles and drivers to the UK economy - and show clear government direction on key issues impacting them.

Philip Hammond. The Fleet News Fleet Budget Manifesto seeks to influence the chancellor to include measures in November's budget that acknowledge the importance of company vehicles and drivers to the UK economy - and show clear government direction on key issues impacting them.

4. Review the 4% diesel supplement

Related to the emissions debate is the decision to increase the diesel supplement from 3% to 4% last year and the announcement that any vehicle meeting the Real Driving Emissions Step 2 (RDE2) test would be exempt.

Euro 6 diesels must emit no more than 0.080g/km of NOx under standard laboratory testing.

Currently RDE1 tests cars under real-world conditions and requires them to emit no more than 2.1 times this amount of NOx.

Optional testing has started and all cars will have to go through the test by September 2019.

RDE2, due to begin in 2020, allows cars to emit up to 1.5 times the official level of NOx.

It becomes mandatory for all cars on sale by January 2021.

However, testing by Emissions Analytics shows that the latest Euro 6 diesel engines are far more efficient for NOx and particulate emissions.

In fact, it points to at least 20 models that comply with RDE2 (rated A or A+).

Could it be sufficient to remove the 4% diesel supplement for these NOx-compliant cars?

We’d like the Government to give it some thought.

“The latest diesels are some of the cleanest and fleets are looking to provide fit for purpose vehicles and this adds extra costs,” said Pryor.

For Claire Evans, head of fleet consultancy at Zenith, it’s a question of fairness.

“The current 4% diesel supplement does not fairly reflect the role these vehicles continue to have for company car fleets,” she said.

“The newest and cleanest diesel vehicles are often the most cost-efficient and environmentally-friendly option for drivers who complete higher business mileage compared to higher-emitting petrol or plug-in vehicles, which simply do not have a suitable range for the type of journeys completed by typical job-need drivers.”

Evans is right.

It is simply not fair to penalise British business for using the fuel type – diesel – that best meets the majority of its needs.

Fleets would switch to electric today if it represented a viable solution. Unfortunately, it doesn’t, other than for specific types of journey profile.

5. Longer-term view of BIK

Pryor believes the Government should also take heed of the other consideration points raised by Fleet News in the Fleet Budget Manifesto.

“Drivers and business need to know what their costs are. We understood the new WLTP would not be a tax-raising option.

“We all need to see CO2 reduced and company-supplied vehicles were showing this can happen,” he told Fleet News.

“The more we can do to encourage the use of ULEVs, the better for all.

“Fleets need a clear working plan to get the right vehicle for the job.”

Hughes also believes it could benefit the environment.

“A longer-term view of company car tax rates would allow decision-makers to better plan the transitioning of their cars into a cleaner, safer and lower-emitting technologies,” he said.

ACFO has long campaigned for greater notice about future BIK levels and has previously secured a commitment from Government that it would provide four years’ notice.

However, BIK is now only known until tax year 2020/21.

“Fleets are looking to run (vehicles) longer and four years is now becoming more common with five years being considered,” said Pryor.

But, whether it’s a four or five-year replacement cycle, Hughes says that the current lack of company car tax rates from 2021 is causing unnecessary confusion, and leading to delays in drivers selecting their next company car.

“It could lead to a lack of supply into the secondhand market that could negatively impact clean air ambition plans further down the line,” he said.

“Fleet News’ Fleet Budget Manifesto reflects the challenges the fleet industry is facing.”

Fleet Budget Manifesto: Six areas for discussion

-

Realignment of benefit in kind tax tables to take into consideration CO2 emissions under WLTP; there should not be any distortion caused by the transition and use of correlated NEDC figures for tax purposes.

-

Reconsider the 4% diesel supplement.

-

Bring forward the 2% BIK incentive for ULEVs to April 2019, not 2020.

-

Raise ULEV incentives through a long-term commitment to plug-in grants.

-

Commit to a longer-term view of BIK – e.g. four or five years.

-

Begin consultation about future and alternative company car taxation policies.

Fleet Budget Manifesto: Next steps

-

Consultation with fleets at the Fleet200 meeting on September 12

-

Consultation with industry via roundtables during September

-

Agreement on Manifesto in October

-

Manifesto presented to Government end of October

The Engineer - 21/08/2018 16:01

Well said all of it. I would also like to suggest a possible system of tax that applies a ratio of business to private mileage usage. Personal use of a car is a benefit, of course. Business use is of no benefit to the driver only the business. In no other sector are people taxed on their 'work tools' the same as if they were entirely a personal gain, or at all! One other point, manufacturers are withdrawing diesel models completely leaving the vehicle choices dwindling, yet my company still has a 129g/km petrol ceiling, but no diesel one! Yet recent concern has not been on CO2 but on particulates of which diesels are bigger emitters. I would urge fleet managers to consider relaxing petrol CO2 ceilings until manufacturers catch up and the situation settles. You will probably only be trading a little more petrol CO2 for a little less diesel particulates so the fleet environmental ethos is still credible.