Fleet operators and company car drivers face delays of more than one year for certain new car and van models, while others are being delivered with missing features, as the global semiconductor shortage worsens.

And some automotive industry executives do not see the problem ending any time soon.

One is predicting the disruption could last until 2023. Speaking at the IAA Munich auto show last month (September 7-12), Daimler CEO Ola Kallenius said soaring demand for semiconductors means the auto industry could struggle to source enough of them throughout next year and into 2023, though the shortage should be less severe by then.

The carmaker has cut its annual sales forecast for its car division, projecting deliveries will be roughly in line with 2020, rather than up significantly.

BMW CEO Oliver Zipse said: “I expect that the general tightness of the supply chains will continue in the next six-to-12 months.”

VW purchasing chief Murat Aksel said: “We hope for a gradual recovery by the end of the year.” But he warned that semiconductor supply will remain “very volatile” in the third quarter.

He believes the automotive industry will require 10% more production capacity for chips.

Of course, it’s not just the carmakers who are affected. The ongoing disruption is causing havoc for leasing companies and creating an unprecedented level of demand in the used car market, pushing residual values to record highs, as fewer vehicles are defleeted.

Manufacturers are being forced to close factories temporarily, while others face cost increases as the price of the much-needed chips soars to more than 30 times higher than before.

Critics are predicting the crisis will have a greater impact on automotive than the coronavirus pandemic. Almost 95% of fleets responding to a Fleet News poll said they were experiencing vehicle delays.

Fleets are being urged to sit tight and continue to place orders for new vehicles, while also being warned that existing models may have to remain on the road for in excess of an extra 12 months.

Matthew Walters, head of consultancy services at LeasePlan, said: “The impact on fleet is pretty severe.

“Last year, we saw a number of formal extensions for companies during the worst of Covid-19 where vehicles couldn’t be delivered and where vehicles couldn’t be collected. These vehicles needed to be extended outside their primary contract term.

“Now we’re in a situation moving into next year where, as an industry, we are likely to see an extension programme again.

“I think it’s a similar period of activity with our customers now, to help them understand what it means for their current order bank, when their orders will be delivered and what that means for their replacement cycles.

“The customer still needs to place orders for vehicles to get themselves in the queue and we are working with them and being open and frank as to when those vehicles are going to be delivered.”

The effects of the supply crisis hit new vehicle registrations hard in August, with new car sales down by 22% – the worst performance for the month since 2013.

While August is traditionally one of the quietest months of the year for new car registrations, ahead of the plate-change in September, August's registrations were down 7.6% on a 10-year average.

Total registrations in 2021 are 25.3% below the 10-year average for the period January-August, according to the Society of Motor Manufacturers and Traders (SMMT).

CONTRACT EXTENSIONS BECOMING MORE COMMON

At a recent Fleet200 meeting, a group of fleet managers responsible for some of the largest fleets in the country said leasing firms were being flexible in allowing them to extend contracts where necessary.

But they highlighted that some company car drivers are facing the prospect of paying increased benefit-in-kind (BIK) tax https://www.fleetnews.co.uk/fleet-faq/what-is-bik-benefit-in-kind-tax-/1/ bills while they wait for electric and plug-in hybrid models.

Sue McGuigan, fleet manager at Eric Wright Group, said: “Drivers switching into electric vehicles (EVs) were expecting a reduction in BIK.

“It’s a bit upsetting for them as they’re now facing extra costs for the next few months. But, there’s nothing we can do about it.”

Iron Mountain head of logistics support Rory Morgan added: “There has to be some realisation that this is how it is at the moment. It’s not just semiconductors, it’s steel and other raw materials that are affected across the board.”

Nick Hardy, sales and marketing manager at FN50 leasing firm Ogilvie Fleet, said the company has more vehicles on extended contracts than ever before.

“We are having to work even more closely with clients with regard to their policies to take into account the increasing capital cost of vehicles and, therefore, rental increases, given the rebalancing in supply and demand factors,” he said.

“Those clients who are embracing lower mileage contracts, as a result of new remote working practices, and at the same time adopting an EV policy, taking advantage of the lower total operating costs, are all winning the battle right now.”

LEAD TIMES EXTENDED TO 12 MONTHS

According to Hardy, most lead times for typical company cars and vans are now at six-nine months.

Jaguar Land Rover (JLR) has warned leasing companies that lead times for 53 model variants are now in excess of one year. The cars affected include versions of the Jaguar E-Pace, Land Rover Discovery, Land Rover Discovery Sport, Range Rover Evoque and Land Rover Defender.

“Although these can remain open for quoting and ordering on your systems if you choose, your supplying retailer will not be in a position to accept orders for these derivatives due to extended lead times,” the carmaker said in a briefing note.

Mercedes-Benz has removed specification features from certain models “from late June production and until further notice”, to limit delivery time delays.

The wireless charging of mobile phones, hands-free access to the boot (by kicking under the rear bumper), multibeam LED headlights and certain audio systems are among the features to disappear from the standard specification of certain cars, with AMG-line derivatives particularly affected.

Toyota, meanwhile, announced a 40% cut in worldwide production in September. It had planned to produce almost 900,000 cars this month, but has now said that figure will be reduced to 540,000 units.

Numerous Ford models are affected, including the best-selling Fiesta. Production of the supermini was halted from May to mid-July, with further disruption experienced last month. Ford’s plant in Turkey, where the Transit van is built, was also closed this summer.

The manufacturer is now shipping some models with missing features, such as sat-nav. It is expected that retrofits will be offered at a later date.

Ford fleet director Neil Wilson said: “I think the issue will be around for a while – probably until Q1 next year. It will ease, but there will be challenges going forward and we have to be good at reacting to those challenges.

“Lead times are different dependent on model; some LCVs are into next year if you order now.”

Walters said the key to managing the crisis is to remain open and transparent: “Manufacturers are being as open as they can be and we are being as open as we can regarding what this means to our customers. The problem is going to be with us for a while and all we can do is work with our customers and our supply chain to keep those fleets on the road.”

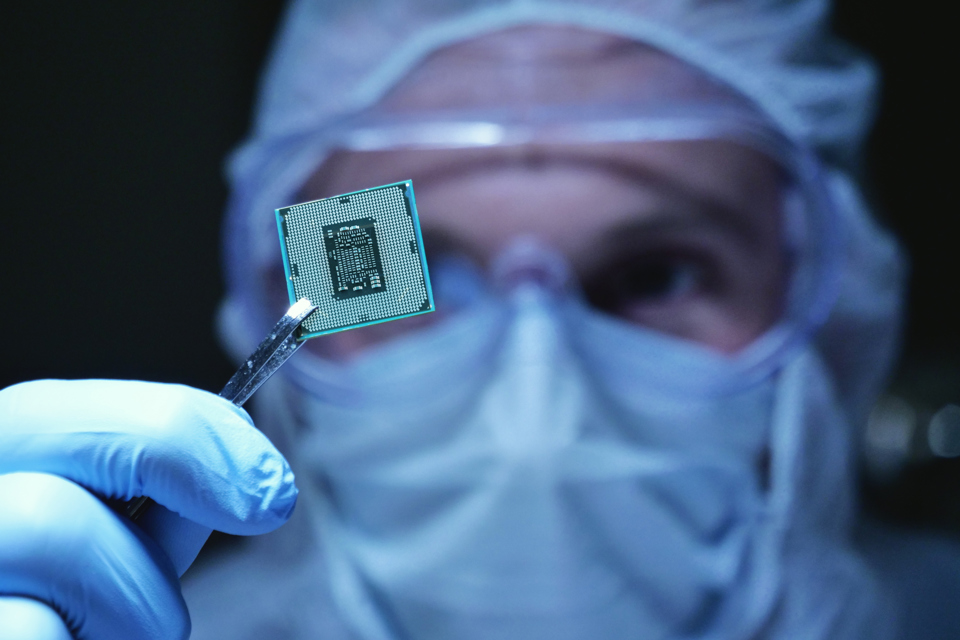

RELIANCE ON CHIPS INCREASING

In recent years, cars have become increasingly dependent on chips, with the average model now requiring around 1,000.

But car makers have been pushed to the back of the queue by technology and telecoms companies, which need more advanced and expensive chips that are more lucrative for semiconductor makers.

Many companies cut orders for semiconductors last year – believing the pandemic would negatively impact demand – which led suppliers to reduce capacity.

The opposite was true, however. Global demand for semiconductors grew by around 15% last year and, with global manufacturing taking place at a handful of factories, a fire at a semiconductor plant in Japan and power outages in Texas, due to storms, exacerbated the problem.

Login to comment

Comments

No comments have been made yet.